Emergency Fund 101: Your Safety Net in a Paycheck-to-Paycheck World

Maya’s car broke down on a Tuesday morning. The repair? $847. She didn’t have it. So she put it on a credit card at 24% interest, turned down a freelance project because she couldn’t get to the client meeting, and spent the next three months paying off that one unexpected expense while the interest piled on.

Here’s what gets me: Maya earns decent money. She’s not irresponsible. She just didn’t have an emergency fund—and that single gap turned a fixable problem into a financial spiral.

An emergency fund is money you set aside specifically for unexpected expenses or income loss—separate from your regular savings. It’s not about being pessimistic; it’s about being realistic. Life doesn’t send you a calendar invite before things break, jobs end, or emergencies hit. And without this buffer, one bad week can derail months of progress.

According to the Federal Reserve, nearly 40% of Americans couldn’t cover a $400 emergency expense without borrowing or selling something. That’s not a personal failing—it’s a system that doesn’t teach people to build financial cushions.

This guide will show you how to build an emergency fund, even if you’re living paycheck to paycheck, freelancing with unpredictable income, or just starting out as a complete beginner. Whether you’re earning minimum wage or navigating irregular income, you’re about to learn exactly how to build emergency savings that actually protect you.

Table of Contents

- What Is an Emergency Fund and Why Does It Matter?

- How Much Emergency Fund Do You Really Need?

- Step-by-Step: How to Build an Emergency Fund on Low Income

- Where to Keep Your Emergency Fund

- Quick Recap: Emergency Fund Essentials

- Common Emergency Fund Mistakes Most People Make

- Emergency Fund vs Savings Account: What’s the Difference?

- When to Use Your Emergency Fund (and When Not To)

- FAQ

- Conclusion

- Compliance & Disclaimer

What Is an Emergency Fund and Why Does It Matter?

An emergency fund is basically your financial safety net—cash you keep accessible for when life throws you a curveball. And life loves throwing curveballs.

It’s not money for that amazing sale you spotted. Not for your best friend’s destination wedding. Not for “I’ve had a rough week and deserve a treat.” This is your “oh crap” money, pure and simple.

Think about it like insurance you create for yourself. Your regular savings? Those might be earmarked for fun stuff—maybe a down payment on a house, that trip you’ve been dreaming about, or just building wealth over time.

Your emergency fund sits in the corner, quiet and boring, waiting for the moments when everything goes sideways.

What an Emergency Fund is NOT:

- It’s not an investment account where you’re trying to get rich

- It’s not a backup budget for things you forgot to plan for

- It’s not your “treat yourself” fund when you’re feeling impulsive

Money stress doesn’t come from emergencies—it comes from being unprepared for them.

When you don’t have emergency savings, every little surprise becomes a full-blown crisis. Your brain goes into panic mode. You start borrowing from sketchy places. You make decisions you wouldn’t normally make because you’re desperate.

But flip that scenario. When you’ve got money sitting there specifically for emergencies? You handle problems like someone who’s got their act together.

Your car needs a new battery? Annoying, sure, but not earth-shattering. You pay it, move on with your life, and maybe complain about it over dinner. That’s it.

Something I noticed while digging into financial research: people without emergency funds basically pay a “broke tax” on everything. They end up at payday loan places paying 400% interest. They carry credit card balances month after month, hemorrhaging money on interest.

They can’t wait for better deals because they need solutions right this second. An emergency fund doesn’t just save you from disaster—it saves you from making expensive desperate choices every time something goes wrong.

Quick reality check: If your income disappeared tomorrow, how long would you last?

(Most people don’t know—and that’s exactly why emergency funds matter.)

The peace of mind alone is worth it. There’s something about knowing you could handle most common problems without your world falling apart. It changes how you sleep at night.

How Much Emergency Fund Do You Really Need?

You’ve probably heard “save three to six months of expenses” thrown around like it’s gospel. And yeah, that’s the eventual goal. But if you’re sitting there thinking “I can barely save $50 a month,” hearing “save $15,000” feels like someone telling you to climb Mount Everest in flip-flops.

Let’s make this actually achievable. We’re breaking it down into stages that won’t make you want to give up before you start.

Phase 1: The $1,000 Starter Emergency Fund

Your first finish line is one thousand dollars. That’s it. Will it cover every possible emergency? Nope. But it’ll handle the most common ones: car trouble, a surprise dental bill, your phone dying, minor medical expenses.

