How to Get Out of Debt Fast — A Real Plan That Works

I still remember the exact moment everything clicked for me. I was sitting at my kitchen table at 2 AM, calculator in one hand, tissues in the other, staring at a pile of credit card statements. $27,143.68. That’s what I owed. And honestly? I had no idea how I’d gotten there.

Maybe you’ve been there too. That sick feeling in your stomach when you realize the minimum payments aren’t even covering the interest. The shame of declining a friend’s dinner invitation because you can’t afford it. The panic when your car makes a weird noise because you know there’s no emergency fund.

Here’s what nobody tells you about debt: it’s not just a math problem. Sure, the numbers matter, but what really keeps us stuck is the emotional weight we carry. The shame. The fear. The feeling that we’re the only ones who can’t seem to figure this money thing out.

I want you to know something right now, before we go any further: you’re not broken. You’re not stupid. You’re not alone. According to recent data, the average American carries over $105,000 in total debt. Credit card balances alone average $6,730 per person, with monthly debt payments hitting $1,237 in 2025.

This guide isn’t about judgment or quick fixes. It’s about real strategies that actually work—the kind that helped me pay off my debt and have helped thousands of others do the same. I’m going to walk you through exactly how to get out of debt, step by step, in a way that fits your actual life.

Related topic: The Netflix Budget: How

Let’s Talk About What “Fast” Really Means

Okay, real talk. When I first decided to tackle my debt, I thought “fast” meant wiping it out in a few months. Like I’d just manifest some money or something. Spoiler alert: that’s not how it works.

Getting out of debt fast doesn’t mean erasing $50,000 in six months (unless you win the lottery, in which case, congrats and call me). What it actually means is paying off your debt way faster than your credit card company hopes you will.

Think about it. If you’re making minimum payments on $10,000 in credit card debt at 18% interest, it’ll take you about 15 years and cost you an extra $9,000 in interest. Fast means cutting that timeline down to maybe 2-3 years instead. That’s huge.

Here’s the mindset shift that changed everything for me: this isn’t a sprint or a diet. It’s not about depri ving yourself until you snap and go on a spending spree. It’s about changing your relationship with money permanently—in a way that actually feels sustainable.

When you hear about someone paying off massive debt “fast,” what they’re really doing is:

- Throwing every extra dollar at their debt instead of letting it sit

- Finding creative ways to earn more money (we’ll talk about this)

- Cutting expenses ruthlessly, but strategically

- Building momentum with small wins

- Staying committed even when it gets hard

I’m not gonna sugarcoat it—you didn’t accumulate this debt overnight, and you won’t eliminate it overnight either. But with the right approach, you can become debt-free years (or even decades) sooner than you ever thought possible. And that feeling? It’s worth every sacrifice.

The Hidden Psychology That Keeps You Stuck

Here’s something that might make you uncomfortable: getting out of debt isn’t really about math. I mean, yes, the numbers matter. But if it were just about math, we’d all be debt-free, right?

The real issue is what’s happening between your ears. And in your heart.

Why We Spend When We’re Hurting

Let me tell you about a Tuesday in March when I had the worst day at work. My boss criticized a project I’d worked on for weeks. I felt exhausted, unappreciated, defeated. You know what I did on the way home? Stopped at Target for “just a few things.”

$127 later, I walked out with candles, throw pillows, a new water bottle, and stuff I didn’t even remember grabbing. That’s emotional spending in action.

Research shows that emotional spending isn’t about the stuff we buy—it’s about trying to soothe feelings like stress, sadness, loneliness, or even excitement. We’re essentially medicating our emotions with shopping. And here’s the kicker: it works. For about 20 minutes. Then we’re left with the debt and the same feelings we were trying to escape.

The Weight That Nobody Talks About

You know what’s wild? Over half of American adults report that dealing with debt seriously messes with their mental health. We’re talking anxiety, depression, sleep problems, relationship stress—the works.

And it’s not just about the numbers on your statements. It’s about the shame of feeling like you should have it together by now. The fear that you’ll never be able to afford a house or retire or help your kids with college. The exhaustion of juggling it all and feeling like you’re getting nowhere.

A study found that half of all adults with debt problems are also struggling with mental health issues. That’s not a coincidence. Debt and mental health feed into each other in this vicious cycle.

Breaking Free From the Pattern

So how do we actually break this cycle? Here’s what worked for me and what I’ve seen work for hundreds of others:

Face it head-on, even though it’s scary. I avoided looking at my total debt for almost a year. Know what happened during that year? It grew. By a lot. The day I finally sat down and added it all up was terrifying. It was also the day I started getting better.

Figure out your triggers. For me, it was stress and FOMO (fear of missing out). For you, it might be boredom, loneliness, or celebrating good news. Spend one week tracking not just what you spend, but how you felt right before each purchase. Patterns will emerge. I promise.

Use the 48-hour rule. This one’s simple but powerful. When you want to buy something that isn’t an absolute necessity, wait 48 hours. Add it to a list if you need to. You’ll be shocked at how many things you forget about or realize you don’t actually want. The emotional urge passes, and you save money.

