Using Credit Cards Responsibly: How I Learned to Build Credit Without Drowning in Debt (And You Can Too)

Look, I’ll be honest with you.

I used to think I had this whole credit card thing figured out. Made my minimum payments. Never missed a due date. Used my card for groceries, gas, the usual stuff. Felt pretty responsible, actually.

Then I checked my balance one random Tuesday afternoon.

$4,500.

I stared at that number for a good five minutes. How did this happen? More importantly—why was I only paying down like $30 of actual debt each month while the rest went straight to interest? That’s when it hit me. I wasn’t managing my credit. It was managing me.

Here’s something wild: Americans now owe over $1.2 trillion in credit card debt. The average person carries around $6,500. But here’s the thing nobody tells you—using credit cards responsibly isn’t about avoiding them entirely. It’s about understanding how they work and making them work for you.

Using credit cards responsibly means treating them like a payment tool instead of free money. Pay your full balance every month. Keep your spending way below your limit. Only buy what you can actually afford right now. Do this, and credit cards become one of the best financial tools you’ll ever have.

Do it wrong? Well. You end up like I did. Staring at a balance that grew while I thought I was being smart.

TL;DR: The Core Rules (For the Impatient)

If you only read one section, make it this:

- Pay your full statement balance every month before the due date

- Keep your balance under 30% of your limit (10% is even better)

- Only charge what you can afford to pay off immediately

- Set up autopay for at least the minimum as a safety net

- Check your statement monthly for errors and fraud

- Never carry a balance thinking it helps your credit score (it doesn’t)

Everything else in this post just explains why these rules matter and how to actually stick to them.

What’s Inside This Guide

- What Does “Responsible Credit Card Use” Actually Mean?

- How Credit Cards Really Work (The Parts They Don’t Advertise)

- The Psychology Behind Credit Card Spending

- Building Your Credit Score the Smart Way

- Daily Habits for Healthy Credit Card Usage

- Credit Card Mistakes to Avoid (I Made All of These)

- When You Should Just Put the Card Away

- Credit Cards vs. Debit Cards: What’s the Difference?

- Choosing Your First (or Next) Credit Card

- Already in Debt? Your Recovery Path

- Common Questions About Using Credit Cards Responsibly

- Final Thoughts

What Does Using Credit Cards Responsibly Actually Mean?

Okay. Let’s start here.

Responsible credit card use sounds like something your parents would say. Or a bank commercial. It’s one of those phrases that everyone uses but nobody really explains.

So here’s my take after years of getting it wrong, then finally getting it right.

Managing credit cards wisely means treating your credit card like it’s a debit card that gives you rewards.

That’s it. That’s the whole thing.

You wouldn’t spend $500 on your debit card if you only had $300 in your checking account, right? Same rules apply to credit cards. The only difference is credit cards let you borrow money for a few weeks. And if you pay it back before they start charging interest, you get to keep any rewards you earned.

Consumer finance data shows that cardholders who pay in full each month save an average of over $1,000 annually in interest charges compared to those who carry balances. It’s actually a pretty sweet deal. If—and this is a massive if—you play by the rules.

What It Looks Like in Real Life

Someone practicing smart credit card habits:

- Pays off the entire balance before the due date every single month

- Keeps their balance under 30% of their credit limit (even better if it’s under 10%)

- Only buys stuff they already budgeted for

- Checks their statement regularly for weird charges

- Never, ever spends money they don’t actually have

Someone heading for trouble:

- Makes minimum payments and carries the balance month after month

- Uses credit to afford a lifestyle their income doesn’t support

- Maxes out their cards or keeps balances super high

- Forgets about due dates or just pays whenever

- Opens multiple cards in a short period without any real plan

Here’s a Real Example That Changed How I Think

I have two friends. Alex and Jordan. Both make about $3,000 a month.

Alex puts $800 on a credit card every month. Groceries, gas, utilities. Normal stuff. Pays the full $800 off every single month. Gets 2% cash back, which comes out to about $16 monthly. Built an excellent credit score doing this. Total interest paid per year? Zero dollars.

Jordan does the exact same thing. $800 monthly charges. But Jordan only pays the $25 minimum each month. And with credit card interest rates hovering around 25% these days, Jordan’s balance keeps growing. By the end of the year, Jordan owes $8,600 and has paid over $1,800 just in interest.

Same income. Same purchases. Completely different outcomes.

That’s what responsible use looks like. It’s not about how much you make. It’s about the system you follow.

Which of these mistakes sounds familiar to you? Most people I know have been Jordan at some point. Including me.

How Credit Cards Really Work (The Parts They Don’t Advertise)

I’m going to be real with you. I used credit cards for three years before I actually understood how they worked.

Nobody explains this stuff. They just hand you a card and assume you’ll figure it out. Or maybe they’re hoping you won’t. Because the less you understand, the more money they make off interest charges.

So let me break it down the way I wish someone had for me.

Billing Cycles vs. Due Dates (They’re Not the Same Thing)

Your billing cycle is usually about 30 days. During this time, everything you buy gets added to your balance.

At the end of the cycle, your credit card company sends you a statement that says “you owe this much.”

Your due date comes about 3-4 weeks after that statement.

The time between these two dates? That’s your grace period. And it’s basically free money—if you use it right.

Here’s how it works:

- March 1-31: You charge $600 in purchases

- April 1: Your statement closes and says you owe $600

- April 25: Payment is due

- If you pay that $600 before April 25, you pay zero interest

- If you pay less, interest starts piling up on what’s left

I didn’t understand this for the longest time. I thought as long as I made some payment, I was good.

