How to Build a Practical Savings Plan That Actually Works for Beginners

Sarah earned $2,100 a month working retail.

Every January, she’d promise herself she’d save more.

By March? Her savings account was empty again.

Sound familiar?

Here’s what most finance advice won’t tell you: A savings plan that works isn’t about having perfect discipline or cutting out coffee. It’s about building a system that matches your real life, not someone else’s ideal scenario.

A practical savings plan is a simple, realistic system for setting aside money based on your actual income, essential expenses, and irregular costs—rather than fixed percentages or ideal budgets.

That’s the definition. Now here’s why it matters.

Look, according to the Federal Reserve, nearly 40% of Americans couldn’t cover a $400 emergency.

That’s not because people don’t want to save.

It’s because most savings plans are built for people who already have money.

The truth about how to build a savings plan: You need to start with what you actually earn. Then account for what you actually spend. And create buffers for when life inevitably gets messy.

This guide will show you exactly how to do that. Real numbers. Practical steps. Whether you earn $500 or $5,000 a month.

This approach comes from watching how real people manage money when income is limited, irregular, or unpredictable. I’ve seen this work across different countries, currencies, and economic situations.

Table of Contents

- What Does It Really Mean to Build a Practical Savings Plan?

- Who This Savings Plan Is (and Isn’t) For

- Step-by-Step: How to Build a Savings Plan for Beginners

- Savings System Summary

- Common Mistakes That Make Savings Plans Fail

- How to Build a Savings Plan with Irregular Income

- What to Do After Your Savings Plan Starts Working

- Compliance and Disclaimer

- Frequently Asked Questions

- Conclusion

What Does It Really Mean to Build a Practical Savings Plan?

Most savings advice starts with “pay yourself first.”

Or “save 20% of your income.”

That’s great if you’re already comfortable.

But what if you’re living paycheck to paycheck?

A practical savings plan is different.

It’s a system that:

Works with your actual income, not theoretical numbers.

If you earn $1,500 a month after taxes, your plan should reflect that. Not what someone making $6,000 can do.

Accounts for unpredictable expenses.

Your car will break down. Your phone will crack. Medical bills will appear.

A realistic plan includes buffers for this.

Starts absurdly small.

Saving $5 a week isn’t failure. It’s $260 a year you didn’t have before.

Small wins create momentum.

The goal isn’t to become a savings robot.

It’s to build a system you can actually maintain during normal life. Not just when everything goes perfectly.

Who This Savings Plan Is (and Isn’t) For

This guide is designed for:

- Complete beginners who’ve never successfully saved before

- Low-income earners who feel traditional advice doesn’t apply to them

- Freelancers, gig workers, and anyone with irregular income

- People living in developing countries or high-cost areas with limited income

- Students, young professionals, and anyone starting from zero

- Anyone who needs stability first, optimization later

This guide is NOT for:

- High-net-worth individuals looking to maximize investment returns

- People with stable high incomes seeking aggressive wealth-building strategies

- Those looking for get-rich-quick schemes or passive income promises

- Anyone needing complex tax optimization or estate planning

What this IS about: Building a foundation that works in real life.

What this ISN’T about: Maximizing every dollar for peak performance.

If you need to prove to yourself that saving is possible? Before worrying about investment returns?

You’re in the right place.

Traditional Advice vs. Practical Savings Plan

| Traditional Advice | Practical Savings Plan |

|---|---|

| Save 20% of income | Save what remains after essentials |

| Fixed targets | Flexible system that adjusts |

| Discipline-based | Automation-based |

| Designed for stability | Designed for real life |

| One-size-fits-all percentages | Customized to your situation |

| Assumes steady income | Works with variable income |

Step-by-Step: How to Build a Practical Savings Plan for Beginners

When learning how to build a savings plan, beginners often focus on percentages and targets.

Instead of systems and sustainability.

The steps below prioritize what actually works. Over what sounds impressive.

Step 1: Calculate Your True Monthly Income

Don’t use your salary.

Use what actually hits your account.

What to do: Track your take-home pay for the last three months.

If your income varies? Use your lowest month as the baseline.

Why it matters: Planning with optimistic numbers is why most budgets fail by week two.

You need your worst-case scenario, not your best.

Real example: Marcus drives for a delivery service.

His monthly income ranges from $1,800 to $2,400.

He builds his plan around $1,800.

