How to Make a Monthly Budget That Actually Works: A Step-by-Step Guide to Control Your Money in 2025

I’ll never forget the morning I checked my bank account and saw $47 staring back at me. It was still two weeks until payday. lets talk about this How to Make a Monthly Budget That Actually Works

Here’s the reality: 78% of Americans live paycheck to paycheck, according to recent financial surveys. But here’s what most people don’t realize—you don’t need to earn more money to break this cycle. You just need a system.

Quick Answer: A monthly budget is a simple plan that tracks your income and expenses, helps you prioritize spending, and ensures you’re saving at least 10-20% of your income. Using methods like the 50/30/20 rule or zero-based budgeting, you can take control of your finances in under 30 minutes per week.

This guide is based on 2025 financial best practices from the Consumer Financial Protection Bureau and certified financial planners. Whether you’re trying to build an emergency fund, pay off debt, or simply stop wondering where your money went, this beginner-friendly guide will show you exactly how to create and stick to a budget that works in real life.

Table of Contents

- What Is a Monthly Budget and Why Does It Matter?

- Step 1: Calculate Your Real Take-Home Income

- Step 2: Track and Categorize Every Expense

- Step 3: Choose the Right Budgeting Method for You

- Step 4: Track Your Spending Throughout the Month

- Step 5: Review and Adjust at Month’s End

- How Much Should You Budget for Each Category?

- Common Budgeting Mistakes to Avoid

- Best Budgeting Tools and Apps in 2025

- When Your Budget Isn’t Working: Troubleshooting Guide

- Compliance & Financial Disclaimer

- Frequently Asked Questions

What Is a Monthly Budget and Why Does It Actually Matter?

Let me be honest with you.

Before I started budgeting, I felt anxious every time I swiped my card. I’d avoid checking my bank account because I was scared of what I’d see.

But I wasn’t bad with money. I just didn’t have a plan.

Go to the next Lesson: Fixed vs. Variable Expenses

The Real Definition of a Budget

A monthly budget is simply a plan for how you’ll allocate your income over the course of a month. It involves three basic steps:

- Tracking what money comes in (income)

- Deciding where it needs to go (expenses)

- Setting aside what you want to save (savings/debt repayment)

The fundamental equation is straightforward: Income – Expenses = Positive Number

That positive number represents your savings or financial cushion.

Why Monthly Budgeting Changed My Life

The Consumer Financial Protection Bureau found that people who actively manage their money through budgeting experience:

- 47% less financial stress

- Better sleep and fewer money-related arguments

- Higher rates of emergency fund savings

- Greater confidence in financial decisions

Think about it this way: if you were driving cross-country, you’d use GPS, right? You wouldn’t just get in the car and hope you end up in the right place.

Your budget is your financial GPS.

Most people choose monthly budgets because the majority of recurring bills operate on a monthly cycle—rent, utilities, subscriptions, and loan payments all typically come due once per month.