Nope.

Any amount you don’t pay in full starts collecting interest immediately.

Interest Rates Are Designed to Confuse You

APR stands for Annual Percentage Rate. Sounds simple enough, right?

But here’s what they don’t tell you in the commercials. That annual rate gets divided up and charged every month.

So if your APR is 24% (pretty common these days), you’re actually paying about 2% per month on whatever balance you carry.

Doesn’t sound like much?

Let me show you what happened to me. I once carried a $3,000 balance thinking I’d pay it off “eventually.”

At 23% APR, I was getting hit with roughly $57 in interest charges every single month. So even when I paid $100, only $43 actually went toward my debt.

The rest lined the bank’s pockets.

It took me eight months to figure out why my balance barely moved.

The Grace Period Disappears If You Carry a Balance

This one shocked me.

Most people think the grace period is always there. It’s not.

If you carry a balance from the previous month, many credit cards stop giving you a grace period on new purchases. Which means the second you swipe your card, interest starts accumulating.

So you end up paying interest on stuff you just bought. Even if you pay it off next month.

It’s like a penalty for having a balance. Nobody tells you this upfront, of course.

The Minimum Payment Trap (This Almost Ruined Me)

Credit card companies require a minimum payment. Usually 1-3% of your balance, or $25-$35, whichever is higher.

Sounds reasonable, right?

It’s literally designed to keep you in debt as long as possible.

According to data from the Consumer Financial Protection Bureau, the share of cardholders making only minimum payments has reached its highest level in years. And I was one of them for way too long.

I did the math once. If you owe $6,000 at 22% APR and you only make minimum payments (let’s say 2%, so $120 a month), you’ll be paying that debt for over 14 years.

Fourteen. Years.

And you’ll pay about $6,500 in interest alone.

Which means that $6,000 in purchases ends up costing you $12,500 total.

Minimum payments keep your account in good standing. That’s all they do. They don’t help you financially. At all.

Key takeaway: Paying only the minimum is the single biggest credit card mistake you can make. Resources like Bankrate have entire calculators dedicated to showing people how much minimum payments actually cost them over time.

The Psychology Behind Credit Card Spending (Why Your Brain Works Against You)

Here’s something they don’t teach in school: credit cards literally rewire how your brain processes spending.

I’m not exaggerating. There’s actual research on this.

Why Credit Cards Disconnect Pain from Spending

When you hand over cash for something, your brain registers a loss. You see the money leave your hand. You feel lighter. There’s a genuine psychological response that says “I just spent money.”

With credit cards?

Nothing. Just a quick tap or swipe. No emotional feedback. No sense of loss. Your brain doesn’t register that you spent anything because nothing physical changed hands.

Studies consistently show people spend 12-18% more when using credit cards versus cash for identical purchases. It’s not because credit card users are less disciplined. It’s because the payment method itself removes the psychological pain of spending.

How Banks Design Experiences to Make You Spend More

Ever noticed how credit card apps are really smooth and easy to use? How paying is literally one tap?

That’s intentional.

Banks and card companies spend millions designing user experiences that remove friction from spending. They want it to feel effortless. Painless. Almost invisible.

Compare that to checking your balance or reading your statement. Usually buried in menus. Multiple clicks. Harder to find.

Again—intentional.

The easier it is to spend and the harder it is to track, the more likely you are to overspend. This isn’t conspiracy theory stuff. It’s basic behavioral economics applied to card design.

Why Debit Cards Feel Different (Even Though They Shouldn’t)

Debit cards work almost identically to credit cards from a user experience perspective. Tap, swipe, done.

But psychologically? They feel totally different.

With debit cards, the money leaves your account immediately. You can’t spend more than you have. There’s a hard limit that your brain recognizes.

With credit cards, that limit is artificial. It’s your credit limit, not your actual money. So your brain treats it differently—more like potential money than real money.

This is why the “treat your credit card like a debit card” advice actually works. You’re forcing your brain to reimpose that psychological barrier.

Building Your Credit Score the Smart Way (Without the Guru BS)

Okay, let’s talk about how to build credit with credit cards.

I used to think credit scores were this mysterious thing that only financial wizards understood. Turns out, it’s actually pretty straightforward. The credit card companies just benefit from you not understanding it.

Payment History Is Everything (35% of Your Score)

About 35% of your credit score comes from payment history. That’s the biggest chunk. Nothing else even comes close.

Every on-time payment helps you. Every late payment hurts you. It’s that simple.

Or it should be.

Here’s what surprised me though. A payment that’s just 30 days late can drop your score by anywhere from 17 to 83 points. If you’re 90 days late? You could see your score tank by over 130 points.

I missed a payment once by four days. Four days. And while it didn’t show up on my credit report (because it wasn’t 30 days late yet), I got slammed with a $35 late fee and my interest rate jumped to 29.99%.

Four. Days.

So yeah. Payment history matters. A lot.

My system now:

- I set up autopay for at least the minimum payment (just as a safety net)

- I have calendar reminders set for 5 days before my due date

- I pay everything early instead of waiting until the last day

- I keep about one month’s worth of expenses in checking as a buffer

Has this system failed me yet? Nope. And I sleep better at night not worrying about missing a payment.