Getting to $1,000 means you’re no longer one bad day away from financial chaos.

If you’re living paycheck to paycheck, saving $1,000 might take you six months, a year, maybe longer. And you know what? That’s completely fine. We’re not racing anyone here. What matters is building the habit and creating that initial cushion.

Phase 2: One Month of Essential Expenses

Once you hit that first $1,000, your next target is one month of bare-bones living costs. I’m talking rent or mortgage, utilities, basic groceries, getting to work, insurance premiums.

Not your current spending—just what you’d need to survive for 30 days if everything went wrong.

This is your “I lost my job” buffer. Research from the Bureau of Labor Statistics shows the average job search takes about 3-5 months, but having even one month saved buys you crucial time to breathe, file for unemployment, polish up that resume, and start your search without immediate panic setting in.

Phase 3: Three to Six Months of Full Expenses

Now we’re talking about the gold standard everyone mentions. Here’s how to figure out your number: three months if you’ve got a stable job, dual income household, or strong family support nearby.

Shoot for six months if you’re self-employed, working in an unstable industry, your income bounces around, or you’re the only earner keeping your household afloat.

Let me show you what this looks like for real people:

Situation 1: Sarah, Single, Stable Job

- Monthly expenses: $2,800

- Emergency fund target: 3 months = $8,400

- Sarah works in healthcare—pretty solid job security, decent insurance coverage. Three months gives her enough breathing room for most scenarios without going overboard.

Situation 2: James, Freelance Graphic Designer

- Monthly expenses: $3,200

- Emergency fund target: 6 months = $19,200

- James’s income is all over the place. Some months he pulls in $6,000, other months barely $1,500. According to recent data on freelance workers, nearly 63% experience significant income volatility month-to-month. Six months protects him during those inevitable dry spells without forcing him to take terrible projects out of desperation.

Situation 3: The Martinez Family, Two Incomes, Two Kids

- Monthly expenses: $5,400

- Emergency fund target: 4 months = $21,600

- Both parents work, which provides some security, but they’ve got kids depending on them and higher fixed costs. Four months splits the difference—realistic but still protective.

Emergency Fund for Beginners on Low Income: Let’s Keep It Real

If you’re making minimum wage or trying to survive in an expensive city on entry-level pay, building six months of expenses might take years. Literal years. And I need you to hear this: start anyway.

Even putting away $25 a month adds up to $300 by year’s end. That’s a broken phone covered. That’s a small medical copay. That’s not nothing. Progress beats perfection every single time, especially when it comes to building an emergency fund for beginners.

Some folks push their emergency fund targets to nine or twelve months. That makes sense if you work in a super specialized field where finding new work takes forever, if you’ve got chronic health stuff going on, or if you live somewhere without many job options.

But don’t let perfect be the enemy of good. A $500 emergency fund beats zero by about $500.

The important thing about figuring out how much emergency fund you need isn’t hitting some magic number next month—it’s understanding your target and taking consistent steps toward it.

Step-by-Step: How to Build an Emergency Fund on Low Income.

Building an emergency fund when money’s tight isn’t about following some finance guru’s aggressive savings challenge. It’s about being smart, being honest with yourself, and showing up consistently.

Here’s the real deal on how to build an emergency fund.

Step 1: Figure Out Your Target Number

Grab a notebook or open your phone and write down your monthly essential expenses. I mean really essential—not what you typically spend, but what you’d need if you were in survival mode:

- Housing (rent or mortgage payment)

- Utilities (electric, water, internet, phone)

- Food (realistic grocery budget, not fantasy diet budget)

- Transportation (car payment, insurance, gas, or transit pass)

- Insurance (health, car, renter’s or homeowner’s)

- Minimum debt payments you legally have to make

Add those up. Now multiply by 1, 3, or 6 depending on your situation we talked about earlier. That’s your target. Don’t freak out if it seems huge—you’re not saving it all by Tuesday.