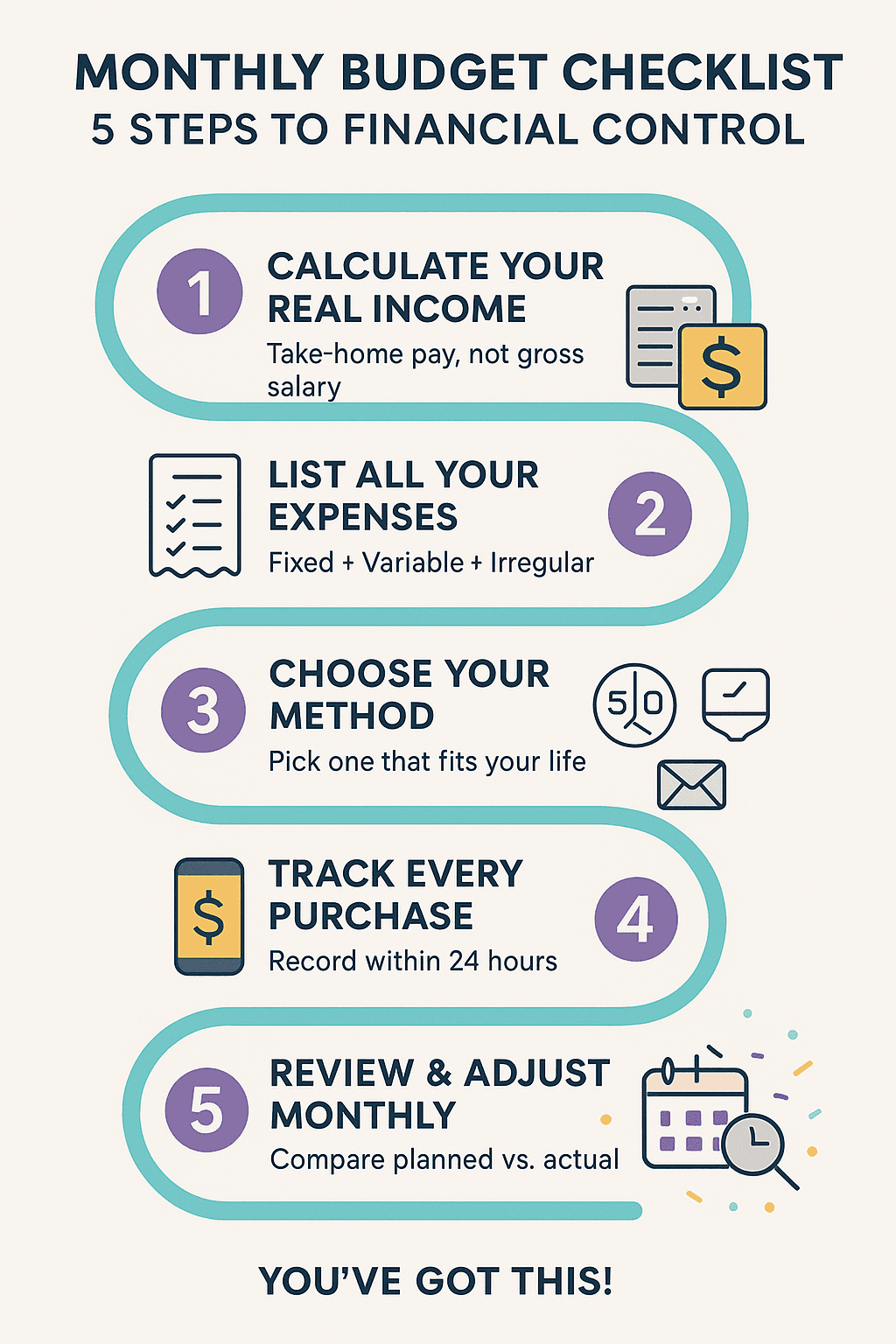

Step 1: Calculate Your Real Take-Home Income (Not Your Salary)

This is where most people mess up right from the start.

They look at their salary and think, “Great, I make $4,000 a month!” But that’s not what hits your bank account.

Find Your Net Income

Net income = Take-home pay after all deductions

Pull up your last few paystubs or check your bank account. Look for the number that actually gets deposited, including deductions for:

- Federal and state taxes

- Social Security and Medicare

- Health insurance premiums

- Retirement contributions (401k, IRA)

- Other automatic deductions

Example calculation:

- Gross monthly salary: $4,500

- Taxes and deductions: -$1,100

- Net monthly income: $3,400 ← This is your real number

Income Frequency Conversion

| Pay Frequency | Calculation Method |

|---|---|

| Weekly | Multiply by 4.33 |

| Bi-weekly (every 2 weeks) | 2 paychecks most months (3 in some months) |

| Semi-monthly (twice per month) | 2 paychecks consistently |

| Monthly | Use the full amount |

Handling Variable or Irregular Income

Freelancer? Server? Commission-based job?

Here’s the safe approach:

- Track your income for 3-6 months

- Use your lowest-earning month as your baseline budget

- During higher-earning months, direct extra income to savings or debt payoff

- Create a buffer account to smooth out income variations

Pro tip: Only include side hustle income if it’s reliable and consistent (at least $200+ monthly for 3+ months).

Step 2: Track and Categorize Every Single Expense

This part is eye-opening.

Most of us have no idea how much we actually spend. Time to become a financial detective.

Fixed Expenses (The Non-Negotiables)

These bills stay roughly the same each month:

- Rent or mortgage payment

- Car payment or lease

- Insurance premiums (health, auto, renters/homeowners)

- Loan payments (student, personal)

- Phone and internet bills

- Childcare expenses

- Gym memberships or subscriptions

Action step: Review 2-3 months of bank statements and list each fixed expense with its average cost.

Variable Expenses (The Flexible Necessities)

These fluctuate month to month but are still necessary:

- Groceries and household supplies

- Gas or public transportation

- Utilities (electricity, water, gas, trash)

- Personal care items

- Clothing

- Medical copays and prescriptions

Action step: Calculate the average spent in each category over the past 3 months.

Discretionary Spending (The Wants)

Things that enhance quality of life but aren’t strictly necessary:

- Dining out and takeout

- Entertainment and streaming services

- Hobbies and recreational activities

- Shopping and impulse purchases

- Coffee shops and daily treats

- Vacations and travel

Be brutally honest here. Small purchases add up fast:

- $5 daily coffee = $150/month = $1,800/year

- $12 lunch 3x/week = $144/month = $1,728/year

Irregular Expenses (The Budget Killers)

These don’t occur every month but need planning:

- Annual insurance premiums

- Vehicle registration and inspections

- Holiday and birthday gifts

- Annual subscriptions (Amazon Prime, Costco)

- Quarterly estimated taxes (self-employed)

- Home or vehicle maintenance

- Veterinary care

Solution: Create sinking funds by setting aside money monthly.