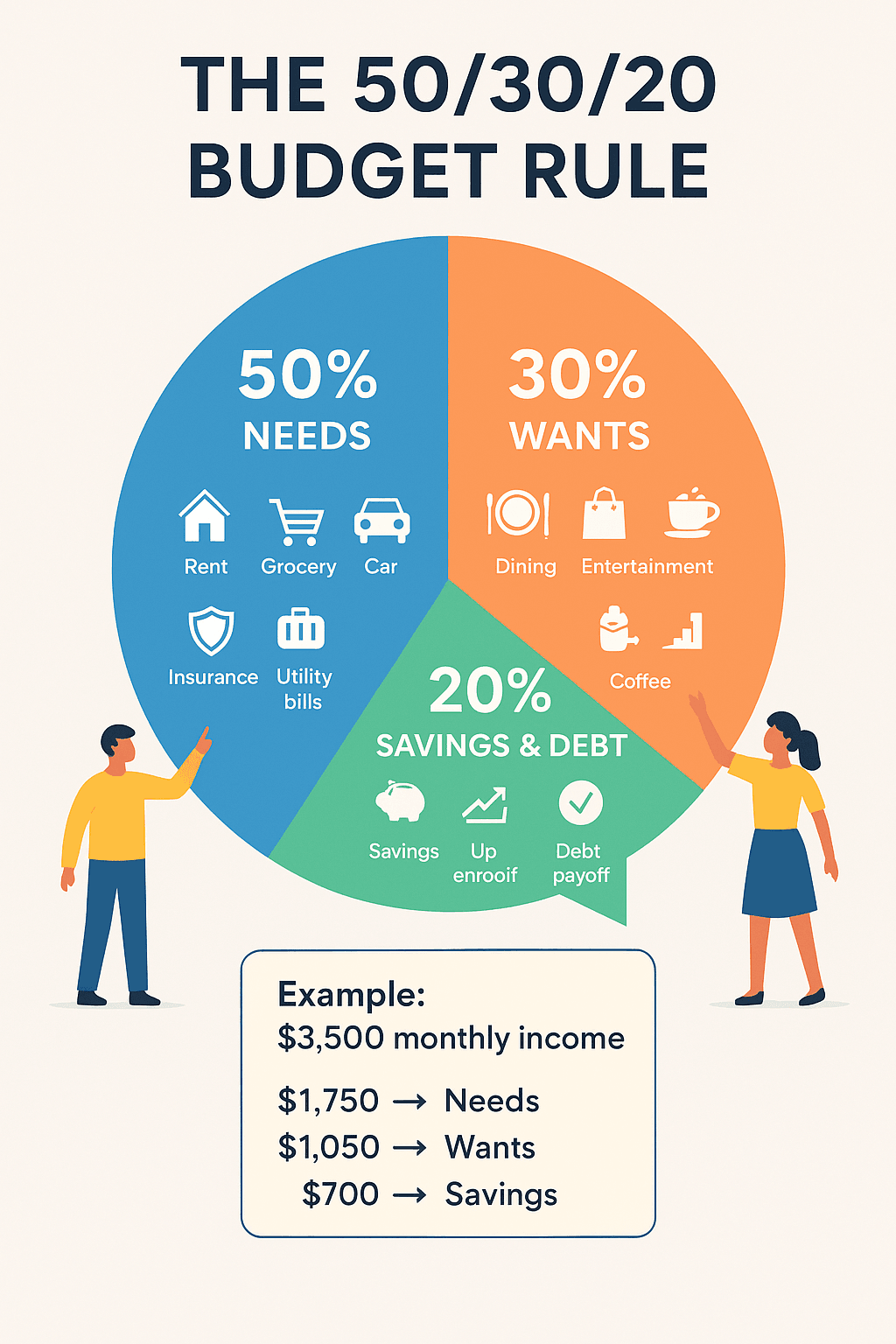

Credit Utilization Best Practices: The 30% Rule (Actually, Aim for 10%)

Credit utilization is how much of your available credit you’re using. You calculate it by dividing your total balance by your total credit limit.

Everyone says keep it under 30%. That’s the standard advice you’ll hear everywhere.

But here’s what I learned: people with excellent credit scores usually keep their utilization in the single digits. Like under 10%. Sometimes under 5%.

According to credit scoring research, your utilization ratio impacts about 30% of your credit score. That makes it the second-most important factor after payment history.

Example:

- Your credit limit: $5,000

- Your current balance: $1,200

- Your utilization: 24%

That’s technically “good” by the 30% rule. But if you want an excellent score? You’d want that balance under $500.

Now, I’m not saying you can’t spend more than 10% during the month. I spend way more than that sometimes.

The trick is to pay it down before your statement closing date.

See, credit card companies report your balance to the credit bureaus when your statement closes, not when you make purchases. So if you charge $2,000 during the month but pay it down to $300 before your statement closes, only the $300 gets reported.

I didn’t know this for years. Wish I had.

How Credit Cards Affect Your Credit Score (The Other Factors)

Beyond payment history and utilization, credit cards affect your score through:

Length of credit history (15% of your score): How long you’ve had your accounts. This is why closing old cards can hurt you.

Credit mix (10% of your score): Having different types of credit (cards, loans, etc.). But don’t open accounts just for this reason.

New credit inquiries (10% of your score): Too many applications in a short time hurts. Each hard inquiry can drop your score temporarily.

Why Your Income Doesn’t Matter (Shocking, I Know)

Here’s something that blew my mind when I first learned it.