Find healthier coping strategies. This was hard for me because retail therapy felt like my only outlet for years. But I started replacing shopping with long walks while listening to podcasts, calling my best friend, or even just journaling. Sometimes I’d let myself have a good cry. It sounds silly, but it worked better than another impulse Amazon order.

The psychology stuff matters just as much as the budget stuff. Maybe even more. Because you can have the perfect debt repayment plan, but if you don’t understand why you got into debt in the first place, you’ll end up right back where you started.

Your Personal Debt Freedom Roadmap

Alright, let’s get into the practical stuff. This is your actual, step-by-step debt repayment plan template that you can start using today. Not tomorrow. Not Monday. Today.

Step 1: Get Real With Your Numbers

This is the hardest step, and it’s the first one because it has to be. You need to know exactly what you’re dealing with.

Grab a notebook, open a spreadsheet, or use your phone’s notes app. List every single debt you have:

- Every credit card (yes, even the one with just $50 on it)

- Student loans

- Car loans

- Personal loans

- Medical bills

- Money you owe friends or family

- Everything

For each debt, write down:

- The current balance

- The interest rate

- The minimum monthly payment

- The due date

Then—and this is important—add them all up. Look at that total number. Breathe. Maybe cry a little if you need to. I won’t judge. I cried.

Here’s something helpful: pull your free credit report from annualcreditreport.com to make sure you haven’t forgotten anything. I discovered a medical bill in collections I didn’t even know about.

Step 2: Figure Out Your Debt-Free Date

Add up all those minimum payments. That’s the absolute least you need to pay each month to stay current on everything.

Now here’s the question that changes everything: how much extra can you throw at this debt? Even $50 or $100 extra per month makes a massive difference.

When I started, I could only scrape together an extra $75 per month. It felt like nothing against my $27,000 debt. But you know what? That $75 knocked years off my timeline.

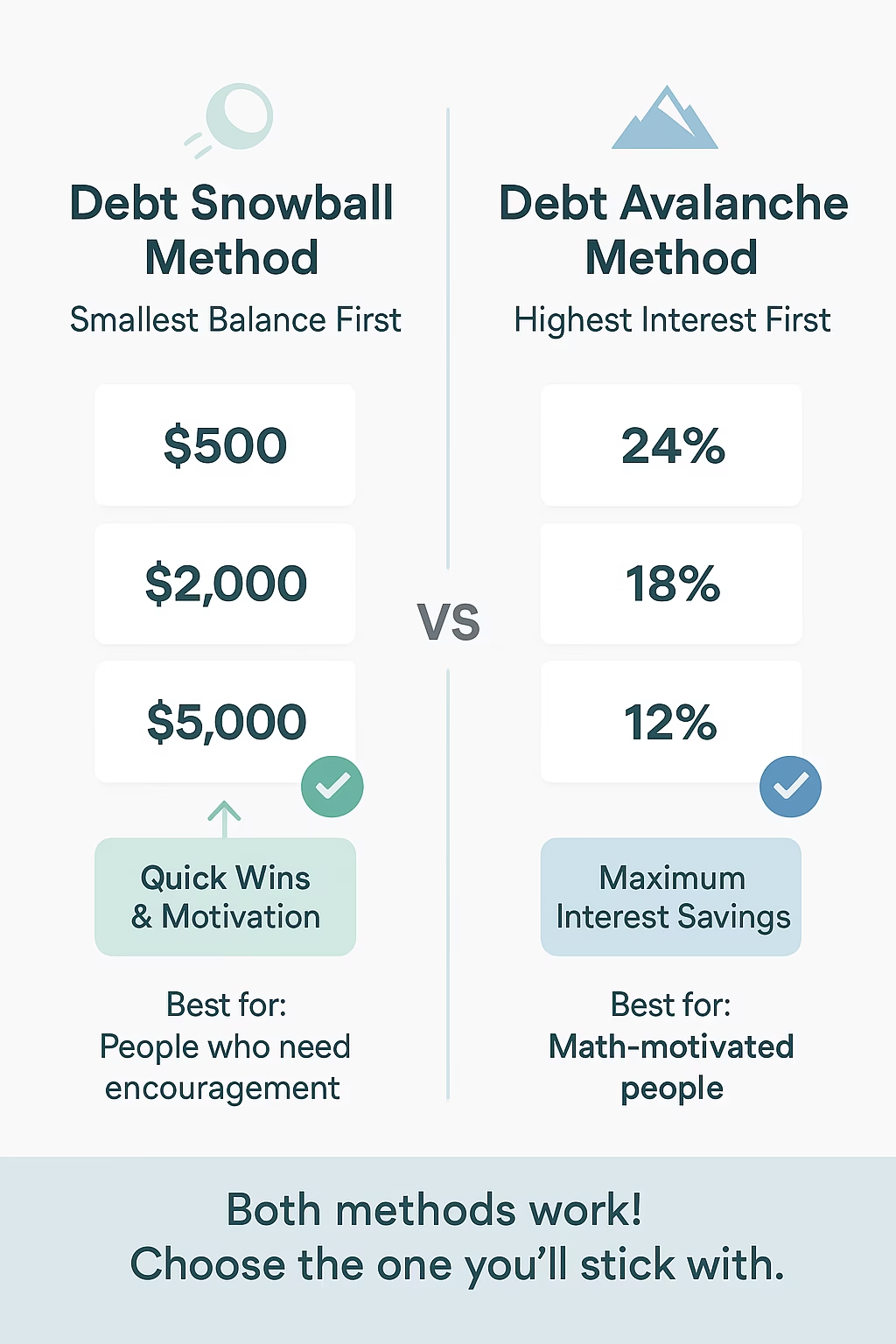

Step 3: Pick Your Repayment Method

You’ve got two main options here, and we’ll dive deeper into both later:

