The Psychology of Money in 2025: Why We Still Overspend and How To Stop

Picture this: It’s 2:47 AM, and you’re lying in bed scrolling through your phone. Suddenly, an ad pops up for those noise-canceling headphones you’ve been eyeing. “Limited time offer – 40% off!” it screams. Your thumb hovers over the “Buy Now” button. You know you shouldn’t. You’ve got rent due next week, and your savings account is looking pretty sad. But those headphones… they’d make your morning commute so much better, right?

Thank you for reading this post, don't forget to subscribe!

If this scenario sounds familiar, welcome to the club of millions struggling with the psychology of money 2025. Despite having access to budgeting apps that would make our grandparents weep with joy, AI financial advisors at our fingertips, and more financial education content than we could consume in a lifetime, we’re still making the same money mistakes our great-grandparents did. The only difference? Now we can do it faster, with one click, at any hour of the day.

I’ve spent the last decade studying why smart, educated people continue to make decisions that sabotage their financial futures. What I’ve discovered isn’t pretty, but it’s profoundly human. Our brains are still running on software designed for a world that no longer exists, while living in an environment specifically engineered to exploit every psychological weakness we have.

The numbers tell a sobering story. According to recent Federal Reserve data, the average American household is carrying $7,951 in credit card debt as we head deeper into 2025. That’s not just a statistic – that’s nearly 8,000 real families lying awake at night wondering how they’re going to make ends meet. And here’s the kicker: most of these people aren’t financially illiterate. They know they shouldn’t overspend. They understand compound interest. They’ve read the books, downloaded the apps, and maybe even taken a financial planning course. Yet here they are, trapped in the same cycle.

Read more: The psychology of money

How We Got Here: The Perfect Storm of Modern Money

Let me tell you about Sarah, a marketing manager I interviewed last year. She’s 29, makes $75,000 annually, has a master’s degree, and considers herself financially savvy. She uses Mint to track her expenses, has automated savings transfers, and even contributes to her 401k. Yet last month, she spent $847 on things she didn’t plan for – a subscription box she forgot to cancel, impulse purchases while waiting for her coffee, and yes, those noise-canceling headphones at 3 AM.

Sarah’s story illustrates something crucial about money psychology in our current era: intelligence and awareness aren’t enough anymore. We’re fighting a battle our brains simply weren’t designed to win.

Think about it this way. Your great-grandmother had to physically walk to the store, count out actual bills, and hand them to another human being to make a purchase. Every transaction had natural friction built in – time to think, physical effort required, and the visceral experience of watching money leave her hands. These weren’t intentional psychological safeguards; they were just the reality of commerce.

Fast forward to today, and I can buy almost anything I want without speaking to another human, without handling physical money, and without leaving my couch. The psychological distance between desire and fulfillment has shrunk to practically zero. It’s like we’ve removed all the guardrails from a mountain road and then wonder why more cars are going off the cliff.

The Digital Dopamine Factory

Here’s what’s really happening in your brain when you make an online purchase. About 2-3 seconds before you click “buy,” your brain releases a flood of dopamine – the same neurotransmitter involved in addiction. This isn’t metaphorical; it’s measurable brain chemistry. The anticipation of getting something new literally hijacks the same neural pathways that evolved to help our ancestors survive.

But here’s the cruel twist: that dopamine hit peaks before you actually get the item. The moment of purchase is often the most satisfying part of the entire experience. By the time your package arrives, your brain has already moved on to the next potential source of that neurochemical reward.

I learned this the hard way during my own spending recovery. Yes, you read that right – someone who studies financial psychology for a living had to go through their own spending recovery. In 2019, I realized I was spending nearly $300 a month on books I wasn’t reading, courses I wasn’t taking, and productivity apps I wasn’t using. The irony wasn’t lost on me.

The wake-up call came when I found myself buying the same online course twice – once in 2018 and again in 2019 – because I’d completely forgotten about the first purchase. That’s when I realized that my relationship with money wasn’t about the money at all. It was about the feeling I got from buying things, from the possibility of becoming a better version of myself, from the momentary sense of control and progress.