Your income doesn’t appear on your credit report. At all.

Someone making $35,000 a year who pays on time and keeps balances low will have a better credit score than someone making $150,000 who carries high balances and occasionally misses payments.

Your credit score measures behavior, not wealth.

Which is actually kind of encouraging when you think about it. You don’t need a high income to build excellent credit. You just need discipline and consistency.

Daily Habits That Keep You Out of Debt (No Willpower Required)

I’m not a fan of advice that depends on you being perfect all the time. Because nobody is. I’m certainly not.

The habits that actually work are the ones you can stick to even when you’re tired, stressed, or just not thinking about money.

Here’s what actually helps me maintain healthy credit card usage.

Weekly Check-Ins (5 Minutes, That’s It)

Every Sunday evening, I spend about 5 minutes looking at my credit card accounts.

Here’s what I do:

- Open the app on my phone

- Scroll through recent transactions

- Make sure everything looks legit

- Check my current balance

- Look for any weird charges

This habit has saved me multiple times. I’ve caught forgotten subscriptions, duplicate charges, even fraud once.

Monthly Reviews (The Important Part)

When my statement comes in, I actually read it.

My monthly routine:

- Go through it line by line (10-15 minutes)

- Compare the total to my budget

- Schedule payment right then—not later

- Check utilization percentage

- Look for any fees

I used to skip this step. Big mistake. In 2024, cardholders disputed nearly $10 billion in charges. Many could have been caught earlier with regular reviews.

Automation Done Right

I’ve tried full autopay. Where it just takes the full balance every month automatically.

It works great—until it doesn’t. I had one month where I forgot about a large purchase, autopay kicked in, and I didn’t have enough in my checking account. Got hit with an overdraft fee from my bank and still didn’t pay the credit card on time because the payment bounced.

Now I do it differently:

Autopay covers the minimum as a safety net. That’s it. Then I manually pay the full balance each month. This way, if I somehow forget or something goes wrong, at least the minimum gets paid and I don’t trash my payment history.

I also have alerts set up for:

- Every transaction over $50

- When my balance hits 50% of my limit

- 7 days before my due date

- 3 days before my due date

- 1 day before my due date

Overkill? Maybe. But I’d rather get too many notifications than miss a payment.

The “Virtual Debit Card” Method

This is the trick that changed everything for me.

When I buy something with my credit card, I immediately move that exact amount from my checking account to my savings account. Immediately. Like, standing in line at the grocery store, I’ll pull out my phone and transfer the money.

So if I spend $73 at the store, I transfer $73 to savings right after.

Then when my statement comes, I just transfer the full balance from savings back to checking and pay it off. The money’s already been “spent” in my head, so there’s no temptation to use it for something else.

Is this necessary if you’re disciplined? Probably not. But I’m not always disciplined. So this system keeps me honest.

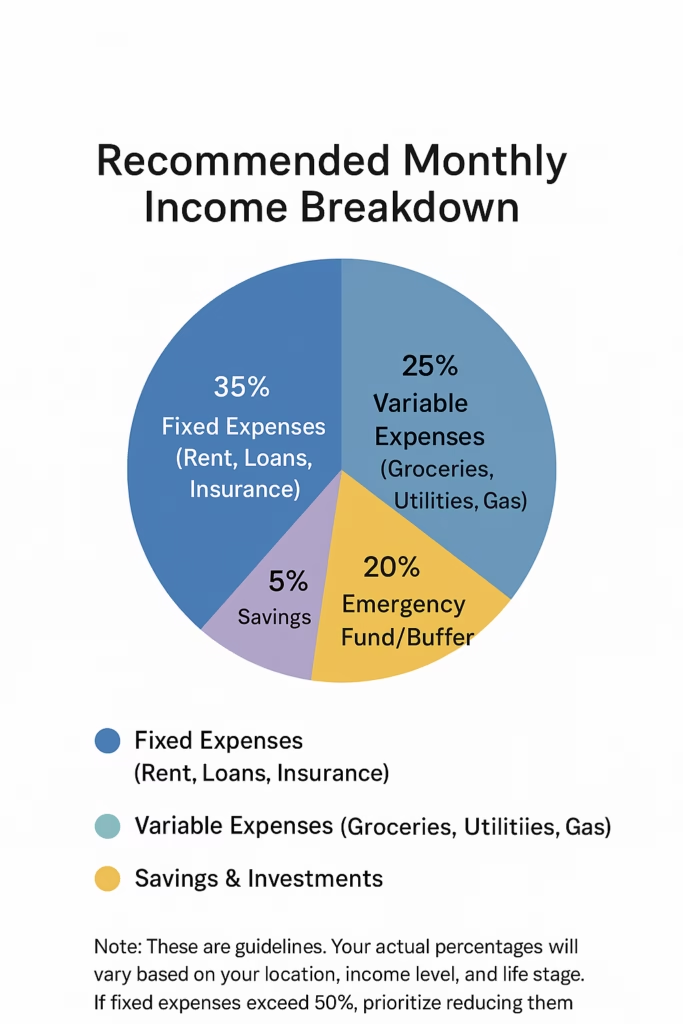

Quick Checklist: Responsible Credit Card Rules

Copy this. Print it. Put it on your fridge:

- [ ] Pay full balance before due date every month

- [ ] Keep utilization under 30% (aim for 10%)

- [ ] Review statement weekly for 5 minutes

- [ ] Check for fraudulent charges monthly

- [ ] Set up autopay for minimum payment

- [ ] Only charge budgeted expenses

- [ ] Transfer “spent” money immediately to separate account

- [ ] Never carry a balance thinking it helps credit

- [ ] Use calendar reminders for due dates

- [ ] Treat credit card like a debit card with rewards

Credit Card Mistakes to Avoid (I Made Every Single One)

Let me save you from the stupid things I’ve done with credit cards.