The Debt Snowball: Pay off your smallest balance first, regardless of interest rate. This gives you quick psychological wins. When you’re feeling defeated and hopeless (which, let’s be honest, you probably are), those quick wins can keep you going.

The Debt Avalanche: Pay off your highest interest rate first. Mathematically, this saves you the most money over time.

Honestly? The “best” method is whichever one you’ll actually stick with. And that’s different for everyone.

Step 4: Build Your Bare-Bones Budget

I know, I know. Budgets feel restrictive and boring and like your mom is watching over your shoulder. But hear me out—this isn’t about restriction. It’s about awareness.

Pull up your last three months of bank and credit card statements. This part is uncomfortable, but it’s necessary. Categorize every single expense:

Things you absolutely need:

- Housing (rent or mortgage)

- Utilities

- Insurance

- Groceries (basic, actual groceries)

- Transportation

- Minimum debt payments

Things you want but don’t technically need:

- Eating out and takeout

- Entertainment and subscriptions

- Shopping

- Hobbies

- Travel

Be brutally honest here. That daily coffee isn’t a need (I know, I know, it feels like one). Those streaming services you forget you have? Not a need.

Step 5: Cut Expenses (Without Hating Your Life)

When you’re trying to figure out how to pay off debt fast, cutting expenses is usually the fastest way to free up money.

Easy cuts that won’t hurt much:

- Cancel subscriptions you don’t actually use (gym, streaming services, meal kits)

- Switch to generic brands at the grocery store

- Cook at home instead of eating out

- Call your providers and negotiate (internet, phone, insurance—I’ve saved $150/month doing this)

- Cancel cable and stick with one or two streaming services

- Skip expensive entertainment and look for free stuff in your area

But here’s what I learned the hard way: don’t cut everything fun. Seriously.

When I first started, I cut everything. No restaurants, no coffee shops, no hanging out with friends, nothing fun at all. You know what happened? I lasted about six weeks before I cracked and went on a $400 spending spree out of pure misery.

Give yourself a small “fun money” category. Even if it’s just $50-100 per month. One woman I read about who paid off $87,000 in debt budgeted $100 a month just for herself. It made the whole thing sustainable.

Step 6: Find Ways to Earn More

Sometimes cutting expenses just isn’t enough, especially if you’re learning how to get out of debt with low income. You need more money coming in.

Quick ways to boost your income:

- Sell stuff you don’t use on Facebook Marketplace, eBay, or Poshmark (I made $1,200 selling old clothes and electronics)

- Pick up freelance work on Upwork or Fiverr

- Drive for Uber or deliver food

- Ask for a raise at work (seriously, when’s the last time you asked?)

- Take overtime if it’s available

- Rent out a spare room or parking space

- Dog-sitting or babysitting

During my debt payoff, I picked up freelance writing gigs on weekends. It was exhausting, but every dollar went straight to debt. The extra $400-600 per month cut my timeline in half.

Step 7: Automate Everything You Can

Set up automatic payments for at least the minimum on every debt. Late fees will sabotage your progress faster than anything.

Then set up another automatic payment—your extra payment toward whichever debt you’re targeting first.

Why automate? Because on February 15th when your friend invites you to dinner and a concert, that money will already be gone to debt before you can talk yourself out of it. Future you will be grateful.

Step 8: Track Your Progress Like Your Life Depends On It

Create some kind of visual tracker. I used a big posterboard with a coloring-in design. Some people use spreadsheets with fancy graphs. Find what works for you.

Update it every single time you make a payment. Watch that number shrink.

And celebrate your wins, even the tiny ones:

- Paid off a $200 medical bill? That’s worth celebrating

- Made it a full month sticking to your budget? Celebrate that

- Knocked out your first credit card? Do a happy dance

The experts at NerdWallet suggest celebrating these milestones to maintain momentum—and they’re absolutely right. Taking it step-by-step makes the whole mountain feel climbable instead of overwhelming.

Snowball or Avalanche? Choosing Your Strategy

Okay, this is where everybody gets stuck. Debt snowball vs avalanche method—which one should you choose?

I’m gonna break down both methods in plain English, then tell you how to decide.

The Debt Snowball: Quick Wins for Your Soul

Here’s how it works: you pay off your smallest debt first, regardless of the interest rate. Once that’s gone, you take the payment you were making on it and add it to the payment on your next smallest debt. And so on.