Example: If you spend $600 on holiday gifts annually, save $50/month in a dedicated “Holiday Fund.”

Step 3: Choose the Right Budgeting Method for Your Personality

There’s no “best” budgeting method. The best budget is the one you’ll actually use.

Method Comparison Table

| Budgeting Method | Best For | Complexity | Flexibility |

|---|---|---|---|

| 50/30/20 Rule | Beginners, simple approach | Low | High |

| Zero-Based Budgeting | Detail-oriented planners | High | Medium |

| Envelope System | Visual learners, overspenders | Medium | Low |

| Pay Yourself First | People who struggle to save | Low | High |

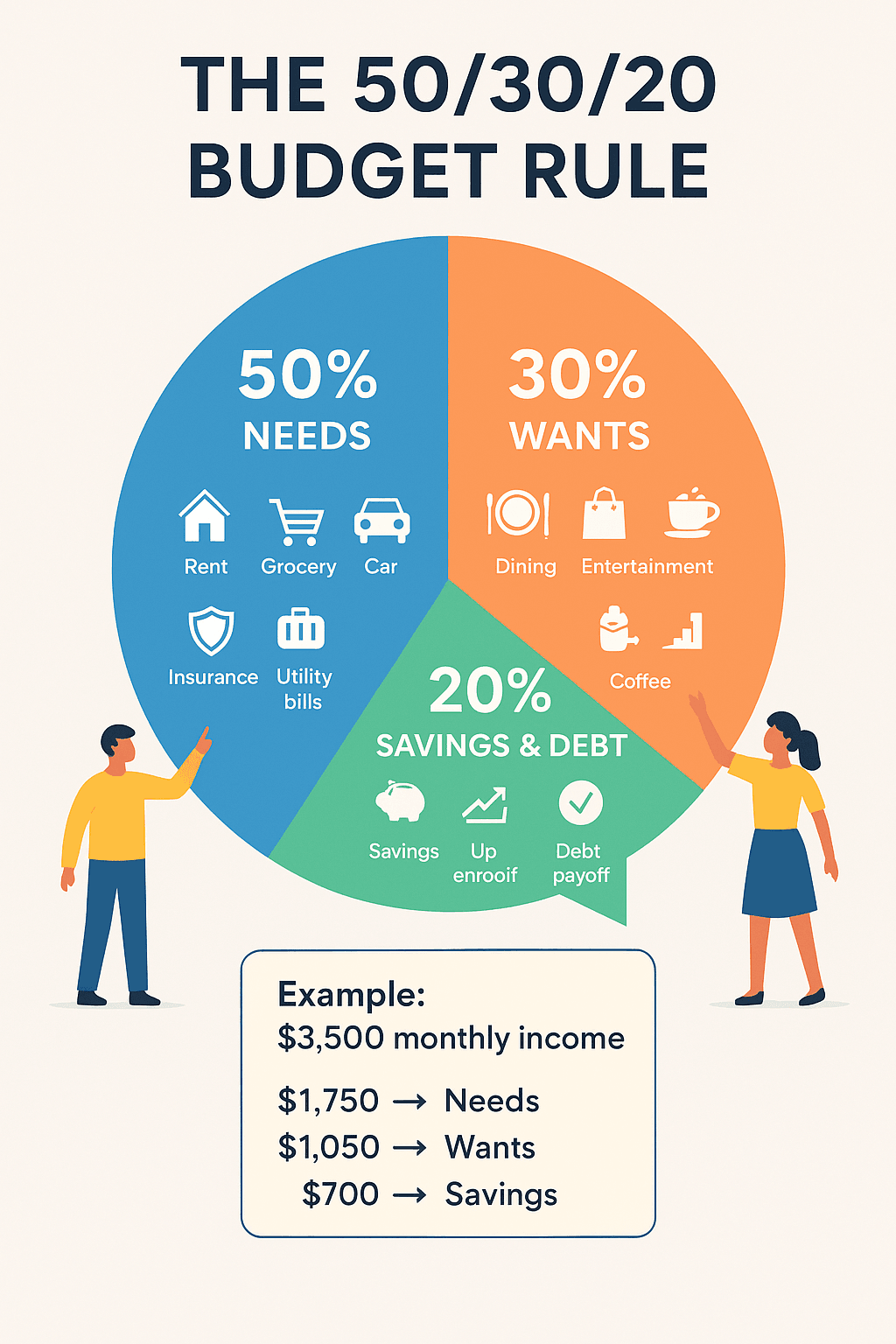

The 50/30/20 Rule (Perfect for Beginners)

Divide your after-tax income into three buckets:

- 50% for Needs: Rent, groceries, utilities, insurance, minimum debt payments

- 30% for Wants: Dining out, entertainment, hobbies, shopping

- 20% for Savings/Debt: Emergency fund, retirement, extra debt payments

Example with $3,500 monthly take-home:

- $1,750 → Needs

- $1,050 → Wants

- $700 → Savings and debt payoff

According to Bankrate, financial experts consistently recommend this 20% savings rate as a minimum target.