Social Media: The Comparison Economy on Steroids

If individual psychology wasn’t challenging enough, we’ve now layered social comparison on top of it in ways that would have been unimaginable just two decades ago. Your Instagram feed isn’t just showing you products – it’s showing you lifestyles, identities, and versions of success that feel simultaneously attainable and desperately out of reach.

Research from Behavioral Economics reveals something fascinating about how we process social information online. When we see someone we perceive as similar to us showcasing a purchase – whether it’s a friend’s new car or an influencer’s morning routine – our brains don’t register it as advertising. Instead, we process it as social proof, as evidence of what’s normal or expected in our peer group.

This is particularly insidious because social media algorithms are designed to show us content that generates engagement, and nothing generates engagement quite like envy, desire, and social comparison. The platforms aren’t trying to help us make good financial decisions; they’re trying to keep us scrolling, clicking, and ultimately, buying.

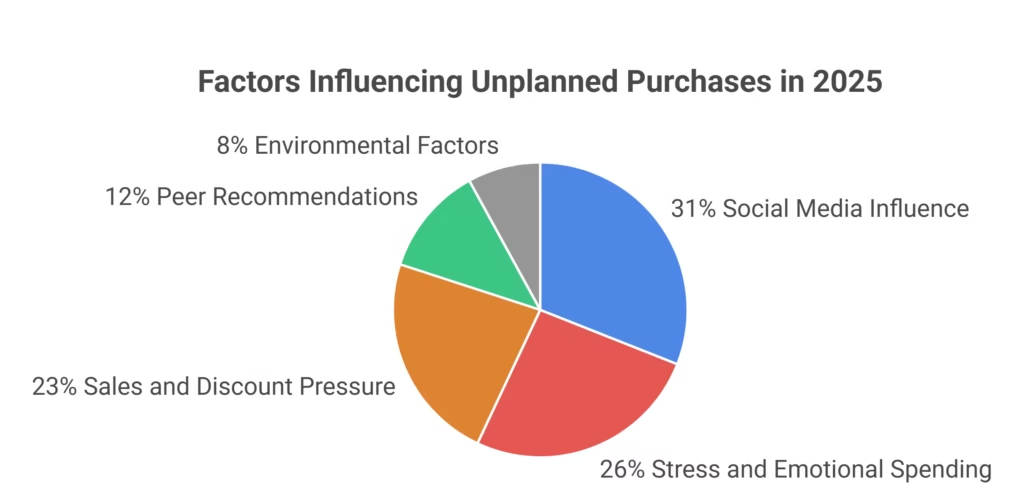

Understanding Your Social Spending Triggers (Based on 2025 Research) Recent studies show that social media influence accounts for 31% of unplanned purchases, with stress and emotional spending contributing another 26%. Sales and discount pressure drive 23% of impulse buys, while peer recommendations account for 12%. The remaining 8% comes from various environmental factors like store layouts, music, and even weather patterns.

I remember interviewing Marcus, a 34-year-old software developer, who told me he’d spent $3,200 in six months trying to recreate the home office setups he saw on YouTube and LinkedIn. “I kept telling myself it was an investment in my productivity,” he explained. “But really, I think I was just trying to feel like I belonged in this world of successful remote workers I kept seeing online.”

Marcus’s insight cuts to the heart of what I call “identity spending” – purchases we make not because we need the item, but because we need to feel like the type of person who owns that item.

The Hidden Psychology Behind Why We Can’t Stop

The Identity Trap: Who You Buy Yourself to Be

Let’s dig deeper into this idea of identity spending, because it’s probably costing you more money than you realize. Every purchase you make sends a signal – to others, yes, but more importantly, to yourself – about who you are and who you aspire to be.

That $8 artisanal coffee isn’t just about caffeine; it’s about being someone who appreciates quality, who has sophisticated taste, who’s worth the extra expense. The premium gym membership isn’t just about fitness; it’s about being someone who prioritizes health, who belongs in spaces with other successful people, who invests in themselves.

None of this is necessarily wrong, but it becomes problematic when we start buying an identity rather than building one through our actions and values. I call this the “purchase-first, become-later” mentality, and it’s everywhere in our culture.