Example: Let’s say you’ve got:

- Credit card 1: $500 at 22% interest

- Credit card 2: $3,000 at 18% interest

- Car loan: $8,000 at 6% interest

With the snowball method, you’d attack that $500 credit card first.

Why this works: Because in a few weeks or months, you’ll have completely eliminated one debt. Gone. Done. Crossed off your list. That feeling is powerful.

When I used the snowball method, paying off my first small credit card ($430) felt like I’d just summited Everest. It proved to me that I could actually do this. That psychological win kept me going through the tough months.

The downside: You’ll pay more in interest over time because you’re not prioritizing the expensive debt.

The Debt Avalanche: Maximum Money Savings

With the avalanche method, you pay off your highest interest rate debt first, regardless of the balance.

Same example, different strategy:

- Credit card 1: $500 at 22% interest ← You’d start here

- Credit card 2: $3,000 at 18% interest ← Then here

- Car loan: $8,000 at 6% interest ← Finally this

Why this works: Mathematically, it saves you the most money on interest. If you’re motivated by numbers and optimization, this is your method.

The downside: If your highest-interest debt is also your biggest balance, your first payoff victory might be a year or more away. That can be discouraging.

As Investopedia explains, the avalanche method is mathematically optimal for minimizing interest costs, but it requires more patience and discipline to stay motivated.

The Comparison Table Everyone Needs

| Factor | Debt Snowball | Debt Avalanche |

|---|---|---|

| Strategy | Smallest balance first | Highest interest rate first |

| Main benefit | Quick wins, staying motivated | Maximum interest savings |

| Best for | People who need encouragement and visible progress | People motivated by math and optimization |

| Total interest paid | More | Less |

| Time to first victory | Usually faster | Potentially slower if high-interest debt is large |

| Difficulty | Easier to stick with | Requires more discipline |

| Emotional impact | High—frequent victories feel amazing | Moderate—slower visible progress |

So Which One Should You Actually Choose?

Here’s my honest answer: pick the one that matches your personality.

If you’ve been struggling with debt for years and feel defeated, go with the snowball. You need those wins to prove to yourself that you can do this. I’m serious. The psychological boost is worth the extra interest you’ll pay.

If you’re highly motivated by numbers and saving money, and you can stay disciplined without frequent victories, go with the avalanche.

Or do what I eventually did: start with the snowball to build momentum by knocking out 1-2 small debts quickly, then switch to the avalanche for maximum savings. There’s no rule saying you can’t combine strategies.

The method that works is the one you’ll actually follow through on. That’s it. That’s the secret.

Real People, Real Results: Stories That’ll Give You Hope

Let me introduce you to some people who faced down debt that seemed impossible and actually won. These aren’t fairy tales—they’re real stories that prove this stuff actually works.

The Woman Who Paid Off $77,000 in Under a Year

After years of avoiding her financial reality, one woman finally sat down and faced the truth: $77,000 in debt. The number made her physically ill.

But instead of giving up, she created something she called the “Budget-by-Paycheck” method. She realized that traditional monthly budgets weren’t working for her, so she planned out every paycheck individually.

Her secret? She didn’t try to be perfect. She budgeted $100 per month just for herself—for fun money, for breathing room, for being human. That little bit of permission to enjoy life made the whole thing sustainable.

What really turned things around was finding her “why.” She wasn’t just paying off debt—she was building a future where money stress wouldn’t control her life anymore. That purpose kept her going when it got hard.

The Teacher Who Conquered $20,000 While Learning to Live Without Credit Cards

Ariel, a teacher from Tampa, was drowning in $20,000 of debt with minimum payments hitting almost $1,000 per month. As someone working in education, finding that kind of money every month felt impossible.

She made a decision that scared her: she went through a debt relief program that helped consolidate her payments. But the real transformation happened when she learned to live without credit cards.

“I was also able to learn how to live without a credit card, which was huge for me,” she said. Breaking that cycle of relying on credit for everything—that was the game-changer.

The Couple Who Paid Off $147,000 (Including Their Mortgage)

Jackie and her husband had around $52,000 in consumer debt plus their mortgage. They’d been through unemployment, hospital bills, vet bills, car problems, and all the normal life chaos that happens.

Here’s what’s beautiful about their story: it wasn’t fast. They didn’t do anything dramatic. They just stuck to one simple rule: “only spend money you already have.”

No more borrowing. When life happened—and it did happen—they found ways to handle it without going back into debt. It took years, but they paid off everything, including their house.

Their story proves that you don’t have to pay off debt at lightning speed. You just have to keep going, even when progress feels slow.

The Gig Worker Who Found Relief

Kevin worked as an actor, personal trainer, narrator, and special events presenter in Los Angeles. His income was completely unpredictable—some months were great, others were terrible. But his bills? Those showed up like clockwork.

Debt piled up fast when work was slow. He felt stuck in a cycle he couldn’t escape.

Working with a debt relief program helped him consolidate everything into one payment he could actually afford based on his variable income. “It was extreme stress relief,” he said.