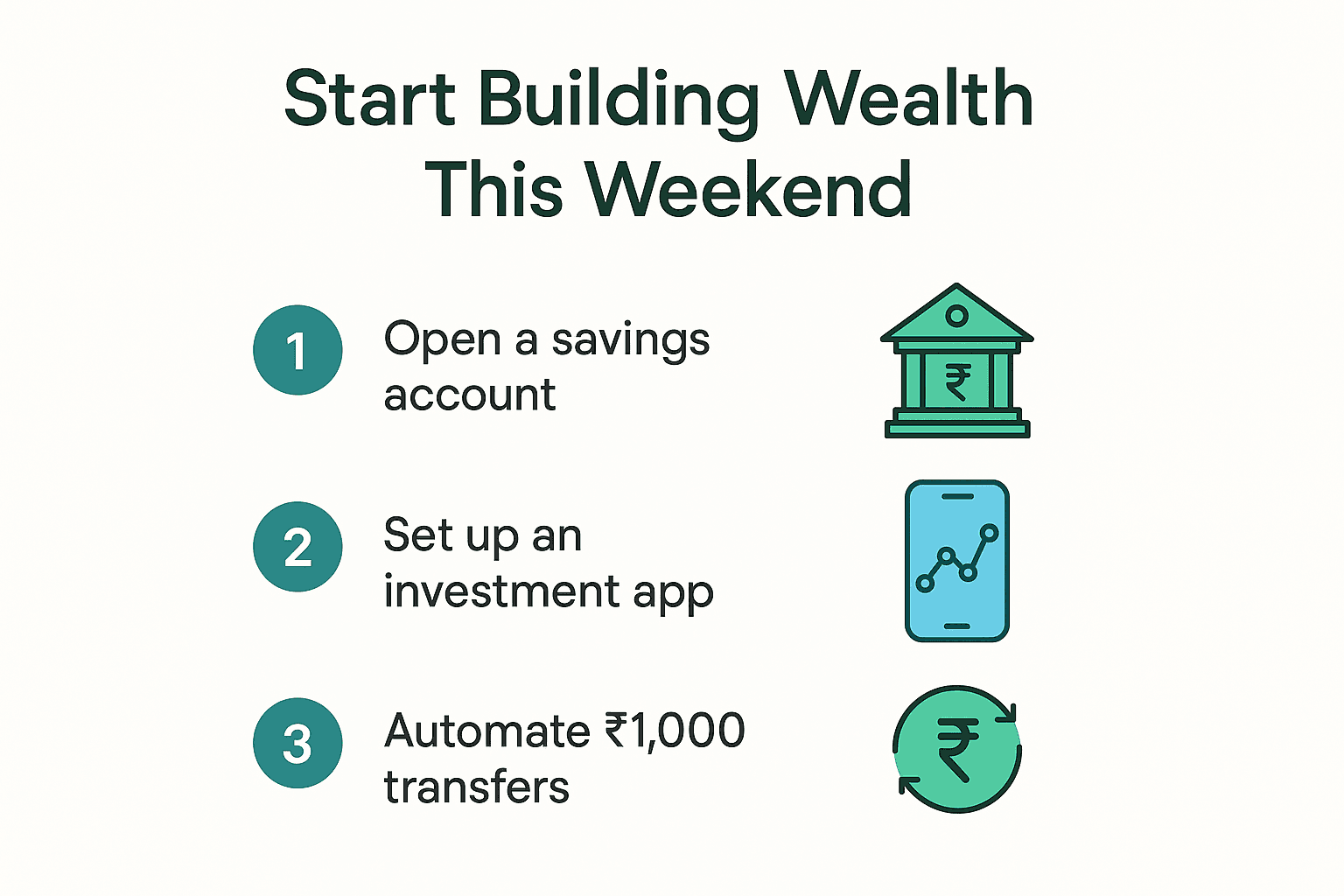

Step 2: Open a Separate Account

This part is non-negotiable, and I mean it. Your emergency fund cannot live in your checking account where it mingles with your taco money and impulse purchases. Just can’t.

Open a high-yield savings account. Online banks usually offer the best interest rates—we’re talking around 4-5% APY as of early 2025, which beats the pathetic 0.01% your traditional bank probably offers.

Here’s a pro move: keep it at a different bank than your checking account. You want just enough friction that you won’t accidentally spend it on not-actually-emergencies, but easy enough access that you can transfer money within 1-2 business days when you genuinely need it.

Step 3: Start With What You Can Actually Save

Can you save $200 a month? Awesome. Can you only swing $20? Also awesome. Seriously. The amount matters way less than the consistency.