Think about the last five non-essential purchases you made. Now, honestly ask yourself: what were you really buying? Were you buying the item, or were you buying a feeling? Were you solving a practical problem, or were you trying to solve an identity problem?

This isn’t about shame or judgment. I’ve been there. We’ve all been there. The point is to develop awareness, because awareness is the first step toward choice, and choice is the first step toward freedom.

The Emotional Spending Spiral

These Three Emotional Responses Could Be Costing You. Here’s What They Are and What You Can Do About It by Investopedia explores how anxiety, depression, and stress create predictable spending patterns. But what the research doesn’t always capture is how these patterns feel from the inside.

Let me share something personal. In 2020, during the height of pandemic anxiety, I found myself ordering delivery food almost every day, despite having a fully stocked kitchen and decent cooking skills. The food wasn’t the point. The food was a way of treating myself, of creating a small bright spot in an otherwise uncertain and frightening world. It was self-care through commerce, comfort through consumption.

The problem with emotional spending isn’t the emotion itself – emotions are valid, and we all need ways to cope with stress, sadness, and uncertainty. The problem is that spending provides such temporary relief that we need to keep doing it, over and over again, just to maintain baseline emotional stability.

Here’s what typically happens: You feel stressed, anxious, or down. You make a purchase that provides temporary relief and a small dopamine boost. The feeling fades quickly, often replaced by buyer’s remorse or financial anxiety. This new anxiety then drives more spending, creating what psychologists call a “maladaptive coping cycle.”

Breaking this cycle isn’t about eliminating emotions or even eliminating all emotional spending. It’s about developing what I call “emotional spending literacy” – the ability to recognize when you’re shopping for feelings rather than things, and having alternative strategies ready.

The Technology Trap: When Our Tools Work Against Us

Here’s a paradox that keeps me up at night: the same technology that could help us make better financial decisions is often the very thing that enables our worst financial habits.

Consider the rise of artificial intelligence in both personal finance and marketing. On one hand, AI-powered budgeting apps can analyze your spending patterns, predict future expenses, and even automatically move money to savings when you’re likely to overspend. On the other hand, AI-powered marketing systems can predict when you’re most vulnerable to making a purchase, what products will appeal to your specific psychology, and even what time of day you’re most likely to buy something you don’t need.

It’s an arms race, and right now, the spending-inducing technology is winning.

How AI Influences Your Spending Decisions (2025 Data) Personalized AI recommendations increase impulse purchases by up to 43% compared to generic marketing. The average consumer receives 127 targeted ads per day, with AI systems analyzing everything from your browsing history and purchase patterns to your social media activity and even your smartphone’s accelerometer data to determine your mood and likelihood to buy.

But here’s what really bothers me about this technological landscape: it’s asymmetric. The companies trying to sell you things have teams of behavioral scientists, data analysts, and AI specialists working around the clock to understand and influence your purchasing decisions. Meanwhile, you’re expected to resist these sophisticated psychological techniques using nothing but willpower and maybe a basic budgeting app.

It’s like bringing a butter knife to a gunfight.

The subscription economy provides another perfect example of this asymmetry. Companies have discovered that it’s much easier to get you to say yes to a small recurring charge than a large one-time payment. They’ve optimized their systems to make signing up easy (often just one click) and canceling difficult (requiring phone calls, waiting periods, or navigating confusing websites).

The average household now manages between 12-15 active subscriptions, according to recent consumer research. These small charges – $9.99 here, $14.99 there – feel manageable individually but collectively represent hundreds of dollars in monthly expenses. And because they’re automated, they often fly under our psychological radar until we sit down to do a comprehensive budget review.

I learned this lesson when I discovered I was paying for three different cloud storage services (apparently, I’d forgotten about the first two when I signed up for the third), two meal planning apps I’d stopped using, and a language learning platform I’d accessed exactly twice in eighteen months. Total monthly damage: $47. Annual damage: $564. For services I wasn’t even using.

The 2025 Money Psychology Landscape: What’s Different Now

The Cryptocurrency Wild West

Let’s talk about something that wasn’t even on most people’s radar a decade ago: cryptocurrency psychology. I’ve interviewed dozens of people who’ve made and lost significant amounts of money in crypto markets, and what strikes me isn’t their technical understanding of blockchain technology or market analysis. What strikes me is how similar their emotional experiences are to traditional gambling addiction.