Anything above that? Becomes bonus savings or guilt-free spending.

Step 2: Track Actual Spending for Two Weeks

You can’t build a realistic savings plan without knowing where money currently goes.

What to do: Write down every expense for 14 days.

Every coffee. Every bus fare. Every late-night food delivery.

Use a notes app, spreadsheet, or paper. Just track it.

Why it matters: Most people underestimate spending by 20-30%.

You’re not tracking to judge yourself. You’re gathering data.

Real example: Priya thought she spent $200 monthly on groceries.

After tracking? It was $340.

She’d counted supermarket trips but forgot the corner store runs. The emergency milk purchases. The workplace lunches.

Step 3: Separate Fixed and Variable Expenses

Not all spending is equal.

Some you can’t change. Some you can.

What to do: Create two lists from your tracking data.

Fixed expenses: Rent, insurance, loan payments, subscriptions you actually use, utility bills (average amount).

Variable expenses: Food, transportation, entertainment, clothing, personal care.

Why it matters: This shows you where flexibility actually exists.

You can’t negotiate rent down by 50%. But you can adjust how much you spend on takeout.

| Category | Fixed | Variable |

|---|---|---|

| Housing | ✓ | |

| Utilities | ✓ | |

| Loan payments | ✓ | |

| Insurance | ✓ | |

| Groceries | ✓ | |

| Eating out | ✓ | |

| Transportation | Mostly ✓ | |

| Entertainment | ✓ | |

| Personal care | ✓ |

Step 4: Create Your Survival Budget

This is your non-negotiable baseline.

What do you absolutely need to function?

What to do: Add up all fixed expenses. Plus the bare minimum for food, transportation, and basic personal care.

This is your survival number.

Why it matters: Knowing this number removes panic.

If you lose income? You know exactly what you need to cover.

Everything above this is where savings potential lives.

Real example: Kenji’s survival budget is $1,450.

Rent $850. Utilities $120. Minimum groceries $280. Basic transportation $150. Phone $50.

His take-home is $2,100.

That means he has $650 monthly to work with. For savings and flexible spending.

Step 5: Choose Your Starting Savings Amount (Start Ridiculously Small)

Here’s where most plans fail.

People set ambitious goals. Hit one bad week. And quit entirely.

What to do: Choose a savings amount so small it feels almost pointless.

If you’re starting from zero? That might be $5 per week. Or $20 per month.

Why it matters: The psychology of saving is more important than the amount.

Building the habit of moving money into savings matters more than the actual dollars at first.

You can always increase it.

Real example: Lin earned $1,900 monthly and had $130 left after all expenses.

Instead of trying to save $100 (which failed before)? She started with $20 monthly.

After three months of success, she increased to $40.

Six months later, $60.

Research on the psychology of saving money shows small consistent actions beat large sporadic ones.

Step 6: Automate the Transfer

Manual saving requires willpower.

Automated saving happens whether you feel like it or not.

What to do: Set up an automatic transfer from checking to savings. The day after your paycheck arrives.

Even if it’s $5, automate it.

Why it matters: You can’t spend what you don’t see.

Automation removes decision fatigue.

Real example: Carlos set up a $30 automatic transfer every payday. To a separate savings account at a different bank.

He called it his “do not touch” account.

No debit card. No app on his phone.

After eight months? He had $240. And hadn’t missed it once.

Step 7: Use the Overflow Method for Variable Income

Standard advice assumes steady paychecks.

Many people don’t have that luxury.

What to do: On low-income months? Save your minimum commitment only.

On high-income months? Save a fixed percentage of everything above your baseline.

Why it matters: This prevents the guilt cycle. Where you can’t save consistently and give up entirely.

Real example: Aisha freelances and earns between $1,200 and $3,000 monthly.

Her minimum commitment is $10 per month.

Her baseline income is $1,200.

On any income above $1,200? She saves 15%.

Last month she earned $2,400. And saved $190.

($10 minimum + 15% of the extra $1,200.)

Step 8: Create a Mini-Emergency Buffer First

Before targeting big goals, build a tiny cushion.

What to do: Your first savings target should be $200-$500. Depending on your income level.

This isn’t retirement money.

It’s “my tire blew out” money.

Why it matters: Without this buffer, the first unexpected expense wipes out your savings. And your motivation.

This small cushion prevents total resets.

Real example: Before his buffer, every time David saved $100? An emergency forced him to withdraw it.