Set up an automatic transfer for the day right after your paycheck hits. Automate this so you don’t have to rely on willpower or remembering. Make it invisible.

For people with low or irregular income:

- Save a percentage instead of a fixed dollar amount. If you earn $1,500 one month, save 5% ($75). If you only make $800 the next month, save 5% of that ($40). The percentage stays constant even when your income doesn’t.

- When unexpected money comes your way—tax refund, birthday cash from grandma, surprise freelance bonus—put 50-100% of it straight toward your emergency fund until you hit your target. Future you will thank you.

- Use the “pay yourself first” method. Before you budget for literally anything else, move money to your emergency fund. Then budget whatever’s left. It feels weird at first, but it works.

Step 4: Find Extra Money (Without Hating Your Life)

I’m not going to sit here and tell you to give up coffee or cancel Netflix. You’re an adult. You know where your money goes. But here are some strategies that actually work without making you miserable:

Negotiate your bills. Call your internet provider, insurance company, and phone carrier once a year. Tell them you’re shopping around for better rates. You’d be amazed—you can often knock $20-50 off your monthly bills with a single phone call. Companies count on you not doing this.

Sell stuff collecting dust. That exercise equipment you haven’t touched in a year? The gadgets in your closet? The books you’re never rereading? Turn them into $200-500 on Facebook Marketplace or eBay.

Take on temporary side work. Not forever—just until you hit that first $1,000 milestone. Drive for Uber a few weekends. Babysit your neighbor’s kids. Walk dogs. Tutor online. It’s temporary pain for long-term peace of mind.

Building an emergency fund on low income often means getting creative—at least temporarily.

Step 5: Protect Your Emergency Fund While It Grows

You’re going to be tempted to raid it. Your friend’s getting married in Cabo. Your laptop’s running slow. There’s an incredible sale on that thing you’ve been eyeing. Don’t do it.

Create a clear rule for yourself: your emergency fund is only for genuine, unplanned, essential expenses. If you could see it coming or if it’s a “want” disguised as a “need,” it doesn’t count.

Write this rule down. Tell a friend. Make it real.

Step 6: Rebuild After You Use It

When you eventually tap your emergency fund—and you will, that’s literally why it exists—treat replenishing it as your top financial priority. Pause other savings goals temporarily if you need to.

The emergency fund comes first because it’s your financial foundation. Everything else gets built on top of it.

Where to Keep Your Emergency Fund

This is where people get super confused and honestly, I get it. The finance world makes this more complicated than it needs to be. You want your emergency fund to be three things:

- Safe (like, zero risk of losing value)

- Liquid (you can get to it within 1-3 days max)

- Earning something (because inflation is slowly eating your money otherwise)

Let me break down what actually works and what doesn’t when deciding where to keep emergency fund money:

| Option | Pros | Cons | Verdict |

|---|---|---|---|

| High-Yield Savings Account | FDIC insured up to $250k, earning 4-5% interest, access within 1-2 days | Interest rates go up and down | Best choice for most people |

| Money Market Account | Similar to savings, sometimes higher rates, FDIC insured | Might need higher minimum balance | Good alternative |

| Regular Checking Account | Access your money instantly | Literally zero interest, way too tempting to spend | Just don’t |

| Cash Under Your Mattress | You can touch it right now | Zero interest, could get stolen, inflation actively destroys its value | Avoid (except maybe $200 for true emergencies) |

| Stocks/Index Funds | Could earn higher returns over time | Can drop 30-40% exactly when you need the money | Wrong tool for the job |

| Cryptocurrency | Potential for high returns | Can lose 50%+ of value overnight, super volatile | Absolutely not for emergency funds |

| CDs (Certificates of Deposit) | Higher interest rates, FDIC insured | Early withdrawal penalties defeat the purpose | Only for amounts above 6 months |

The sweet spot: Keep your emergency fund in a high-yield savings account at an online bank. You’ll earn 4-5% interest (compared to basically nothing at traditional brick-and-mortar banks), your money is completely safe thanks to FDIC insurance, and you can transfer it to your checking account in 1-2 business days when something goes wrong.

Some people get fancy and split their emergency fund once it’s fully built—maybe keeping 3 months in a regular savings account for quick access and putting another 3 months into short-term CDs for slightly better rates.

That’s fine if you’re disciplined and past the building phase, but don’t overcomplicate things when you’re just starting out.