Zero-Based Budgeting (For Maximum Control)

Every single dollar gets assigned a job until you reach zero.

Example with $3,500 monthly income:

- $1,200 → Rent

- $400 → Groceries

- $250 → Car payment

- $150 → Gas

- $100 → Utilities

- $300 → Student loans

- $500 → Savings

- $300 → Fun money

- $200 → Irregular expenses fund

- $100 → Miscellaneous

- Total: $3,500 (Zero remaining)

Every dollar has a purpose. Maximum awareness and control.

The Envelope System (Old School, Still Effective)

Allocate cash to labeled envelopes for each spending category. When an envelope’s empty, you stop spending in that category.

Modern adaptation: Use digital envelope apps like Goodbudget or create separate checking accounts for each category.

Pay Yourself First (Automated Savings)

Save first, budget the rest.

- Automatic transfer to savings on payday

- Treat savings as a non-negotiable “bill”

- Budget remaining income for expenses

This method ensures consistent progress toward savings goals.

Step 4: Track Your Spending Throughout the Month (This Is Where the Magic Happens)

Creating a budget is 20% of the work. Tracking is where transformation happens.

Choose Your Tracking Tool

Budgeting Apps (Automated):

- YNAB (You Need A Budget) – Best for zero-based budgeting

- Monarch Money – Great for couples and families

- EveryDollar – Simple and affordable

- Goodbudget – Digital envelope system

- Empower – Combines budgeting with investment tracking

Spreadsheets (Customizable):

- Google Sheets (free, cloud-based)

- Microsoft Excel

- Free downloadable templates

Manual Tracking:

- Paper notebook and pen

- Bank’s built-in budgeting features

Weekly Budget Review (15 Minutes Every Sunday)

Check each category:

- Am I on track or over budget?

- Any surprise expenses coming this week?

- Do I need to move money between categories?

- What spending decisions am I proud of?

Record Every Purchase

The golden rule: Record every transaction within 24 hours.

Yes, even the small ones. Especially the small ones. Those $3 coffees and $8 lunches are silent budget killers.

Use your phone immediately after purchases. Takes five seconds.

Step 5: Review and Adjust at Month’s End

End of month is judgment day. Time to compare planned vs. actual spending.

The Monthly Reality Check

Go through each category:

| Category | Budgeted | Actual | Difference |

|---|---|---|---|

| Groceries | $400 | $475 | -$75 (over) |

| Entertainment | $150 | $95 | +$55 (under) |

| Dining Out | $100 | $230 | -$130 (over) |

Don’t judge yourself. Just observe and learn.

Finding Budget Gaps

Your first few months will reveal forgotten categories:

- Pet food and vet care

- Oil changes and car maintenance

- Birthday gifts throughout the year

- Annual credit card fees

- Quarterly subscriptions

This is normal. Every forgotten category makes next month’s budget more accurate.

Celebrate Your Wins

Did you stick to your grocery budget? Celebrate that.

Did you save money this month? Acknowledge it.

Positive reinforcement makes budgeting sustainable long-term.

How Much Should You Budget for Each Category?

While everyone’s situation is unique, these guidelines help you evaluate if spending is on track.

Recommended Budget Percentages

| Category | Recommended % of Take-Home Pay | Notes |

|---|---|---|

| Housing | 25-30% | Rent/mortgage, property tax, HOA |

| Transportation | 15-20% | Car payment, gas, insurance, maintenance |

| Food (Groceries) | 10-15% | Varies by family size and location |

| Savings | 20%+ | Emergency fund + retirement |

| Debt Repayment | 10-15% | Beyond minimum payments |

| Utilities | 5-10% | Electric, water, gas, internet, phone |

| Insurance | 10-15% | Health, life, disability (if not deducted) |

| Personal/Discretionary | 5-10% | Entertainment, dining out, hobbies |

Detailed Category Guidance

Housing (25-30% maximum): If you’re spending over 35%, consider getting a roommate, downsizing, or increasing income. High housing costs make other financial goals nearly impossible.

Transportation (15-20% maximum): Includes car payments, insurance, gas, maintenance, and public transit. If over 20%, consider refinancing, using public transit more, or downsizing vehicles.