He felt like saving was pointless.

After building a $300 emergency-only fund in a separate account? His regular savings finally started growing.

Because he stopped raiding it for every crisis.

starting with small emergency funds before tackling larger savings goals. this will help you to manage money easily and this make you to feel less stressed for your money.

Step 9: Review and Adjust Every Two Months

Your life changes. Your plan should too.

What to do: Every eight weeks, look at what’s working and what isn’t.

Did you hit your savings target? Was it too aggressive or too easy?

Do you need to adjust?

Why it matters: A plan you abandon is worthless.

Better to save $30 a month consistently. Than aim for $200 and quit.

Real example: After two months, Nina realized her $80 monthly target was too high.

She was pulling money back out by week three.

She dropped to $45. Succeeded for four months. Then raised it to $60.

Progress isn’t linear.

Savings System Summary

The core framework at a glance:

✓ Income baseline — Use your lowest recent month, not your average or best month

✓ Survival budget calculated — Fixed expenses plus minimum variable expenses

✓ Automated small savings — Start with an amount so small it feels effortless

✓ Emergency buffer first — Build $200-$500 before other savings goals

✓ Separate savings account — Keep it at a different bank with no easy access

✓ Bi-monthly review — Adjust every 8 weeks based on what’s actually working

✓ Overflow method for variable income — Save minimum on low months, percentage on high months

This isn’t about percentages or rules.

It’s about creating a system that survives contact with real life.

Copy this framework. Adjust the numbers to your situation. And ignore advice that doesn’t fit your reality.

Common Mistakes That Make Savings Plans Fail

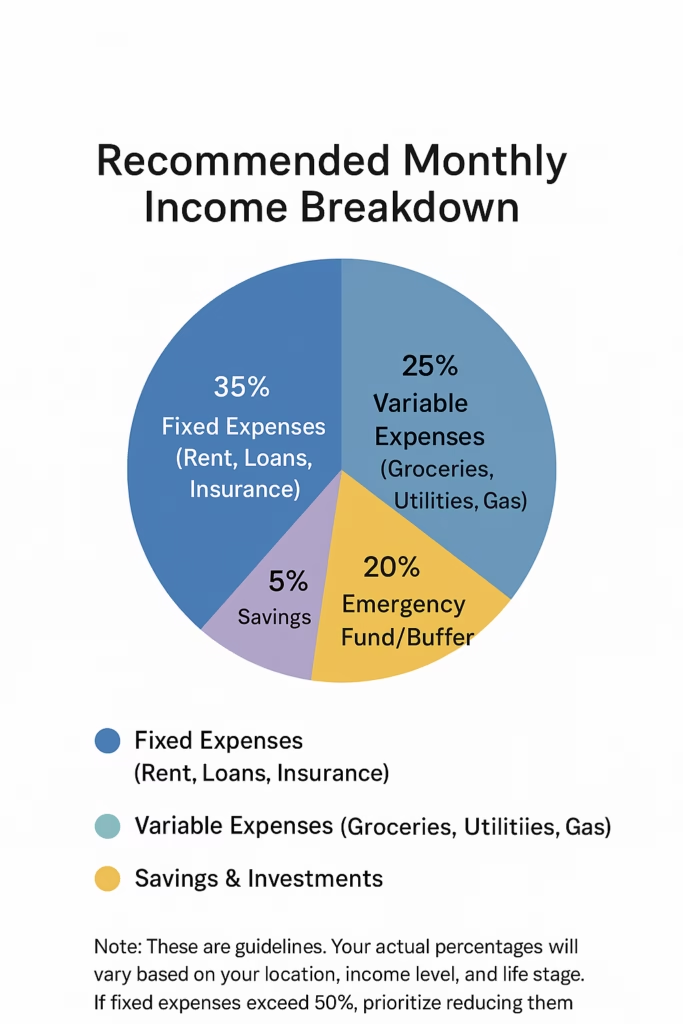

Mistake 1: Copying Someone Else’s Percentages

You’ve heard “save 20% of your income.”

That’s built for middle-class incomes.

If you earn $1,500 monthly and your rent is $700? Saving 20% ($300) leaves you $500 for everything else.

That’s not realistic. It’s a setup for failure.

Better approach: Save what remains after survival expenses are covered. Even if that’s 2% right now.