The key is finding that balance between accessibility and growth. Your emergency fund isn’t an investment—it’s insurance. Safety beats returns here, every time.

Quick Recap: Emergency Fund Essentials

Let’s pause for a second. If you’re feeling overwhelmed, here’s what you need to remember:

- An emergency fund is separate from regular savings—it’s your financial shock absorber for unexpected expenses and job loss

- Start with $1,000 as your first milestone, then work toward 3-6 months of essential expenses based on your job stability

- Keep it in a high-yield savings account at a separate bank for safety and accessibility (4-5% interest beats 0%)

- Automate your savings the day after payday—even $20-50 monthly builds up faster than you think

- Use it only for genuine emergencies—unexpected medical bills, essential repairs, job loss. Not sales, vacations, or wants

You don’t have to do this perfectly. You just have to start and stay consistent.

Common Emergency Fund Mistakes Most People Make

Let’s talk about where people mess this up, because knowing the traps helps you sidestep them.

Mistake #1: Waiting for the “Perfect Time” to Start

“I’ll start my emergency fund once I pay off my debt completely.” “After I get that raise.” “When I finish saving for this other thing.”

No, no, and no. Start now. Start with $10 if that’s all you’ve got. Your emergency fund protects you while you work on everything else.

Without it, one unexpected car repair destroys all your other progress. You end up right back where you started, or worse.

Mistake #2: Keeping It Way Too Accessible

Your emergency fund sitting in your checking account will get spent. That’s not a character flaw—that’s just how human brains work. We’re terrible at resisting money we can see and touch easily.

Create some healthy friction. Different bank. No debit card attached to it. Make it just inconvenient enough that you won’t tap it to order pizza on a Friday night when you’re too tired to cook.

Mistake #3: Trying to Invest Your Emergency Fund

I see this constantly in online forums: “But I could earn 10% in the stock market instead of 4% in a boring savings account!”

Sure. Until the market tanks 25% the exact same month your transmission dies and you’re forced to sell at a massive loss just to get your car fixed. Or you lose your job during a recession when everything’s down.

Emergency funds aren’t investments. They’re insurance. They’re boring on purpose. Safety beats returns here, and anyone telling you otherwise doesn’t understand the fundamental purpose of emergency savings.

Mistake #4: Defining “Emergency” Too Broadly

Your roof is leaking water into your living room. Emergency.

Your favorite band announces a reunion tour with tickets on sale now. Not an emergency, even though it feels urgent.

Make a clear, specific rule about what counts as an emergency, write it down, and stick to it. The whole emergency fund vs savings account distinction matters here—one is for surprises, one is for plans.

Mistake #5: Saving While Drowning in High-Interest Debt

Here’s the one exception to “emergency fund first”: if you’ve got credit card debt at 20-30% interest, you’re losing more money in interest than you’re gaining in security.

The smart move? Build a small starter emergency fund ($500-1,000), then aggressively attack that high-interest debt, then finish building your full emergency fund. Otherwise you’re essentially saving at 4% while simultaneously paying 24%. The math doesn’t work.

Mistake #6: Never Using It When You Actually Should

Some people build up their emergency fund and then feel so guilty about touching it that they refuse to use it even during genuine emergencies. They feel like they’ve failed somehow.

That’s completely backwards. You built it specifically for moments like these. When a real emergency hits, use the money without guilt, handle the problem, then rebuild the fund.

That’s literally the entire point of having it.

Emergency Fund vs Savings Account: What’s the Difference?

People use these terms like they’re the same thing, but they’re actually different tools for different jobs. Understanding the emergency fund vs savings account distinction helps you manage your money way better.

- Purpose: Handle unexpected crap—sudden expenses and income loss

- Goal: 1-6 months of essential living expenses

- Accessibility: High priority (need it within 1-3 days)

- Usage: Only when genuinely unplanned stuff happens

- Mindset: This is your financial insurance policy and peace of mind

Regular Savings:

- Purpose: Stuff you’re planning for—vacation, house down payment, new car, wedding

- Goal: Whatever specific target you’ve set for yourself

- Accessibility: Can be less liquid (CDs, investment accounts might work here)

- Usage: When you hit your goal or timeline

- Mindset: Building toward something you actually want in life

Think of it like this: your emergency fund is playing defense. It protects what you’ve already got and keeps you from sliding backward. Your regular savings are playing offense—they help you move forward and build the life you actually want.