Food:

- Single person: $250-400/month for groceries

- Family of four: $600-1,000/month

- Dining out belongs in discretionary spending, not food budget

Savings (20% minimum): Build emergency fund covering 3-6 months of expenses first, then focus on retirement and long-term goals.

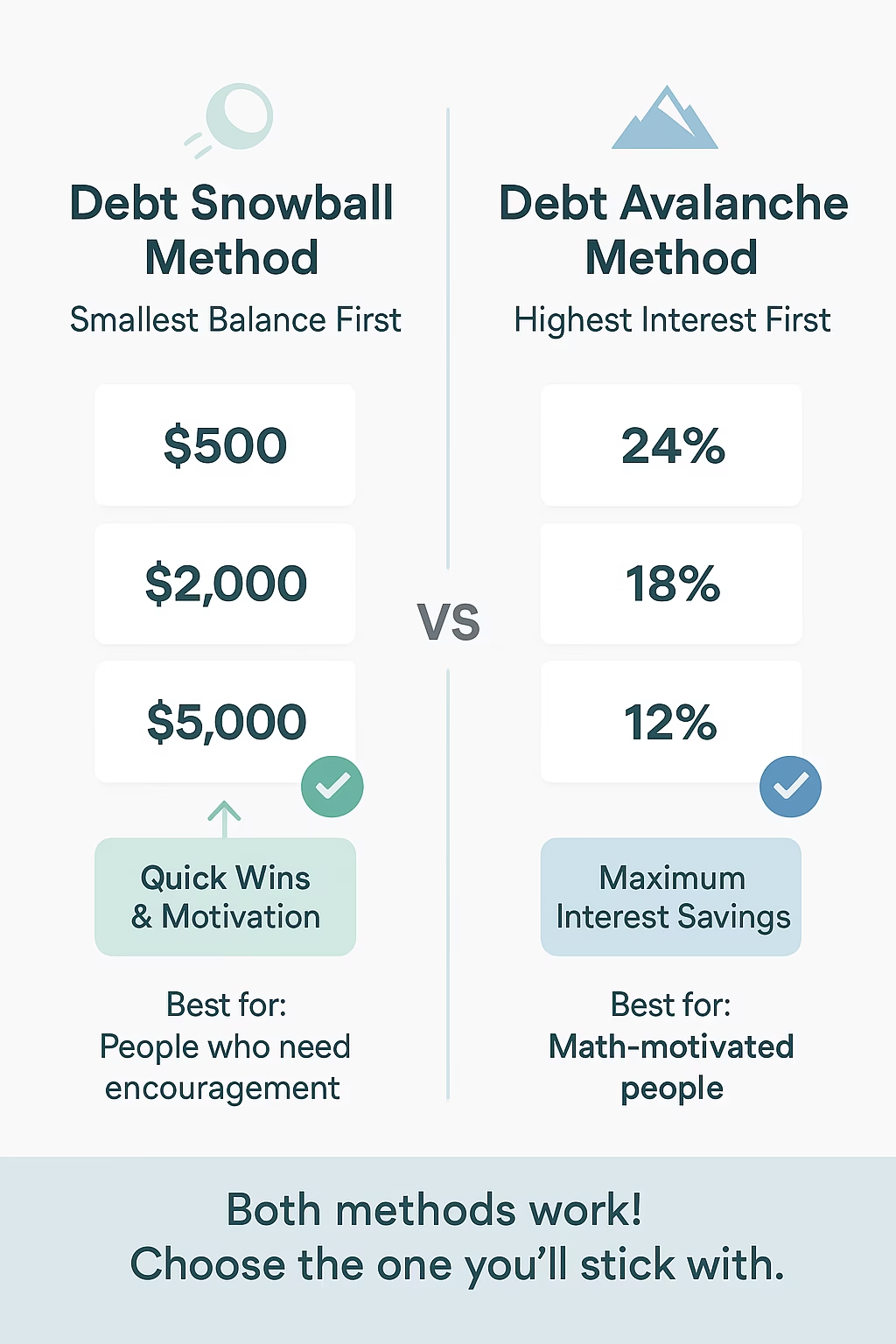

Debt Repayment: Prioritize high-interest debt. Allocate 10-15% beyond minimums to accelerate payoff.

Common Budgeting Mistakes and Myths to Avoid

Even with good intentions, these pitfalls sabotage most budgets.

Mistake #1: Using Gross Income Instead of Net

The Problem: Budgeting based on salary before taxes creates a budget with money that doesn’t exist.

Example:

- Gross salary: $50,000/year ($4,166/month)

- Take-home after taxes: $3,200/month

- Gap: $966/month of money that’s not available

Solution: Always budget based on take-home pay (net income).