What They All Had in Common

Look at these stories and you’ll notice patterns:

- They stopped avoiding their debt and faced it honestly

- They found ways to increase income beyond their regular paycheck

- They cut expenses, but not in ways that made them miserable

- They knew WHY they wanted freedom—their deeper reason for doing this hard thing

- They celebrated progress to stay motivated

- They stuck with it through setbacks

As CNBC reports in their debt payoff stories, the people who successfully become debt-free aren’t superhuman. They’re just regular people who made a plan and refused to give up on it.

Debt might seem completely insurmountable while you’re staring at it from the bottom. But these people climbed that mountain. And honestly? You can too.

Mistakes I Made So You Don’t Have To

Let me save you some time, money, and heartache by sharing the biggest mistakes I made—and that I see other people making all the time.

Mistake #1: Consolidating Without Fixing the Problem

I consolidated my credit cards into a personal loan with a lower interest rate. Smart move, right?

Wrong. Because I didn’t address why I’d maxed out those cards in the first place. So guess what happened? Within six months, those credit cards were creeping back up. Now I had the loan payment AND new credit card debt.

Consolidation can be a great tool, but only if you’ve fixed your spending habits first. Otherwise, you’re just creating more debt on top of consolidated debt.

Do this instead: Spend at least one month tracking every penny and understanding your emotional triggers before you consolidate anything.

Mistake #2: Skipping the Emergency Fund

I was so eager to attack my debt that I threw every extra cent at it. Then my car needed a $800 repair. Guess where that money came from? Yep. Right back onto my credit card.

You cannot aggressively pay down debt without at least a small emergency cushion. I learned this lesson three times before it finally stuck.

Do this instead: Save $1,000 first (even if it kills you to not put it toward debt), then attack your debt with everything you’ve got.

Mistake #3: Trying to Pay Extra on Everything

In my enthusiasm, I tried to pay extra on all five of my debts simultaneously. It felt productive. It wasn’t.

Know what happened? After six months, I couldn’t see progress on any of them. Every balance looked basically the same. I got discouraged and almost quit.

Do this instead: Pay minimums on everything, then focus all extra money on ONE debt at a time. The progress you’ll see will keep you motivated.

Mistake #4: Being Too Restrictive

I went full scorched-earth on my budget. Canceled everything. No fun, no treats, no social life. I was miserable.

Two months in, I cracked. Spent $400 in one weekend because I felt so deprived. Then felt terrible about it and wanted to give up entirely.

Do this instead: Build in a small amount of fun money—$50, $100, whatever you can swing. This isn’t selfish. It’s survival.

Mistake #5: Not Negotiating

For the first year of my debt payoff, it never occurred to me to just ask for better terms. Then I read about someone who called their credit card company and asked for a lower interest rate.

They said yes??? Just like that???

So I tried it. Called all my credit cards. Got three out of five to lower my rates. Some by a lot. That conversation saved me probably $1,500 in interest over my payoff timeline.

Do this instead: Call everyone—credit cards, medical billing, service providers. The worst they can say is no. But often, they’ll say yes.

Mistake #6: Keeping It Secret

I didn’t tell anyone I was paying off debt for almost a year. I was too ashamed. But that meant I had no accountability and no support.

When I finally told my best friend, everything changed. She checked in on me. Celebrated wins with me. Suggested free activities when I couldn’t afford to go out. Having one person in your corner makes this whole thing less lonely.

Do this instead: Tell at least one trusted person about your goal. Even better, find someone who’s also paying off debt and check in with each other regularly.

Mistake #7: Treating It Like a Math Problem

This is the biggest one. I treated debt payoff like it was purely about numbers and spreadsheets. I didn’t address the emotional and psychological stuff.

So I paid off debt, but I didn’t change my relationship with money. And guess what? A couple years later, I found myself sliding back into debt because I hadn’t dealt with the root causes.

Do this instead: Work on your money mindset while you’re paying off debt. Journal about your triggers. Consider talking to a therapist about money stress. Join communities of people on the same journey.

Tools That Actually Help (Not Just More Apps)

Let’s talk about resources that genuinely make this journey easier. Not just random apps you’ll download and forget about.

Calculators That Show You the Finish Line

Seeing exactly when you’ll be debt-free makes it feel real instead of like some impossible dream.

Debt Payoff Planner (free app for iOS and Android): This one’s my favorite. You plug in your debts, and it shows you visual timelines for both snowball and avalanche methods. Watching those payoff dates move up as you make extra payments is incredibly motivating.

NerdWallet’s Debt Payoff Calculator: Head over to NerdWallet’s website and use their free calculator to see exactly how long it’ll take to become debt-free with your current payments versus accelerated payments. The difference will probably shock you.

Budgeting Tools That Don’t Feel Like Homework

YNAB (You Need A Budget): This one costs money ($99/year), but it’s worth it if you’re serious. The philosophy is “give every dollar a job.” It completely changed how I thought about money.

EveryDollar: Free version available. Based on zero-based budgeting. Straightforward and not overwhelming.

Mint: Completely free. Connects to all your accounts and tracks everything automatically. Good if you want a big-picture view without much effort.