Myth: Should You Carry a Balance to Build Credit?

About 22% of Americans think you need to carry a balance to build credit. It’s completely wrong.

The truth: Your credit score cares about on-time payments, utilization ratio, account age, and credit mix. Carrying a balance just makes you pay interest. It doesn’t help your score at all.

I gave credit card companies hundreds in unnecessary interest thinking I was “building credit.” I wasn’t. I was just being financially illiterate.

Using All Your Available Credit

Maxing out your cards tanks your score even if you pay on time. People with excellent scores keep utilization super low—usually under 10%.

Using 90% of your limit signals financial desperation to lenders.

Only Making Minimum Payments

I had a $5,000 balance once. Minimum payment was $100 monthly at 24% APR. After three months of “progress,” my balance had dropped by $80. Eighty dollars. After paying $300 total.

The rest went to interest. If I’d continued, I’d have paid over $11,000 total for $5,000 in purchases.

Minimum payments maximize the bank’s profits, not your financial health.

Ignoring Statements

For almost a year, I had autopay set up and never looked at statements. Turned out I was paying for a cancelled gym membership, forgotten subscriptions, and duplicate charges.

By the time I looked, I’d overpaid by hundreds. Now I read every statement. Takes 10 minutes. Has caught multiple errors.

Closing Paid-Off Cards

I closed a card after paying it off. Felt good. My credit score dropped 40 points.

Closing cards reduces available credit (increases utilization ratio) and eventually shortens credit history. Unless it has an unjustifiable annual fee, keep it open with one small recurring charge on autopay.

Emotional Spending

Bad day? I’m browsing online stores.

Stressed? Suddenly I’ve ordered $150 in unnecessary stuff.

Credit cards make this easy because there’s no immediate pain. With cash, you feel it. With credit? Just tap and go.

My 24-hour rule: anything over $50 that’s not budgeted goes in the cart, I close the browser, wait a full day.

Usually I forget about it or realize I don’t need it.

This has saved thousands.

When You Should Just Put the Card Away

Real talk for a minute.

There are times when using a credit card is just a bad idea. Even if you have perfect discipline. Even if you always pay on time.

I wish someone had told me this earlier. Would’ve saved me a lot of stress.

Real Emergencies vs. Shopping “Emergencies”

I’ve had both. And they’re very different.

Actual emergencies where a credit card makes sense:

- Medical bills you need to pay now

- Car repairs that you need to get to work

- Emergency home repairs (broken heater in winter, burst pipe, etc.)

- Last-minute travel for family emergencies

Things that feel like emergencies but aren’t:

- Sales that are “ending soon”

- Concert tickets because “everyone’s going”

- Vacation deals that seem too good to pass up

- Upgrading your phone when your current one works fine

The difference? Real emergencies are unexpected, unavoidable, and affect your safety or livelihood. Everything else is just good marketing making you feel FOMO.

I’ve fallen for the fake emergencies so many times. “This sale ends tonight!” Okay, but the sale ending doesn’t create a genuine need. It just creates urgency.

Learning to tell the difference has been huge for me.

If You Can’t Answer These Three Questions, Don’t Swipe

Before I use my credit card for anything unplanned, I ask myself:

1. When exactly will I pay this off? Not “soon” or “eventually.” An actual date.

2. Where will that money come from? Specific income source. Not just “I’ll figure it out.”

3. What will this actually cost me? Including interest if I need to carry it for a bit.

If I can’t answer all three clearly, I don’t buy it. Period.

This rule has stopped me from making so many impulsive purchases. Because when you actually think through the logistics, a lot of purchases don’t make sense.

When You’re Already Carrying Balances

If you’re already carrying a balance on one or more cards, stop using them for new purchases.

I know that sounds obvious. But I didn’t follow this advice for way too long.

I’d have a $2,000 balance on one card, still carrying it month to month, and I’d keep using that same card for new purchases. “I’m already paying it off,” I’d think. “What’s another $50?”

That $50 adds up. Fast. And it makes getting out of debt so much harder.

If you’re in debt, stop digging. Focus on paying down what you owe before adding more charges.

Warning Signs You Need to Stop Using Credit

These are the red flags that mean you need to cut up your cards (or at least freeze them in a block of ice):

- You’re making minimum payments on multiple cards

- You’re using one credit card to pay another

- You’re borrowing money from friends or family to cover card payments

- You feel anxious or avoid checking your balances

- You hide purchases from your partner or yourself

If any of these are happening, it’s time to stop using credit entirely and focus on recovery.

I’ve been there. Not fun. But it’s better to acknowledge the problem early than let it spiral.

Credit Cards vs. Debit Cards: What’s the Difference?

People ask me this all the time. “Should I just use my debit card instead?”