Mistake #2: Being Unrealistically Restrictive

The Problem: Cutting all enjoyment leads to burnout and spending splurges.

Solution: Include reasonable amounts for entertainment and discretionary spending. It’s better to budget $100 for fun and stick to it than budget $0 and blow $300 in frustration.

Mistake #3: Set It and Forget It

The Problem: Life changes constantly—raises, moves, new babies, paid-off loans. Static budgets become irrelevant.

Solution: Review and adjust quarterly or when significant life changes occur.

Mistake #4: Treating Savings as Optional

The Problem: “I’ll save whatever’s left” means saving nothing.

Solution: Make savings a line item. Automate transfers to savings on payday.

Mistake #5: Ignoring Small Purchases

The Math:

- $5 coffee × 20 workdays = $100/month = $1,200/year

- $12 lunch × 3 days/week = $144/month = $1,728/year

Solution: Track everything. Small purchases need accounting like large ones.

Mistake #6: Giving Up After One Bad Month

The Reality: You will have bad months. Emergency expenses happen. Moments of weakness occur.

Solution: Analyze what went wrong, adjust if needed, start fresh next month. Budgeting is a skill that improves with practice.

Debunking Budget Myths

| Myth | Reality |

|---|---|

| “Budgets are restrictive” | Budgets create freedom to spend confidently |

| “You need complex software” | Pen and paper work fine |

| “Budgeting takes hours” | 15-30 minutes weekly once established |

| “Only broke people budget” | Wealthy people budget most carefully |

| “You can’t budget with irregular income” | Just requires different strategies |

Best Budgeting Tools and Apps in 2025

Technology has made budgeting more accessible than ever.

Top Budgeting Apps Comparison

| App | Best For | Cost | Key Features |

|---|---|---|---|

| YNAB | Zero-based budgeting | $14.99/month | Real-time tracking, goal setting, educational resources |

| Monarch Money | Couples/families | $16.99/month | Collaboration features, investment tracking |

| EveryDollar | Beginners | Free (basic) | Simple interface, Dave Ramsey method |

| Goodbudget | Envelope system | Free (limited) | Sync across devices, virtual envelopes |

| Empower | Investment focus | Free | Net worth tracking, retirement planning |

Free Budgeting Resources

- Google Sheets templates

- Microsoft Excel templates

- Your bank’s built-in budgeting tools

- Printable budget worksheets

- Simple notebook and pen

The truth: The tool matters far less than consistent use. Choose whatever you’ll actually use regularly.

Automation Strategies

Set up automatic transfers for:

- Savings (immediate transfer on payday)

- Bill payments (avoid late fees)

- Debt payments (ensure consistency)

Caution: Monitor account balance to avoid overdrafts when multiple automatic payments occur close together.

When Your Budget Isn’t Working: Troubleshooting Guide

Been budgeting for months but still stressed? Something needs adjustment.

Problem 1: Consistently Over Budget

Possible causes:

- Budgeted amounts are unrealistically low

- Not tracking consistently

- Spending leak in small purchases

- Income too low for expenses

Solutions:

- Review 3 months of actual spending and adjust categories upward

- Commit to recording every transaction within 24 hours

- Identify and address specific leaking categories

- Consider increasing income or making lifestyle changes

Problem 2: Budget Feels Too Restrictive

Possible causes:

- Too many “wants” categorized as “needs”

- No allowance for enjoyment

- Wrong budgeting method for personality

Solutions:

- Add unrestricted “fun money” category ($50-100)

- Switch to 50/30/20 for more flexibility

- Include small rewards for hitting goals

- Re-evaluate need vs. want categories

Problem 3: Irregular Income Makes Budgeting Impossible

Solutions:

- Base budget on minimum earnings from past 6 months

- Create buffer fund equal to one month’s expenses

- Prioritize bills by importance (essentials first)

- Save excess during high-earning months for lean months

- Consider the “average month” method over 6-12 months

Problem 4: Emergency Expenses Keep Destroying Budget

Solutions:

- Increase emergency fund target (you may need more)

- Create dedicated sinking funds for “predictable emergencies”

- Add miscellaneous buffer category (5-10% of budget)

- Review if “emergencies” could be anticipated (car maintenance, medical)

📋 Compliance & Financial Disclaimer

Important Notice:

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Every individual’s financial situation is unique.

Please note:

- This content is not a substitute for professional financial planning or advice

- Budget recommendations are general guidelines and may not suit your specific circumstances

- Tax laws and financial regulations change; consult current IRS guidance for tax-related questions

- The author is not a certified financial planner, accountant, or tax professional

Before making significant financial decisions:

- Consult with a qualified financial advisor

- Review your specific situation with a certified public accountant (CPA)

- Consider seeking guidance from a fee-only financial planner

Budget percentages and recommendations are based on widely accepted financial planning principles but may require adjustment for your individual needs, location, and goals.