There’s Jake, a 26-year-old teacher who started with a $500 investment in Bitcoin and ended up taking out a $15,000 personal loan to invest in various altcoins. “It felt like I was finally getting ahead of the system,” he told me. “Everyone around me was struggling with student loans and low salaries, but crypto felt like my chance to leap ahead, to not have to wait thirty years to build wealth.”

The psychology here isn’t really about cryptocurrency at all. It’s about hope, about desperation, and about the very human desire to find a shortcut to financial security. Crypto markets just happened to provide a vehicle for these emotions, complete with 24/7 trading, social media communities that reinforce risky behaviors, and enough success stories to keep the dream alive.

The Creator Economy Illusion

Social media has also given rise to what I call the “creator economy illusion” – the belief that anyone can monetize their passion, build a personal brand, and achieve financial freedom through content creation. This isn’t necessarily wrong, but it’s created some interesting psychological side effects.

I’ve noticed a trend among younger adults who justify expensive equipment, courses, and tools as “investments in their side hustle” or “building their personal brand.” The $2,000 camera, the $500 microphone, the $297 online course about Instagram marketing – these purchases feel different from regular spending because they’re connected to the possibility of future income.

But here’s the uncomfortable truth: for every person who successfully monetizes their social media presence, there are thousands who spend more on the dream than they ever earn from it. The creator economy is real, but it’s also become a new vehicle for the same old identity spending and get-rich-quick psychology that’s always existed.

The Wellness-Industrial Complex

Another fascinating development in spending habits 2025 is the intersection of wellness culture and consumer spending. We’re living through what might be called the “optimization era,” where every aspect of life – sleep, productivity, fitness, mindfulness, even our morning routines – has become something to be optimized, tracked, and improved through the right products and services.

Walk into any upscale grocery store, and you’ll find $12 bottles of adaptogenic water, $35 bags of superfood powder, and $20 bars of “functional” chocolate. Open Instagram, and you’ll see ads for $200 sleep trackers, $300 meditation cushions, and $500 red light therapy devices.

This isn’t just about expensive products; it’s about how we’ve learned to medicalize normal human experiences and then sell solutions for them. Feeling tired? You need this supplement. Feeling anxious? You need this app. Feeling unproductive? You need this planner, this course, this system.

I’m not against wellness or self-improvement – quite the opposite. But I am concerned about how consumer culture has co-opted our legitimate desire for health and growth, turning it into another avenue for endless spending.

Breaking Free: Strategies That Actually Work

Step 1: Radical Honesty About Your Money Story

Before we get into tactics and tools, we need to get honest about something most people never examine: your money story. This is the collection of beliefs, experiences, and emotional associations that shape how you think about and interact with money.

Maybe your money story includes growing up in a household where money was scarce, where every purchase required careful consideration and sometimes heated discussions between your parents. Maybe it includes the memory of your family losing their home during a recession, creating a deep association between financial security and survival. Or maybe it includes growing up in relative comfort but with parents who used money as a form of control or love.

These early experiences create what psychologists call “money scripts” – unconscious beliefs that drive our financial behavior long into adulthood. Some common ones include:

- “I have to spend money to show people I care about them”

- “If I have money, something bad will happen to take it away”

- “Rich people are greedy/shallow/unhappy”

- “I don’t deserve to have money”

- “Money will solve all my problems”

None of these beliefs are necessarily true or false, but they all influence behavior in powerful ways. The first step in changing your relationship with money is identifying which scripts are running in the background of your mind.

Try this exercise: Think about your earliest money-related memory. Maybe it’s getting your first allowance, or watching your parents argue about bills, or the first time you bought something with your own money. What emotions come up when you remember this experience? What did it teach you about what money means?

Step 2: Environmental Design (Make the Healthy Choice the Easy Choice)

Here’s a truth that took me years to accept: willpower is overrated. It’s a finite resource that gets depleted throughout the day, and it’s no match for sophisticated marketing systems designed by teams of behavioral scientists.