It’s not a simple yes or no. Both have their place. Here’s how they actually compare:

| Feature | Credit Card | Debit Card |

|---|---|---|

| Fraud Protection | Excellent – you dispute charges before paying | Good – but money is gone until dispute resolves |

| Credit Score Impact | Builds credit with responsible use | No impact on credit score at all |

| Spending Limit | Credit limit (borrowed money) | Whatever’s in your bank account |

| Cash Flow Timing | Pay 3-4 weeks later (grace period) | Money leaves account immediately |

| Rewards | Often includes cash back or points | Rarely offers rewards |

| Interest Charges | Yes, if you carry a balance | None (it’s your own money) |

| Overdraft Risk | No overdrafts possible | Can overdraft if you overspend |

| Psychological Effect | Easy to overspend (feels painless) | Harder to overspend (immediate impact) |

My personal approach: I use credit cards for everything I’ve budgeted, then pay them off in full. This gets me rewards and builds credit without any interest charges. But I treat them exactly like debit cards in terms of what I allow myself to spend.

If you struggle with overspending, start with a debit card until you build the discipline. Then transition to credit cards once you’ve proven to yourself that you can stick to a budget.

There’s no shame in knowing your limits.

Picking a Credit Card That Won’t Screw You Over

I’ve had seven different credit cards over the years. Here’s what I’ve learned about choosing cards that work for you instead of against you.

What Actually Matters for Beginners

When you’re learning responsible credit card use for beginners, focus on basics:

Must-haves: No annual fee, decent grace period, simple flat-rate rewards, free credit score tracking, good mobile app

Skip initially: High annual fees, complex rotating category rewards, cards requiring excellent credit, store-only cards

Simple beats sophisticated when you’re learning.

Low Interest Rate vs. Rewards Cards

Choose low APR if: You’re not confident you’ll pay in full monthly, want a safety net, or are still building discipline.

Choose rewards if: You’re certain you’ll never carry a balance and already pay cards in full monthly.

If you carry balances, interest charges always exceed rewards earned. A 2% cash back card charging 24% interest means a 22% net loss.

Secured Cards Work

When I had no credit history, I started with a secured card. Put down a $300 deposit, used it responsibly for 8 months, then graduated to an unsecured card with my deposit refunded.

If you’re starting from scratch or rebuilding, secured cards are your best bet.

How to Compare Cards

Focus on these in order:

- Annual fee – can you justify it?

- Interest rate – what if you carry a balance once?

- Rewards structure – earn on what you already buy?

- Redemption options – can you actually use rewards?

- Sign-up bonus – nice but not the main factor

I made a simple spreadsheet to compare three cards. Helped visualize which matched my actual spending patterns.

Global Context

If you’re outside the United States, the core principles still apply—pay in full, keep utilization low, track spending. But interest rates, grace periods, and credit reporting vary by country. Always check your local regulations and card terms.

Already in Credit Card Debt? Your Recovery Path

If you’re already carrying significant credit card debt, this section is for you. No judgment. I’ve been there. About 47% of American credit cardholders carry balances month to month. You’re not alone.

Step 1: Stop Using the Cards

First thing: stop using the cards you’re trying to pay off. Remove them from your wallet, freeze them in ice, or cut them up if needed. Make using them require deliberate effort.

Step 2: List Everything You Owe

Write down: card name, balance, interest rate, minimum payment, due date. Seeing it all in one place hurts. But you need to know what you’re dealing with.

Step 3: Choose Your Payoff Strategy

Debt Avalanche: Pay minimums on everything, throw extra money at highest interest rate first. Saves the most money.

Debt Snowball: Pay minimums on everything, throw extra money at smallest balance first. Feels better psychologically.

I used the snowball method because I needed those small wins. Pick whichever you’ll actually stick to.

Step 4: Find Extra Money

Even $50-100 extra per month makes a huge difference.

What worked for me:

- Cancelled unused subscriptions (saved $75/month)

- Meal prepped instead of eating out (saved ~$150/month)

- Picked up occasional freelance work (added $200-400/month)

Step 5: Consider Balance Transfers (Carefully)

0% balance transfer cards can save hundreds in interest if you pay off the debt during the promotional period. But watch out for transfer fees (3-5%) and don’t keep spending on the old card.

Step 6: Don’t Shame Yourself

You made some mistakes. So did I. So have millions of people. Shame doesn’t help you pay down debt faster. Focus on the system, make progress, celebrate small wins.

Common Questions About Using Credit Cards Responsibly

1.Is it bad to use my credit card every month?

Not even a little bit. In fact, using your credit card monthly is exactly what you should do—as long as you pay the full balance before the due date.

Monthly use shows active credit management, helps build payment history, and can earn you rewards. The only time it’s bad is if you’re carrying balances and paying interest.

2.How much of my credit limit should I actually use?

Everyone says 30%. But if you want excellent credit, aim for 10% or less.

You can spend more than 10% during the month—just pay it down before your statement closes. For example, with a $3,000 limit, you could spend $1,500 but pay it down to $300 before the statement date. Only the $300 gets reported to credit bureaus.

Financial education platforms like NerdWallet have extensively covered utilization ratios and their impact on credit scores.

3.Do I need to carry a balance to build credit?

No. No no no.

You do NOT need to carry a balance to build credit. You can pay in full every month and build an excellent score. Carrying a balance doesn’t help your credit—it only helps the credit card company’s profits.

Pay in full every month, build great credit, save money on interest.