Accuracy Notice: While every effort has been made to ensure accuracy, financial information and app features may have changed since publication. Verify current details directly with service providers.

Frequently Asked Questions About Monthly Budgeting

How do I make a monthly budget if I’ve never budgeted before?

Start simple: (1) Calculate your take-home income, (2) List all expenses for one month by reviewing bank statements, (3) Use the 50/30/20 rule to allocate 50% to needs, 30% to wants, and 20% to savings. Track spending for the first month without judgment—just observe where money goes. Adjust in month two based on what you learned.

What’s the easiest budgeting method for beginners?

The 50/30/20 rule is the easiest for beginners because it provides clear structure without overwhelming detail. You only need to track three categories instead of dozens. It’s flexible enough to accommodate different lifestyles while ensuring you save at least 20% of income.

How much should I budget for groceries per month?

Grocery budgets vary by location and family size: Single person: $250-400/month, Couple: $400-600/month, Family of four: $600-1,000/month. These are baseline ranges for home cooking. Your actual needs depend on dietary restrictions, local food costs, and eating habits. Track actual spending for 2-3 months to find your realistic number.

Can I create a budget with irregular or variable income?

Yes. Use your lowest-earning month from the past 6 months as your baseline budget. During higher-earning months, direct excess income to savings or debt rather than increasing lifestyle spending. Create a buffer account equal to 1-2 months of expenses to smooth income variations between paychecks.

What budgeting app is best for couples?

Monarch Money is highly rated for couples in 2025 because it offers real-time sync, collaboration features, and the ability for both partners to access and update the budget simultaneously. YNAB and Goodbudget also work well for couples. Choose an app that both partners are willing to use consistently.

How do I stick to a budget when unexpected expenses keep coming up?

Build an emergency fund covering 3-6 months of expenses and create sinking funds for predictable irregular expenses (car maintenance, medical, gifts, annual fees). Add a 5-10% “miscellaneous” buffer category to your monthly budget for truly unexpected costs. Review if your “emergencies” could actually be anticipated and planned for.

Should I pay off debt or save money first?

Build a small emergency fund ($500-1,000) first to avoid going deeper into debt when surprises happen. Then aggressively pay off high-interest debt (credit cards over 15% APR) while maintaining minimum payments on other debts. Once high-interest debt is eliminated, increase emergency fund to 3-6 months of expenses while paying down remaining debt.

Take Control of Your Money Today

Three months from now, you could be looking at your bank account with confidence instead of anxiety.

You could have money saved for the first time in years. You could be making real progress on goals that once felt impossible.

But only if you start.