You need both, period. Your emergency fund makes sure one bad break doesn’t destroy you financially. Your savings let you make actual progress toward your dreams.

Most people should focus on building a starter emergency fund first, then work on both simultaneously.

Here’s a practical approach that makes sense:

- Save up $1,000 for your initial emergency fund

- Pay off any high-interest debt that’s killing you

- Build your emergency fund to full size (3-6 months)

- Then split your future savings between topping off your emergency fund, retirement contributions, and specific savings goals

When to Use Your Emergency Fund (and When Not To)

This is where the rubber meets the road. Theory is nice, but let’s get specific about what actually counts as an emergency worthy of touching that money you’ve been carefully saving.

Clear YES—Definitely Use Your Emergency Fund:

- You lost your job or took a major income hit

- Significant medical expenses your insurance won’t cover (studies show unexpected medical bills affect nearly 1 in 3 Americans annually)

- Essential home repairs (roof’s leaking, furnace died in winter, pipe burst)

- Essential car repairs when you absolutely need your car for work

- Emergency travel (family death, urgent family medical situation)

- Urgent veterinary care for your pet

- Necessary dental work that can’t wait

Probably YES—Depends on Your Situation:

- Smaller medical expenses that would strain your regular monthly budget

- Car repairs when you have other transportation options available

- Replacing essential appliances that died (fridge, washing machine)

- Insurance deductibles for legitimate claims

Probably NO—Try to Find Another Way:

- Annual expenses you should’ve budgeted for but forgot (car registration, insurance premiums, holiday shopping)

- Gifts for weddings, birthdays, or holidays

- Elective medical procedures that can wait a few months

- Upgrading things that still work fine but are old

- Sales and deals, even really good ones that feel urgent

Clear NO—Do Not Touch Your Emergency Fund:

- Vacations or travel for fun

- New electronics or gadgets you want but don’t need

- Social expenses (bachelor parties, destination weddings, concert tickets)

- Investment opportunities

- Starting a side business or passion project

- Literally anything that’s a “want” rather than a “need”

The gut-check question you should always ask: “If I don’t spend this money right now, will it cause significant harm to my health, safety, housing, or ability to earn income?”

If the answer is no, it’s not an emergency. Find another way.

Financial emergencies exist on a spectrum. Losing your job is obviously an emergency. Needing new work shoes because yours have actual holes and you work in a professional office where appearance matters? That might qualify.

Wanting new shoes because your current ones aren’t trendy anymore? That’s not an emergency, that’s shopping.

When you’re unsure, ask yourself: “Can I solve this problem another way?” If yes, try that first. If no, and it’s genuinely urgent and necessary, use the fund without beating yourself up.

That’s literally why you built it in the first place. Then, make a plan to rebuild it.

Frequently Asked Questions

How much emergency fund do I need as a beginner?

Start with $1,000 as your first milestone—that’s emergency fund for beginners rule number one. This covers most common surprises like car repairs, minor medical bills, or replacing something essential that broke.

Once you’ve got that $1,000 saved, work toward one month of essential expenses (just the absolute basics, not your full lifestyle). Then gradually build to 3-6 months depending on whether you’ve got stable employment or more variable income.

If saving $1,000 feels completely overwhelming right now, start with $500. Or $250. Or honestly, $50. Any emergency fund beats having zero emergency fund.

Can I invest my emergency fund to earn higher returns?

No, and I really mean that. Your emergency fund should never go into stocks, index funds, crypto, or anything that can lose value. The entire purpose is stability and immediate accessibility, not growing wealth.

Keep it in a high-yield savings account or money market account where it’s FDIC insured and can’t drop in value. The one exception: once you’ve built up 6+ months of expenses, you could potentially keep 3 months readily accessible in savings and put the additional amount in very short-term CDs for slightly higher interest.

But only if you’re disciplined enough to maintain that split and not raid it.

Should freelancers keep a bigger emergency fund?

Yes, absolutely. If you’re freelancing or self-employed, aim for 6-12 months of expenses instead of the standard 3-6 months. Your income fluctuates unpredictably, projects end without warning, and you don’t have unemployment insurance as a safety net if things go sideways.

According to recent data on freelance workers, nearly 63% experience significant income volatility month-to-month. The larger cushion protects you during inevitable slow periods without forcing you to accept terrible low-paying clients out of desperation.