Mistake 2: Not Accounting for Irregular Expenses

Your savings plan includes rent, food, and utilities.

Then your cousin gets married. Your laptop dies. Registration fees are due.

These aren’t emergencies. They’re irregular but predictable expenses.

Better approach: Track irregular expenses from the past year.

Gifts, annual fees, clothing, medical, car repairs.

Divide by 12. That’s your monthly irregular expense amount.

Include it in planning.

Mistake 3: Making Savings Easily Accessible

If your savings account has a debit card attached? Or shows up in your banking app alongside checking?

You’ll spend it.

Convenience is the enemy of saving.

Better approach: Open savings at a different bank.

One that takes 2-3 days to transfer money out.

Make accessing it slightly annoying.

Mistake 4: Treating All Savings the Same

Retirement savings, emergency funds, and saving for a vacation are different goals. With different rules.

Mixing them creates confusion.

Better approach: Even if amounts are tiny, separate them. Mentally or literally.

Your emergency $300 has different rules than your “new phone fund.”

Mistake 5: Giving Up After One Failure

You saved for two months. Then had to withdraw it all for a dental emergency.

Most people see this as proof that saving doesn’t work for them.

Better reality: That’s exactly why you were saving.

The fund did its job.

Start again.

How to Build a Savings Plan with Irregular Income

Freelancers, gig workers, seasonal employees. Commission-based earners.

They all face a different challenge.

Standard advice assumes predictable paychecks.

Here’s what actually works.

The Baseline Method

Calculate your average monthly income over the past six months.

Now subtract 20%.

That’s your planning baseline.

Live on that number.

Everything above it gets split: 50% to savings, 50% to flexible spending or extra debt payments.

Why this works: It creates a built-in buffer for low months. Without requiring complex budgeting.

The Two-Account System

All income goes into Account A (holding account).

On the first of every month? Transfer your baseline amount to Account B (spending account).

Everything remaining stays in Account A and accumulates.

At the end of each quarter, move a portion to actual savings.

Why this works: It smooths out income volatility. And prevents the feast-or-famine spending cycle.

The Percentage Lock

Instead of fixed amounts, save a percentage of every payment you receive.

Immediately.

Even if it’s 5%.

Transfer it before you mentally count that money as spendable.

Why this works: It scales with your income automatically. And builds the habit of saving from every source.

Global note: These principles work regardless of currency or country.

Whether you’re earning in dollars, rupees, pesos, naira. Or any other currency.

The percentages and systems matter more than the actual amounts.

This approach has proven effective in both developed and developing economies. Formal employment and informal cash-based work.

Research from the World Bank on financial inclusion shows that people in developing countries often demonstrate higher savings rates when given appropriate tools and systems.

What to Do After Your Savings Plan Starts Working

You’ve been saving consistently for six months.

Your emergency buffer exists. The system feels automatic.

What’s next?

Increase Automation Gradually

Once your initial savings amount feels effortless? Increase your automatic transfer by a small increment.

If you started at $20 monthly and it’s been comfortable for three months? Try $30 or $35.

Small increases compound over time. Without feeling like sacrifice.

Separate Goal-Based Savings

Your emergency fund and your “save for a laptop” fund shouldn’t mix.

Even if both are small, create separation.

Mental or literal.

Many banks allow multiple savings sub-accounts.

Name them clearly: Emergency Only. Travel Fund. Education. Whatever matters to you.

Consider Your First Investment Step

This article isn’t about investing.

But after 12-18 months of consistent saving? You might be ready to explore it.

Start with education first.

Learn about low-cost index funds. Retirement accounts available in your country. And the difference between saving and investing.

Don’t rush this.

Saving successfully for a year is a bigger achievement than most people realize.

Investing badly can erase progress quickly.

Build the foundation first.

When you’re ready for that next step, resources like NerdWallet’s beginner investing guide can help you get started with confidence.

Track Long-Term Progress

After six months, calculate your savings rate.

(Total saved divided by total earned.)

After a year? Compare your net worth (assets minus debts) to where you started.

Progress isn’t always visible month to month. But annual comparisons reveal real change.

Maintain the System Through Life Changes

Job change. Income increase. Moving cities.

These disrupt savings plans.

When life changes? Revisit Steps 1-4 with your new numbers.

Recalculate your baseline and survival budget.

Don’t assume your old plan still fits your new reality.

The goal isn’t perfection.