Instead of relying on willpower, focus on environmental design – structuring your physical and digital environments to make good financial decisions automatic and bad ones difficult.

This might look like:

Digital Environment Changes:

- Removing shopping apps from your phone (you can still access them through web browsers, but this adds helpful friction)

- Unsubscribing from promotional emails and texts (companies spend millions optimizing these messages to trigger purchases)

- Using website blockers during vulnerable times (late nights, stressful periods, payday)

- Setting up automatic transfers to savings that happen immediately when you get paid

Physical Environment Changes:

- Keeping a list of everything you want to buy in a notebook, with a requirement to wait 72 hours before purchasing anything over $50

- Using cash for discretionary categories like dining out or entertainment

- Creating a designated space in your home for items you’ve bought but haven’t used – seeing this “purchase graveyard” can be powerfully motivating

Social Environment Changes:

- Finding friends who share similar financial values and goals

- Limiting time spent in environments specifically designed to encourage spending (malls, certain social media platforms, promotional events)

- Joining communities focused on financial wellness, minimalism, or intentional living

I learned the power of environmental design when I realized that I was much more likely to overspend when I was tired, stressed, or bored. So I created what I call “spending speed bumps” for these vulnerable times. After 9 PM, I can’t make any online purchases without first texting a friend to tell them what I’m buying and why. On stressful days, I have to write down my emotional state before making any non-essential purchases. When I’m bored, I have a list of free activities to try before I’m allowed to browse shopping websites.

These aren’t perfect systems – I still occasionally override them – but they’ve reduced my impulse purchases by about 70%.

Step 3: The Psychology of Automation

One of the most powerful insights from behavioral psychology is that we’re much more likely to stick with default options than to actively choose alternatives. Financial services companies know this, which is why they’ve made it so easy to sign up for recurring charges and so difficult to cancel them.

But we can use this psychological tendency to our advantage by automating our healthy financial behaviors.

How can behavioral science help our spending habits? 5 questions for Wendy De La Rosa emphasizes something crucial: the most effective financial strategies are the ones that work whether you’re motivated or not, whether you’re having a good day or a bad day, whether you remember to do them or not.

Here’s what automation might look like:

Savings Automation:

- Set up automatic transfers to happen the day you get paid, before you’ve had time to mentally allocate that money to expenses

- Use apps that round up your purchases to the nearest dollar and save the difference

- Automatically increase your 401k contribution by 1% every year

- Set up separate automatic transfers for different goals (vacation, emergency fund, home down payment)

Bill and Subscription Management:

- Automate all your fixed expenses so you never have to think about them

- Set up calendar reminders to review and cancel unused subscriptions every three months

- Use apps that track all your recurring charges and make cancellation easier

Investment Automation:

- Set up automatic investment contributions to low-cost index funds

- Use target-date funds that automatically adjust risk as you age

- Consider robo-advisors for hands-off investment management

The beauty of automation is that it removes the decision-making burden from your daily life. Instead of having to choose to save money every month, or choose to invest every month, or choose to pay bills on time every month, these things just happen. This frees up your mental energy for other decisions and reduces the cognitive load of managing your finances.

Step 4: Developing Emotional Spending Literacy

Remember earlier when I talked about emotional spending and the maladaptive coping cycle? Breaking this pattern requires developing what I call emotional spending literacy – the ability to recognize when you’re shopping for feelings rather than things, and having alternative strategies ready.

This starts with building awareness of your emotional spending triggers. For the next week, try this experiment: before making any non-essential purchase, pause and ask yourself three questions:

- What am I feeling right now?

- What am I hoping this purchase will do for me emotionally?

- Is there another way I could address this feeling that doesn’t involve spending money?

Don’t judge your answers – just notice them. You might discover that you shop when you’re lonely, or when you’re feeling behind in life, or when you’re celebrating small wins, or when you’re procrastinating on difficult tasks.

Once you identify your patterns, you can start developing alternative responses. If you shop when you’re lonely, maybe you call a friend instead. If you shop when you’re feeling behind, maybe you work on a personal project that gives you a sense of progress. If you shop when you’re procrastinating, maybe you use a productivity technique like the Pomodoro Method to tackle the task you’re avoiding.