Learning Resources That Actually Teach You Something

Books that changed my perspective:

- The Total Money Makeover by Dave Ramsey (if you want a straightforward, no-nonsense approach to debt snowball)

- Your Money or Your Life by Vicki Robin (if you want to understand the psychology behind your money choices)

- I Will Teach You to Be Rich by Ramit Sethi (practical strategies without the guilt trips)

Websites worth your time:

- Investopedia’s personal finance section for understanding debt strategies and financial concepts without confusing jargon

- CNBC Select’s debt guides for real stories and practical advice from people who’ve actually done this

If You Need Professional Help

Sometimes DIY isn’t enough, and that’s okay. If your debt feels truly unmanageable, consider working with a nonprofit credit counseling agency:

National Foundation for Credit Counseling (NFCC): They’ll help you create a debt management plan and can even negotiate with creditors on your behalf.

Financial Counseling Association of America (FCAA): Offers free or low-cost counseling services.

A word of warning: avoid for-profit “debt settlement” companies that charge huge fees upfront. Stick with nonprofit organizations that actually want to help you, not just take your money.

Community Support That Keeps You Going

Don’t underestimate the power of connecting with people on the same journey:

r/personalfinance and r/DaveRamsey on Reddit: Active communities with tons of support and advice

#DebtFreeCommunity on Instagram and TikTok: Real people sharing their journeys, wins, and struggles

Debt-Free Community groups on Facebook: Search for groups focused on debt payoff—they’re full of encouragement and practical tips

Having people who get it makes those tough months bearable. Seriously. Find your people.

Your Questions Answered

How can I get out of debt fast with a low income?

This is the question I get most often, and I’m not gonna lie—it’s harder with a low income. But it’s not impossible. I’ve seen people making minimum wage pay off significant debt.

Here’s your two-pronged approach:

Cut expenses ruthlessly:

- Eliminate everything non-essential temporarily (yes, everything)

- Cook all meals at home using budget recipes

- Find free entertainment—library books, hiking, free community events

- Negotiate or pause services you can (call providers and explain your situation)

- Apply for assistance programs if you qualify (there’s no shame in getting help)

Increase income any way you can:

- Take on any side gig that uses skills you already have

- Sell anything you don’t absolutely need

- Look into gig work like food delivery if you have a car

- Ask about overtime or additional shifts at work

- Check if you’re eligible for earned income tax credit or other benefits

Even on a low income, paying an extra $50-75 per month changes your timeline dramatically. Start where you are. Every little bit actually matters.

Which is better—debt snowball or debt avalanche?

I’m gonna give you the most honest answer: whichever one you’ll actually stick with.

The avalanche method saves you more money on interest. That’s just math. But here’s what they don’t tell you: if you give up halfway through because you’re not seeing progress, you save zero dollars.

Choose snowball if:

- You need quick wins to stay motivated (no judgment—most of us do)

- You’ve struggled with debt for years and feel defeated

- Your highest-interest debt is also your largest balance

- You have several small debts you can eliminate quickly

Choose avalanche if:

- You’re highly motivated by saving money

- You can stay disciplined without frequent victories

- Your highest-interest debt has a manageable balance

- You’re comfortable with delayed gratification

The difference in total interest between the two methods is usually less than you think—often just a few hundred to a couple thousand dollars. Finishing the journey is worth way more than the mathematical difference.

My advice? Start with snowball to build momentum, then consider switching to avalanche once you’ve got some wins under your belt.

Can debt consolidation hurt my credit score?

Short answer: temporarily, maybe. Long-term, probably not if you handle it right.

Here’s what happens:

- Applying for a consolidation loan creates a hard inquiry (small, temporary dip in your score)

- Opening a new account lowers your average account age (slight impact)

- If you close credit cards after consolidating, your available credit drops (could affect your utilization ratio)

But here’s the good news:

- Making on-time payments on your consolidation loan boosts your score over time

- Having fewer accounts to juggle means less chance of missing a payment

- Lower utilization ratios (if you pay off credit cards but don’t close them) help your score

My credit score actually went up about 50 points six months after consolidating because I was finally making consistent on-time payments and my utilization ratio dropped.

The key is this: consolidate, then don’t rack up new debt. If you can’t trust yourself not to use those paid-off credit cards, cut them up or freeze them in a block of ice.

How long does it take to become debt-free?

I wish I could give you a simple answer, but it really depends on:

- How much debt you have

- Your income and how much extra you can pay

- Your interest rates

- How aggressive you want to be

- What life throws at you along the way

Here are some realistic timelines based on what I’ve seen:

$5,000-$10,000 in debt: 1-2 years with focused effort

$20,000-$30,000 in debt: 2-4 years depending on income

$50,000+ in debt: 3-7 years with aggressive payoff strategy

One woman paid off $77,000 in less than a year, but she made extreme lifestyle changes and was super intense about it. That level of intensity works for some people, but it’s not the only way.

I took about 3.5 years to pay off $27,000. Some months I made huge progress. Other months life happened and I could barely scrape together extra payments. That’s normal.

Use a debt payoff calculator to see your projected timeline, then do everything you can to beat it. But also give yourself grace when things don’t go perfectly.