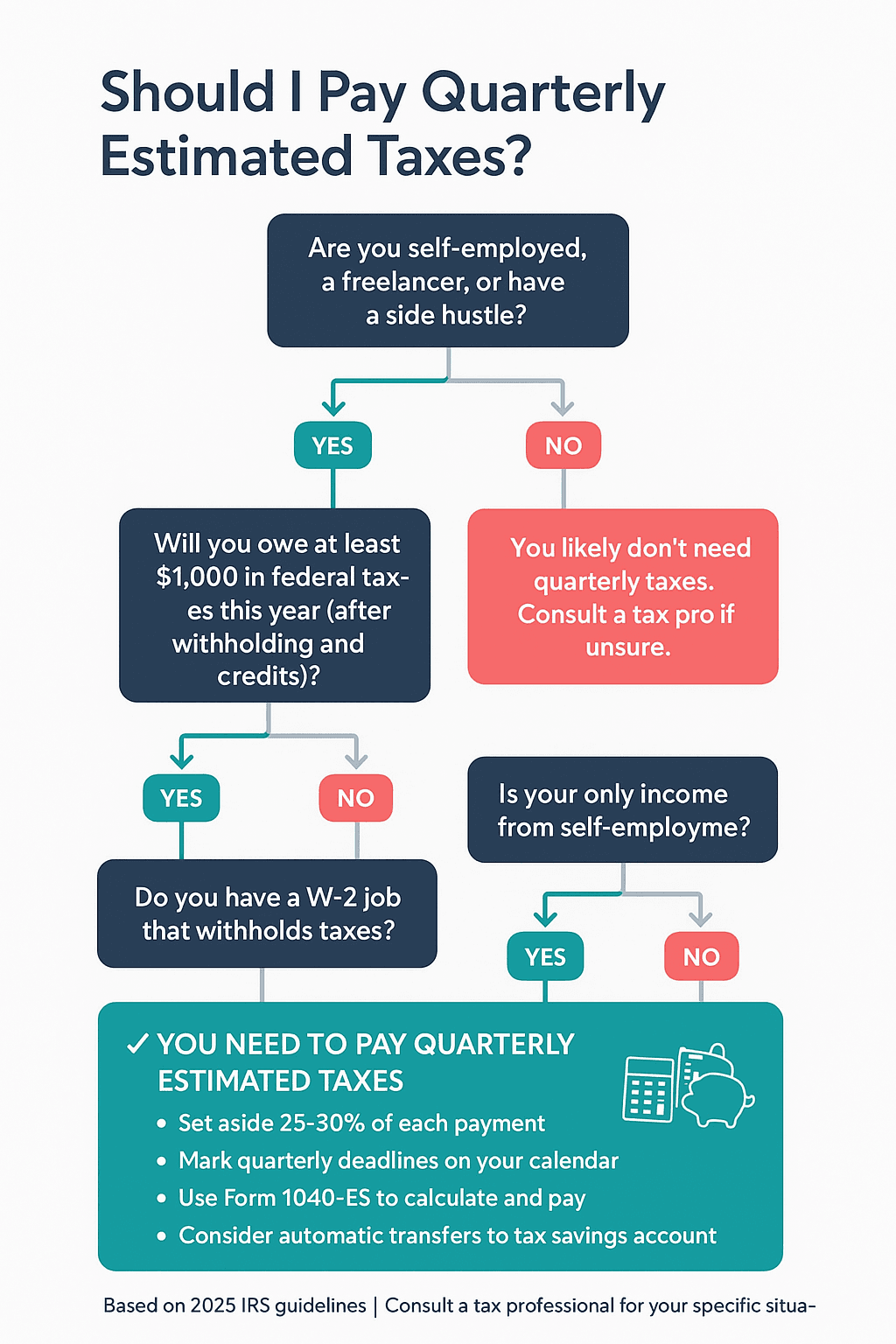

4.What happens if I miss one payment?

Less than 30 days late: Late fee ($25-$40), possible penalty APR, no credit report impact

30+ days late: Everything above plus reported to credit bureaus, score drops 17-83 points, stays on report 7 years

90+ days late: Score drops 100+ points, might go to collections

What to do: Call your card company immediately (they’ll often waive first-time late fees), pay ASAP, then set up autopay.

One missed payment is recoverable. Don’t make it a habit.

5.Should I close a credit card after I pay it off?

Usually no. Closing cards reduces available credit (increases utilization ratio) and eventually shortens credit history.

Close it if: Annual fee you can’t justify, serious self-control issues, or you’re paying for unused benefits.

Better alternative: Keep it open, remove from wallet, set up one small recurring charge with autopay.

6.How long does it take to build good credit?

With responsible use, expect noticeable improvements in 6-12 months. I started with a 620 score and reached 740 after 18 months of consistent on-time payments and low utilization.

The key is consistency. Twelve consecutive on-time payments matter way more than one perfect month.

Final Thoughts (The Stuff That Actually Matters)

Using credit cards responsibly isn’t rocket science. It’s discipline, consistency, and honesty with yourself about your habits.

About 47% of American credit cardholders carry balances month to month. You don’t have to be in that group. I’m not anymore. And I don’t make a ton of money. I just follow a system.

The core principles:

- Spend only what you’ve budgeted

- Pay the full balance every month

- Keep utilization under 30% (ideally under 10%)

- Check statements regularly

- Choose cards matching your actual spending

You don’t need to be perfect. I still make impulse purchases sometimes. But I pay it off and stay aware.

The real game-changer: Your credit score measures behavior, not income. Someone making $35,000 who pays on time will always outscore someone making $150,000 who’s chaotic with credit.

You don’t need to be rich to build excellent credit. You just need discipline.