It’s building a system flexible enough to survive real life. While strong enough to keep working.

In future guides, we’ll break down beginner-friendly investing options, debt prioritization, and goal-based savings systems.

Compliance and Disclaimer

This content is for educational purposes only. It does not constitute professional financial advice.

Every individual’s financial situation is unique. What works for one person may not suit another.

Always consult a qualified financial advisor before making significant financial decisions. We do not guarantee specific outcomes from following this guidance.

Your results depend on income, expenses, habits, and external factors beyond anyone’s control.

Frequently Asked Questions

What is the best savings plan for beginners with low income?

The best savings plan for beginners with low income starts with tracking actual spending for two weeks. Then identifying your true survival budget.

After that? Save whatever remains. Even if that’s just $5 or $10 per month.

Focus on building the habit first. Before worrying about the amount.

Automate the transfer to make it effortless. And keep your savings in a separate account you can’t easily access.

How much should I save per month with a $2,000 income?

With a $2,000 monthly income, aim to save whatever remains after covering your survival budget.

(Fixed expenses plus minimum variable expenses.)

This might be $50 to $200. Depending on your cost of living.

Start with an amount you can sustain for three months straight. Even if it feels small.

The goal is consistency. Not impressive percentages.

Can I build a realistic savings plan if my income varies every month?

Yes. Use the baseline method.

Calculate your average monthly income over six months. Then subtract 20% to account for low months.

Build your spending plan around this conservative number.

On months when you earn more? Save a percentage (like 30-50%) of everything above your baseline.

This approach prevents overspending in good months. And provides a cushion for lean months.

How do I stick to a savings plan when unexpected expenses keep coming up?

Create a two-tier system.

A small emergency buffer ($200-$500) separate from your main savings goal.

This buffer exists specifically to handle unexpected expenses. Without derailing your plan.

Additionally? Track your irregular expenses from the past year.

Medical, car repairs, gifts, annual fees.

Include a monthly amount for these in your planning.

What feels “unexpected” is often just irregular.

What’s a monthly savings plan template that actually works for real people?

A practical template includes:

(1) Your take-home income based on your lowest recent month

(2) All fixed expenses listed out

(3) Minimum amounts for variable expenses

(4) A small emergency buffer target

(5) An automated savings transfer amount that feels almost too easy

(6) A review date every two months to adjust

The key is making the template match your reality. Not aspirational numbers you can’t maintain.

How do I build a savings plan when I live paycheck to paycheck?

When you’re living paycheck to paycheck, learning how to build a savings plan starts with finding even $5-$10 you can consistently set aside.

Review your spending for two weeks to identify small adjustments. Not dramatic cuts.

Automate this tiny amount immediately after payday.

The goal isn’t reaching a target quickly. It’s proving to yourself that saving is possible in your situation.

After three months of success? You can gradually increase the amount.

Conclusion

Learning how to build a savings plan isn’t about finding the perfect budget template. Or hitting arbitrary percentage targets.

It’s about creating a system.

One that works with your actual income. Your actual expenses. Your actual life.

Start small enough that failure feels impossible.

Automate enough that willpower becomes irrelevant.

Separate your savings enough that spending it requires real effort.

And review often enough that you adjust before frustration builds.

The difference between people who save successfully and those who don’t?

It isn’t discipline.

It’s having a system that matches their reality. Instead of someone else’s ideal.

Your savings plan should feel slightly boring. Not heroic.

If it requires constant motivation? It’s not sustainable.

If it feels like deprivation? You’ll quit.

Understanding how to build a savings plan that lasts means accepting that progress looks different for everyone. And that’s normal.

Your $25 monthly savings might seem small compared to someone else’s $500.

But if yours is consistent and theirs isn’t?

You’re actually ahead.

Start today with one tiny action.

Calculate your survival budget. Or set up a $5 automatic transfer.

Not tomorrow. Not next month.

Today.

Small systems, repeated consistently. They beat ambitious plans that fade by February.

Every single time.

Saving isn’t about becoming someone else. It’s about finally having room to breathe.

Go to the Next Lesson:

Beginner’s Guide to Bank Accounts(2026): Types, Benefits, and How to Choose the Right One

Now that you’ve learned how to build a practical savings plan, the next step is understanding where to keep that money. This lesson breaks down how different bank accounts work, which ones are best for your goals, and how to choose the right option for your financial journey.