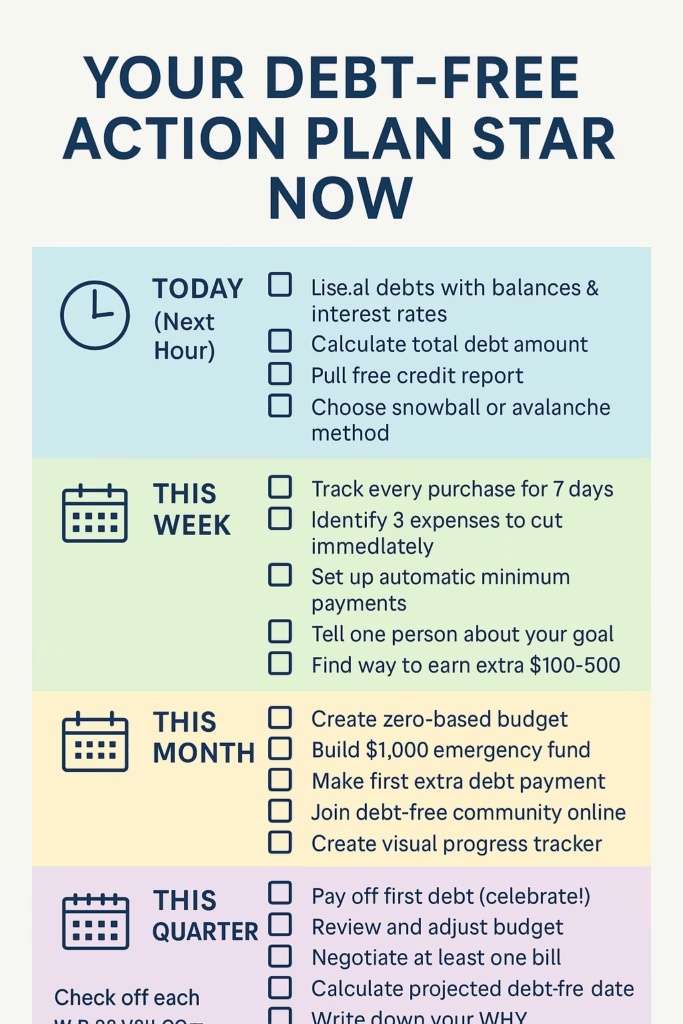

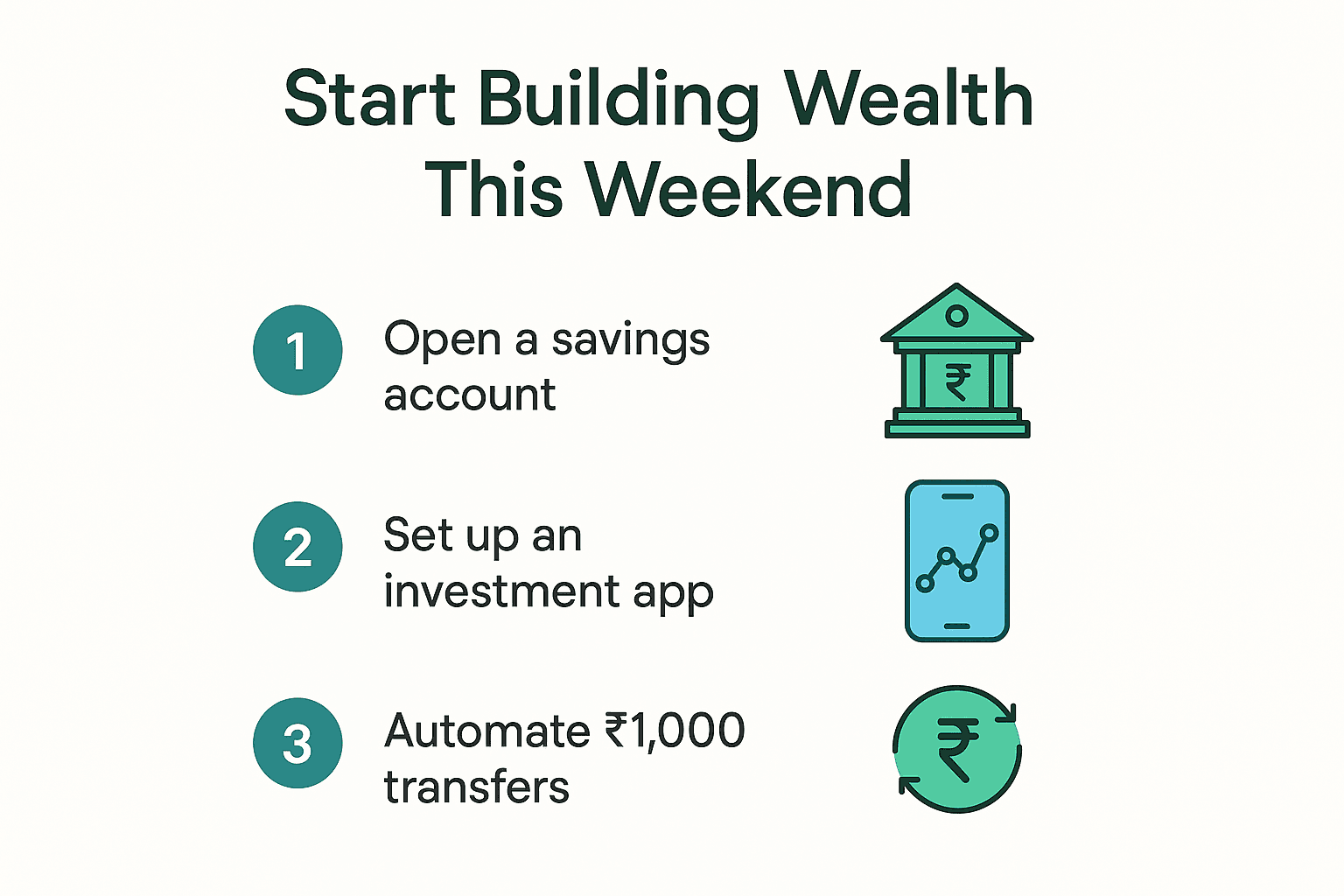

Here’s your action plan for this week:

- Calculate your real take-home income today

- Track every expense for 7 days without judgment

- Choose one budgeting method to try for 30 days

- Set up automatic savings transfer for your next payday

- Schedule 15 minutes next Sunday for your first budget review

Remember, your first budget will probably be wrong in several ways. That’s completely normal. Each month teaches you something new about your money habits.

Budgeting isn’t about restriction—it’s about freedom. Freedom to spend confidently on things you value while building the future you want.

Go to the next Lesson: Fixed vs. Variable Expenses

Your budget is your financial GPS. And every journey starts with a single step.

What will you do today to take control of your money?