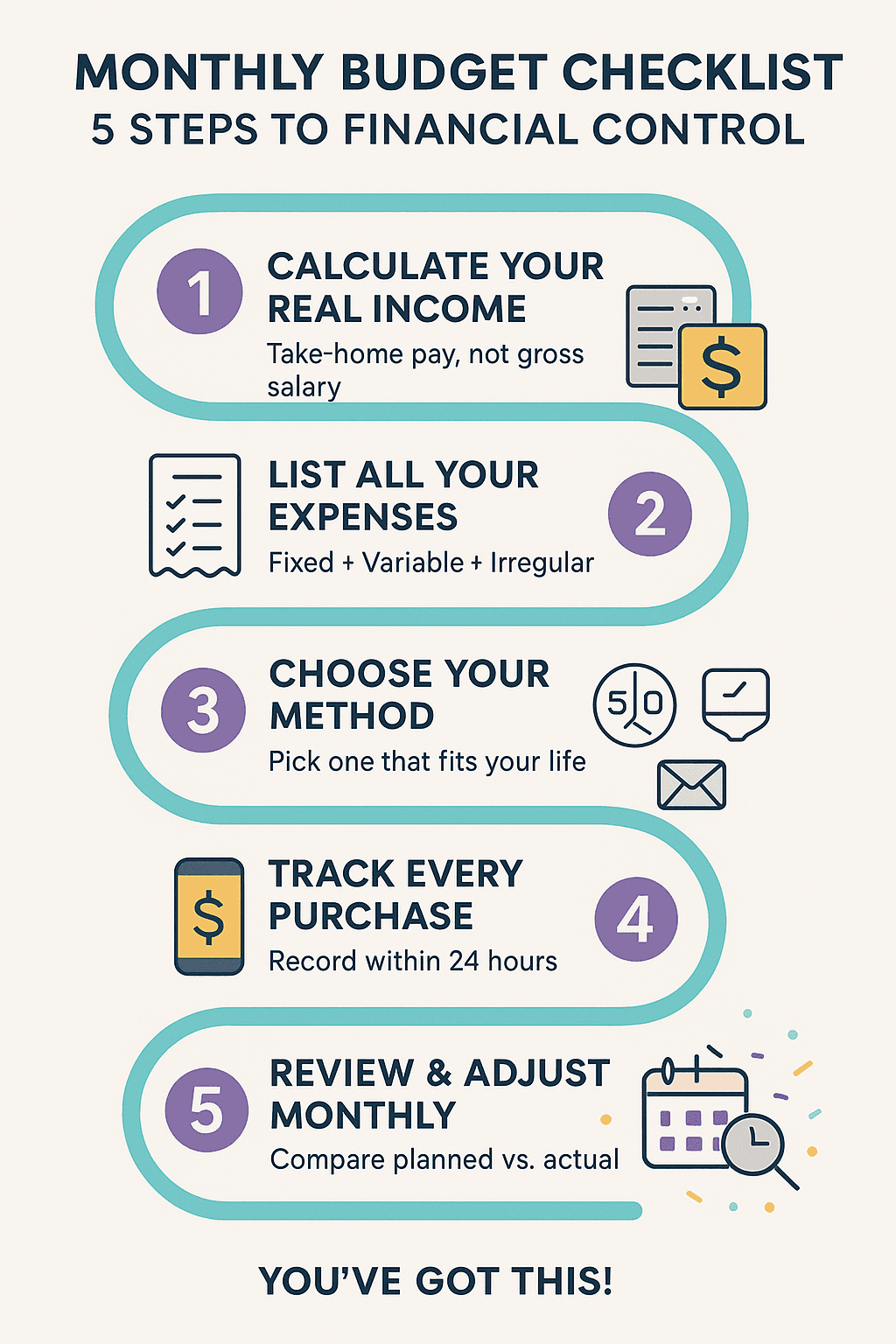

What to Do This Week

Pick one thing from this post. Just one.

Maybe it’s setting up autopay, scheduling weekly reviews, adding calendar reminders, or checking your utilization ratio.

Do that one thing. Master it. Then add another.

Small, consistent changes beat massive overhauls you abandon after two weeks.

Bookmark This. Share It. Come Back.

If this helped, bookmark it for later reference. Share it with someone struggling with credit card debt or just starting out.

Come back after your next statement. Read the habits section again. See which ones you’re actually doing.

You’ve got this.

Important Disclaimer

This content is for educational purposes only. I’m sharing my personal experiences and what I’ve learned about credit card management. This is not professional financial advice.

Credit card terms, interest rates, and regulations vary by location and change over time. What I’ve described reflects general principles and my personal experience, but your situation may be different.

Before making major financial decisions:

- Check your specific credit card terms and conditions

- Verify current interest rates and fees

- Consider consulting with licensed financial advisors or credit counselors

- Research your local consumer protection regulations

Your circumstances are unique. Your income, existing debt, financial goals, and credit history all affect what strategy makes sense for you. This post provides general education, not personalized recommendations.

Different countries and regions have different credit systems, regulations, and consumer protections. If you’re outside the United States, verify how credit reporting and card regulations work in your area.

The disclaimers are boring but necessary. Take this information, apply what’s useful to your situation, and make informed decisions that work for you.

Thanks for reading this incredibly long guide to using credit cards responsibly. If you made it this far, you’re already ahead of most people—you care enough to educate yourself. That’s huge.

Now stop reading and go implement something. Literally anything from this post. Just start.