What’s the very first step to getting out of debt?

The absolute first step—before budgets, before strategies, before anything else—is to face your debt honestly and completely.

I know it’s scary. Trust me, I avoided this step for almost a year because I was terrified of what the total would be.

But here’s your day-one action plan:

1. Gather everything: Pull out every credit card statement, loan document, medical bill—all of it. Put it in one pile.

2. Make your list: Write down every debt with its balance, interest rate, and minimum payment. Use paper, a spreadsheet, your phone—whatever works for you.

3. Add it up: Calculate that total number. Yes, it might make you feel sick. That’s normal. Breathe through it.

4. Pull your credit report: Go to annualcreditreport.com (it’s actually free, despite the sketchy-sounding name) and check for anything you might have forgotten.

5. Sit with it: Give yourself permission to feel whatever you’re feeling—fear, shame, anger, overwhelm. All of it is valid.

6. Make one decision: Decide that today is the day you start changing this. Not tomorrow. Not Monday. Today.

That’s it. You don’t need to have all the answers yet. You just need to know where you stand and commit to moving forward.

Starting Today (Yes, Today)

Okay, we’ve covered a lot. You’ve got strategies, examples, warnings about mistakes, tools to help you. But none of it matters if you don’t actually start.

And I know what you’re thinking. “I’ll start on Monday.” “I’ll start next month when I get paid.” “I’ll start after the holidays.” “I’ll start when I feel ready.”

Here’s the truth I learned the hard way: you’ll never feel ready. There will never be a perfect time. There will always be a reason to wait.

What Debt Freedom Really Feels Like

Before we talk about action steps, let me tell you what’s waiting for you on the other side of this journey.

When I made my final debt payment, I didn’t feel the explosion of joy I’d expected. What I felt was peace. Deep, quiet peace.

I slept better that night than I had in years. Not because anything in my external life had changed in that moment, but because the weight was finally gone.

Now, a few years out, here’s what debt freedom looks like:

- My paycheck is mine—not already spent before I even get it

- When my friends suggest dinner out, I can say yes without panic

- Car troubles are annoying, not catastrophic

- I have actual savings that grow instead of disappearing

- I can be generous with people I care about

- I make spending choices based on my values, not my credit limit

Freedom doesn’t mean I’m rich. It means I’m in control. And that feeling is priceless.

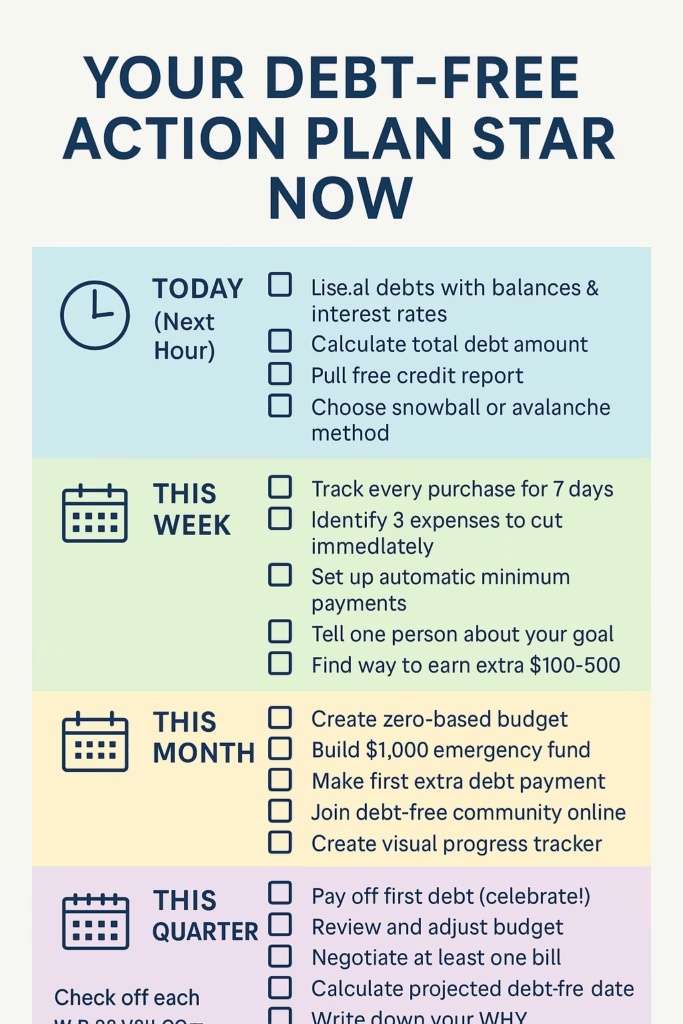

Your Action Plan: What to Do Right Now

Don’t just close this tab and go back to scrolling. Make this the moment that changes everything.

