How to Start Building Your Emergency Fund When You’re Living Paycheck to Paycheck

Feeling like your paycheck disappears the moment it hits your account? You’re not alone—and you’re not powerless.

Let’s be real. Saving money sounds great in theory. But when rent, groceries, and bills are eating up most of your income, the idea of putting money aside feels impossible. Especially when the advice out there tells you to stash away six months of expenses—like, okay… where?

But here’s the thing: emergencies don’t wait until you’re financially ready. And while saving may seem out of reach right now, building an emergency fund is still doable—even on a tight budget.

Let’s walk through how you can start saving without turning your life upside down.

Why You Need an Emergency Fund—Even If You’re Broke

Think about this:

- What happens if your phone suddenly breaks and you need a new one for work?

- What if a family member falls sick and you need to cover their medical costs?

- What if you lose your job next month?

These aren’t far-fetched situations. They happen every day, to people in all income brackets. And when you don’t have a financial cushion, your only options are usually credit cards, loans, or borrowing from friends and family—which can quickly snowball into stress and long-term debt.

An emergency fund gives you breathing room. It’s not about getting rich—it’s about avoiding getting stuck.

“An emergency fund is like a parachute—you hope you never have to use it, but when you need it, it’s everything.”

Let’s Be Honest—The Usual Advice Doesn’t Work for Everyone

You’ve probably heard: “Save six months of expenses.” Sure, that’s a solid goal. But for someone barely scraping by, it can feel like being told to climb Mount Everest without shoes.

If you’ve ever felt discouraged by traditional savings advice, here’s your permission to ignore it (for now).

Start where you are. Use what you have. Do what you can. That’s more than enough.

Micro Steps You Can Start Today

Building your emergency fund doesn’t require a huge windfall. It starts with tiny, consistent actions. Here’s what you can try:

- Set aside ₹50–₹100 a week. It doesn’t sound like much, but over time, it adds up. ₹100 a week = ₹5,200 a year.

- Use auto-save apps. Some banks or fintech apps round up your purchases and deposit the change into savings. It’s painless and automatic.

- Cut one “meh” expense. Cancel a subscription you forgot about. Brew coffee at home 3 days a week. Find one thing that won’t hurt to skip—and redirect that money into your fund.

These aren’t sacrifices. They’re strategic swaps.

Creative Ways to Boost Your Savings (Without Feeling Deprived)

Saving doesn’t have to mean cutting back on everything fun. Try a few of these:

- Sell stuff you don’t use. Old books, clothes, gadgets—turn them into cash with local apps or marketplaces.

- Do one-time gigs. Platforms like Fiverr, Upwork, or local freelance work can help you earn quick money for your fund.

- Try a “no-spend weekend.” Make it fun! Cook at home, play free games, binge your favorite shows—and save what you would’ve spent.

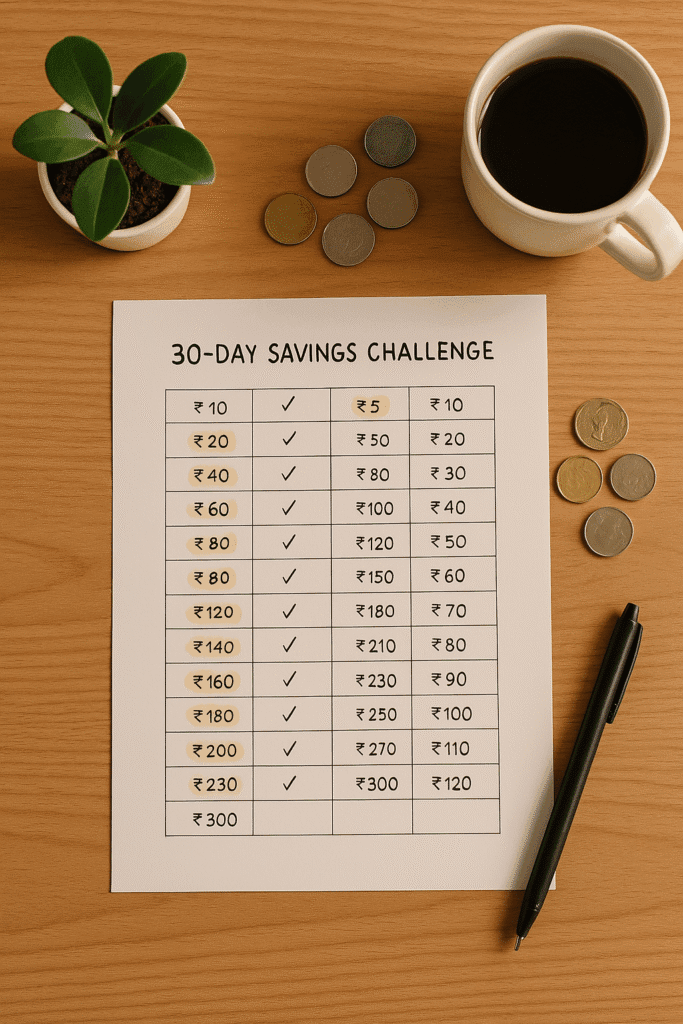

Pro tip: Treat saving like a challenge or game, not a punishment. It’s way more motivating.

Where Should You Keep Your Emergency Fund?

This part’s important. You want your money to be easy to access in a real emergency, but hard to dip into for everyday wants.

- Avoid your checking account. Too tempting.

- Look for a high-yield savings account. These offer better interest and are separate from your daily spending.

- Name your account. Seriously—call it “Peace of Mind Fund” or “Emergency Only.” It’s a small psychological trick that makes a difference.

Staying Motivated When Money is Tight

Saving is hard. Doing it on a low income? Even harder. But motivation grows when you see progress.

- Track your milestones. Hit ₹1,000? Celebrate. Hit ₹5,000? Dance a little.

- Visual reminders help. Use a savings tracker, a jar, a sticky note—something physical you see every day.

- Remember your why. Peace of mind. Less stress. No panic when life throws a curveball.

Real Talk: This is About Progress, Not Perfection

Maybe today you can only save ₹10. That’s okay. Tomorrow might be ₹100. The key is consistency, not size.

“Don’t wait until you have a lot to start. Start so you can have a lot later.”

The best time to start your emergency fund? Yesterday.

The second-best time? Today.

Let’s Talk: What’s One Thing You Can Do This Week to Start Saving?

Maybe it’s skipping one delivery meal. Maybe it’s putting aside ₹50. Maybe it’s selling that old Bluetooth speaker you haven’t touched in a year.

Drop your idea in the comments—I’d love to hear it. Let’s support each other.

Feeling stuck doesn’t mean you’re failing.

It just means you’re at the beginning of something new—and you’re taking the first step.

You’ve got this. 💪