The goal isn’t to eliminate all emotional spending – sometimes buying something small and meaningful can genuinely improve your mood and be worth the cost. The goal is to make these decisions consciously rather than automatically, and to have other tools in your emotional toolkit besides spending money.

Step 5: The Power of Community and Accountability

One of the most underutilized strategies for changing financial behavior is leveraging the power of social support and accountability. Humans are fundamentally social creatures, and we’re much more likely to stick with goals when other people know about them and support us.

This doesn’t mean you need to share the intimate details of your financial situation with everyone you know. But it does mean finding ways to connect with others who share your values around money and can support you in making the changes you want to make.

Success rates of different spendings control methods. Studies show that automated savings systems have a 78% success rate for sustained behavior change, while cash-only spending approaches work for 71% of people who try them. Implementing waiting periods before purchases succeeds 65% of the time, while simply deleting shopping apps works for about 52% of people. Relying on willpower alone has only a 23% success rate, highlighting the importance of systematic approaches over individual determination.

This might look like:

- Joining online communities focused on financial wellness, debt reduction, or intentional living

- Starting a monthly money check-in with a trusted friend where you share your progress and challenges

- Working with a financial therapist or counselor who specializes in the psychology of money

- Participating in challenges like “no-spend months” or “mindful spending” experiments with others

- Finding an accountability partner who’s also working on changing their relationship with money

I’ve seen people make dramatic improvements in their financial lives simply by having someone to text before making impulse purchases, or by participating in online forums where they could celebrate small wins and get support during difficult moments.

The key is finding the right level of accountability for your personality and situation. Some people thrive with public accountability and sharing their goals widely. Others prefer more private forms of support. Experiment to find what works for you.

Living Better With Money in 2025

Redefining Wealth in the Modern Era

As we work on changing our individual relationships with money, it’s worth stepping back and questioning some of the broader cultural messages about wealth and success that influence our spending decisions.

Traditional markers of success – the big house, the luxury car, the expensive clothes – were developed in a different economic era and may not serve us well in 2025. Housing costs have skyrocketed relative to incomes. Car ownership is becoming less necessary in many urban areas. The most successful people I know often live relatively simply, investing their money in experiences, relationships, and future financial security rather than status symbols.

This doesn’t mean asceticism or deprivation. It means being intentional about what wealth actually means to you, rather than accepting someone else’s definition.

For some people, wealth means freedom – the ability to choose how to spend their time without being constrained by financial necessity. For others, it means security – knowing they can handle unexpected expenses without panic. For others, it means generosity – being able to help family members, donate to causes they care about, or support their community.

What does wealth mean to you? Not what does society tell you it should mean, not what your parents thought it meant, not what social media suggests it means – what does it mean to you?

The Practice of Intentional Spending

Once you’ve gotten clearer on your personal definition of wealth and success, you can start practicing what I call “intentional spending” – making purchasing decisions based on your actual values rather than impulse, emotion, or social pressure.

Intentional spending isn’t about being frugal or cheap. It’s about being deliberate. It means spending generously on things that truly matter to you and cutting ruthlessly on things that don’t.

Maybe you discover that you deeply value experiences over things, so you cut back on shopping for clothes and home decor but maintain a robust travel budget. Maybe you realize that your morning coffee ritual is genuinely important to your daily happiness, so you keep that $5 daily latte but eliminate other small luxuries that don’t bring you joy.

Maybe you find that you care deeply about supporting local businesses and sustainable practices, so you’re willing to pay more for groceries and household items that align with these values, but you’re not interested in spending money on the latest tech gadgets.

The point isn’t to follow anyone else’s spending priorities – it’s to discover your own and then align your financial choices with them.

Building Anti-Fragile Financial Habits

Finally, as we think about money psychology in 2025 and beyond, I want to introduce the concept of anti-fragile financial habits. This term, borrowed from author Nassim Taleb, refers to systems that don’t just survive stress and chaos – they actually get stronger because of it.

Most people’s financial systems are fragile – they work fine when everything is going well, but they collapse under stress. You lose your job, get sick, or face an unexpected expense, and suddenly all your good intentions around budgeting and saving go out the window.