In the next hour:

- List all your debts with balances, interest rates, and minimums

- Calculate your total debt (yes, look at that scary number)

- Pull your free credit report to catch anything you missed

- Decide whether snowball or avalanche fits your personality better

This week:

- Track every single purchase for 7 days (every coffee, every app, everything)

- Identify three expenses you can cut immediately

- Set up automatic minimum payments on all debts

- Tell one trusted person about your goal (accountability matters)

- Find one way to earn an extra $100-500 this month

This month:

- Create your first real budget that accounts for every dollar

- Start building that $1,000 emergency fund

- Make your first extra payment on your target debt

- Join an online debt-free community for support

- Create some kind of visual tracker and put it where you’ll see it daily

This quarter:

- Pay off your first debt (if possible—celebrate like crazy when you do)

- Review your budget and adjust what’s not working

- Negotiate at least one bill or interest rate

- Calculate your projected debt-free date

- Write down your “why”—the real reason you want freedom

The Power of Starting Small

You don’t have to overhaul your entire life today. You don’t need a perfect plan. You don’t have to know exactly how you’ll pay off every dollar.

You just need to take one small action that moves you forward.

Pay $20 extra on one debt. Cancel one subscription you don’t use. Sell one item sitting in your closet. Track your spending for one day. Make one phone call to negotiate a bill.

That single action? It creates momentum. Momentum builds confidence. Confidence fuels bigger actions. Bigger actions create results. Results prove to you that this is actually possible.

I started with $25 extra toward my smallest debt. It felt laughably small against $27,000. But it proved I could do this. And that’s what I needed.

What to Do When It Gets Hard

Because it will get hard. There will be moments when you want to quit. When you feel like you’re not making progress fast enough. When everyone around you is spending freely and you’re stuck brown-bagging lunch.

Here’s what got me through those moments:

1. Look at how far you’ve come, not just how far you have to go. Keep every debt statement from when you started. On tough days, pull them out and compare them to now. Progress is still progress, even when it feels slow.

2. Remember your why. I kept a note in my wallet that said “Freedom > Stuff.” Every time I wanted to impulse buy something, I’d see it. What’s your why? Write it down. Look at it often.

3. Find your people. Connect with others paying off debt. The r/personalfinance community on Reddit got me through so many moments of doubt. You’re not alone in this.

4. Celebrate every single win. Paid off a $100 medical bill? That’s worth celebrating. Made it a month without using credit cards? Celebrate that. Progress is progress.

5. Give yourself grace. You’ll have months where you can’t pay extra because life happens. That’s okay. You’re not failing. You’re being human. Just get back on track next month.

One Last Thing Before You Go

I need you to know something. Your debt doesn’t define you.

It doesn’t mean you’re irresponsible or stupid or broken. It means you’re human. Maybe you had medical emergencies. Maybe you went through a job loss. Maybe you made some financial mistakes when you were younger. Maybe you were just trying to survive.

None of that changes your worth as a person.

But here’s what I also need you to know: you have the power to change this. You really do.

Thousands of people who felt just as hopeless as you might feel right now have walked this path and made it to the other side. People with more debt, less income, bigger challenges, and more setbacks than you.

The only difference between them and the people still stuck in debt? They started. They stumbled, they adjusted, they kept going. They had bad months and great months. They wanted to quit a hundred times but didn’t.

And one day—maybe in two years, maybe in five—they made their last payment and realized they were free.

That day is coming for you too.

Your Next Move

Close this tab. But before you do, commit to one action right now. One thing. It doesn’t have to be big.

Text a friend and tell them you’re starting your debt payoff journey. Open a spreadsheet and start listing your debts. Transfer $10 to a savings account to start your emergency fund. Cancel one subscription you don’t use.

Just do one thing that moves you forward.

Because getting out of debt fast—or even slowly—isn’t about having perfect circumstances or a huge income or everything figured out.

It’s about making the decision that today is the day things start changing. And then showing up tomorrow and making that same decision again.

You’ve got this. I believe in you. More importantly, you’re about to prove to yourself that you can do hard things.

Now go. Start. Your debt-free life is waiting.

Important Compliance & Disclaimer

Financial Disclaimer: Everything in this post is for informational and educational purposes only. I’m not a financial advisor, and this isn’t financial advice—it’s just my experience and research shared to help you on your journey.

Your financial situation is unique to you. What worked for me or others might not work exactly the same for you. Before making major financial decisions like debt consolidation, refinancing loans, or big budget changes, please talk to a certified financial planner (CFP), licensed financial advisor, or nonprofit credit counselor who can look at your specific situation.

The strategies, examples, and numbers I’ve shared are generalized. Interest rates, fees, and financial products change all the time, so always verify current terms with your lenders.

If dealing with debt is affecting your mental health (and it probably is—it affects most of us), please consider reaching out to a mental health professional too. Organizations like the National Foundation for Credit Counseling (NFCC) can connect you with both financial and mental health resources.

I’m not responsible for financial decisions you make based on what you’ve read here—but I’m rooting for you to succeed anyway. Do your homework, ask questions, and get professional guidance for your specific needs.

About This Guide: This post is based on personal experience, extensive research, and analysis of real debt payoff success stories and strategies as of October 2025. It’s designed to give you practical, actionable steps you can implement regardless of your income or debt amount.

Last Updated: October 2025

Remember: You don’t need to be perfect. You don’t need to have it all figured out. You just need to start with one small step today. Your debt-free future is closer than you think.