It also gives you actual leverage to be picky about projects and negotiate better rates because you’re not operating from a place of financial fear.

When should I use my emergency fund?

Use your emergency fund for unexpected, necessary expenses you genuinely can’t cover with your regular monthly income: job loss, major medical bills not covered by insurance, essential home or car repairs, emergency family travel.

Don’t use it for planned expenses you forgot to budget for, holiday shopping, that amazing sale happening right now, or wants dressed up as needs.

Ask yourself: “Will not spending this money right now cause real harm to my health, safety, housing, or ability to earn income?” If the answer is no, find a different way to cover it. Your emergency fund is for genuine surprises, not poor planning or impulse desires.

What’s the difference between an emergency fund and regular savings?

An emergency fund is defensive money specifically set aside for unexpected expenses and income loss—you keep it liquid in a savings account for quick access when life goes wrong.

Regular savings are offensive money for planned goals and purchases you’re intentionally working toward, like vacations, down payments, or new cars. Your emergency fund protects what you currently have and prevents you from sliding backward. Your savings build what you want and help you move forward.

You need both, but in different accounts serving different purposes. Most people should build a starter emergency fund first before aggressively pursuing other savings goals.

Conclusion

If you’re reading this and feeling behind, I need you to hear something: you’re not broken, and you haven’t failed at life. The system doesn’t teach this stuff. Schools don’t have “How to Build an Emergency Fund 101” classes.

Most people who have financial security either stumbled into it by accident, inherited it, or had someone teach them early. It’s not because they’re smarter or more disciplined than you.

An emergency fund isn’t about being paranoid or expecting the worst. It’s about being realistic. Things break down. People get sick. Jobs get eliminated. Emergencies happen to everyone.

And when those moments arrive—not if, but when—having money specifically set aside is the difference between handling it like a functional adult and watching everything spiral out of control.

You don’t need six months of expenses saved by next Tuesday. You don’t need to feel guilty about where you’re starting from. You just need to start.

Twenty dollars this week. Fifty next month. Whatever you can actually manage consistently without making yourself miserable.

The people who build real financial stability aren’t the ones who occasionally save huge amounts when they feel motivated. They’re the ones who save smaller amounts relentlessly, month after month, even when it feels pointless.

Especially when it feels pointless.

Maya, from the beginning of this article? She’s got $3,200 in her emergency fund now. Took her 18 months of consistent saving to get there. Her car broke down again last month—cost her $620 this time.

She paid cash, got it fixed, drove to her client meeting, and went home without stress or credit card interest piling up. Same car. Same income. Completely different outcome.

That’s the actual power of having an emergency fund.

Your action step today: Open a high-yield savings account and transfer $10 into it. Or $5. Or literally $1 if that’s what you can spare. Just start.

Then set up an automatic transfer for next week, even if it’s tiny. That’s it. You’ve officially begun building your financial safety net.

The gap between having absolutely no emergency fund and having something—anything—shrinks your financial risk more than you’d think. Start building your emergency fund buffer today.

Future you is going to be incredibly grateful you did.

Compliance & Disclaimer

This article provides educational information about personal finance and building an emergency fund based on widely accepted financial principles and research. It’s meant to help you understand concepts and make informed decisions, but it’s not personalized financial advice tailored to your specific situation.

I’m not a licensed financial advisor, certified accountant, or investment professional. Your financial situation is unique—your income, expenses, debt load, life goals, and comfort with risk all matter.

Before making any significant financial decisions, consider talking with a qualified financial professional who can look at your specific circumstances and give you personalized guidance.

The strategies and recommendations discussed here represent general guidance that works for many people based on sound financial principles, but there’s no one-size-fits-all approach to money. Use this information as a starting point for your own research and decision-making process.

Interest rates, economic conditions, banking products, and financial regulations change over time. Always verify current rates, terms, and conditions before opening accounts or making financial commitments. What’s true today might shift tomorrow.

Take what’s useful here, leave what doesn’t apply to you, and build a financial safety net that actually works for your life.

Go to the Next Lesson:

How to Build a Practical Savings Plan That Actually Works for Beginners

Now that you understand the importance of having an emergency fund, it’s time to make a plan for growing your savings beyond just safety money. This lesson walks you through creating a practical, realistic savings plan that fits your goals and your budget.