Anti-fragile financial habits, on the other hand, are designed to work especially well during difficult times. They’re built to handle the reality of human psychology under stress, rather than assuming you’ll always make rational decisions.

What might anti-fragile financial habits look like?

- Multiple layers of automation so that your savings and investments continue even when you’re too stressed or busy to think about money

- Emotional spending plans that acknowledge you’re going to make some impulse purchases when you’re upset, but limit the damage through predetermined spending accounts or dollar limits

- Flexible budgeting systems that can accommodate changes in income, unexpected expenses, or shifts in priorities without falling apart entirely

- Strong social support systems that provide accountability and encouragement during difficult financial periods

- Diverse income streams so that losing one job doesn’t devastate your entire financial picture

- Regular financial check-ins that help you spot problems early and adjust course before small issues become big ones

The goal is to create financial habits that work with your psychology, not against it, and that remain stable even when life gets messy.

Conclusion: Your Money, Your Psychology, Your Choice

As we wrap up this deep dive into the psychology of money 2025, I want to leave you with something important: you’re not broken if you’ve struggled with money. You’re not weak if you’ve made purchases you later regretted. You’re not a failure if you’ve tried budgeting systems that didn’t work for you.

You’re human, living in a world specifically designed to exploit the psychological weaknesses we all share. The deck is stacked against you, the game is rigged, and the fact that you’re even thinking about these issues puts you ahead of most people.

But here’s the empowering part: once you understand the game, once you see the psychological mechanisms at work, you can start to opt out. You can design your own system, build your own safeguards, and create your own definition of financial success.

The tools and knowledge to build wealth are more accessible than ever before. The challenge lies not in accessing information but in applying it consistently despite our psychological biases. And that’s exactly what we’ve been talking about – not just what to do, but how to actually do it, given the realities of human psychology.

Every small change compounds over time. Every moment of awareness creates the possibility for choice. Every choice, no matter how small, is a step toward the financial life you actually want rather than the one that just happens to you.

Remember, personal finance is personal. What works for your friend, your coworker, or some influencer online might not work for you, and that’s okay. The goal isn’t to follow someone else’s system perfectly – it’s to understand yourself deeply and create systems that work with your unique psychology, circumstances, and goals.

The psychology of money 2025 teaches us that our relationship with money is really a relationship with ourselves – our fears, our dreams, our values, and our vision of the future. Changing how you handle money isn’t just about improving your bank account balance; it’s about creating alignment between your deepest values and your daily choices.

And that, more than any budgeting app or investment strategy, is the foundation of real financial wellness.

Frequently Asked Questions About Money Psychology in 2025

What exactly is the psychology of money in 2025, and why is it different from previous years? The psychology of money in 2025 refers to how our ancient brain wiring interacts with modern financial technology, social media influence, and economic pressures. What makes it unique is the speed and sophistication of systems designed to trigger spending, combined with 24/7 access to purchasing opportunities and constant social comparison through digital platforms.

I understand budgeting and investing, so why do I still overspend on things I don’t need? Knowledge and behavior are two different things. Our emotional and psychological responses often override rational decision-making, especially when we’re tired, stressed, or experiencing strong emotions. Modern marketing specifically targets these psychological vulnerabilities, making overspending a predictable response rather than a character flaw.

How can I stop emotional spending without feeling deprived? Start by developing awareness of your emotional spending triggers, then create alternative responses that address the underlying feeling. Instead of eliminating emotional purchases entirely, set up a small “joy spending” budget that allows for occasional treats without derailing your financial goals. Focus on spending intentionally rather than automatically.

What are the biggest psychological traps that cause overspending in 2025? The major traps include social media comparison, identity spending (buying things to feel like a certain type of person), subscription creep, AI-powered personalized marketing, and the removal of natural friction from purchasing decisions. The combination of instant gratification technology and sophisticated behavioral targeting creates a perfect storm for overspending.

Is it normal to feel overwhelmed by money management, even with all the tools available today? Absolutely. Having more tools and information doesn’t necessarily make financial decisions easier – sometimes it makes them more complex. It’s completely normal to feel overwhelmed, and it’s important to remember that good financial management is more about consistent small actions than perfect knowledge or complex strategies.