2025 Student Loan Limits (August Update): Federal vs. Private, What Changed, and the Cheapest Way to Borrow—and Repay—Now

Look, I’ll be straight with you—the student loan world got flipped upside down this year. If you’re trying to figure out how to pay for college or deal with existing loans, you’re probably drowning in confusing headlines about new limits, rate changes, and policy shifts that nobody seems to explain in plain English.

I’ve been tracking these changes since they started rolling out, and honestly? It’s been a mess. But here’s the thing that matters most: while the rules got more complicated, there are actually some opportunities hiding in all this chaos if you know where to look.

The biggest change? Federal loans aren’t the automatic “best choice” anymore. Yeah, you read that right. For the first time in years, some students might actually save money going private. But—and this is important—only if they know what they’re doing.

Federal undergraduate rates dropped to 6.39% this year (first decrease in forever), but new borrowing caps mean tons of students can’t get enough federal money to cover their costs. So they’re forced into the private market, where rates start around 3% for people with great credit but can hit 15% if you’re not careful.

Here’s what nobody’s telling you: the “federal loans are always better” advice your parents got? That’s outdated. The “private loans are evil” warnings from 2008? Also outdated. The truth sits somewhere in the middle, and it depends entirely on your situation.

I’m going to walk you through exactly what changed, show you the real numbers (not the marketing BS), and give you a step-by-step plan for borrowing smart and paying back strategically. Because frankly, most of the advice out there is either outdated or trying to sell you something.

What Actually Changed This Year (And Why It Matters)

Remember when applying for student aid was straightforward? Fill out the FAFSA, get your federal loans, maybe supplement with a small private loan if needed. Those days are gone.

The One Big Beautiful Bill Act passed in July, and buried in its 2,847 pages were some pretty significant changes to how student loans work. Most news outlets focused on the flashy stuff, but the real impact is in the details that affect your wallet.

The New Limits That Actually Matter

The 2025 student loan limits Parent PLUS loans got hit hard. Used to be, parents could basically borrow unlimited amounts (as long as they passed a basic credit check). Now? There are income verification requirements and actual borrowing limits based on the student’s program and the family’s financial situation.

Graduate students got squeezed too. The aggregate borrowing limit for grad school dropped from $138,500 to $120,000. Doesn’t sound like much until you realize that includes your undergrad debt. If you borrowed $30k for your bachelor’s degree, you can now only borrow $90k for grad school instead of $108,500.

Here’s what this looks like in practice: A nursing student I know needed $25,000 for her final year. Under the old rules, her parents could have taken a PLUS loan for the full amount. Now? They qualified for $8,000 in PLUS loans. She had to find $17,000 elsewhere.

The Rate Situation (Finally Some Good News)

At least federal rates went down. After years of increases, undergraduate federal loans dropped to 6.39% for loans disbursed between July 1, 2025, and June 30, 2026. Graduate rates fell to 7.94%, and PLUS loans are at 8.94%.

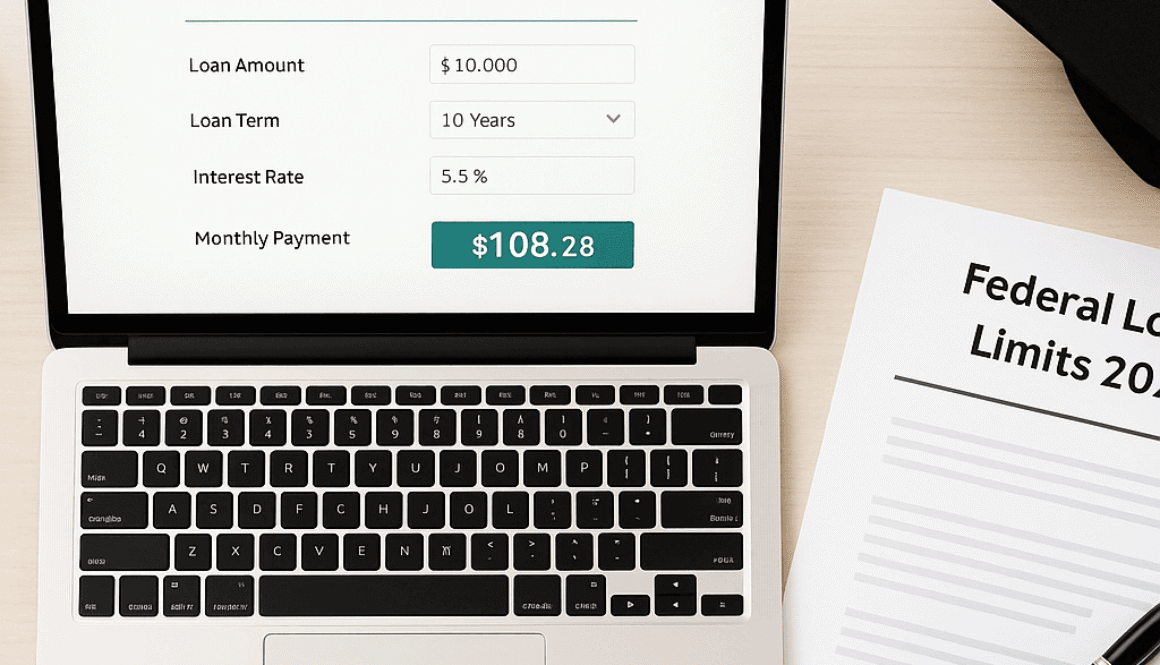

That might not sound like much, but on a $10,000 loan over 10 years, that 0.14% decrease saves you about $85. Not life-changing, but hey, it’s something.

The bigger story is what’s happening in the private market. Competition has gotten fierce. Lenders are offering rates as low as 2.99% for borrowers with excellent credit. The catch? “Excellent credit” means a 780+ credit score, stable income history, and often a cosigner with similar credentials.

Who Got Hit Hardest

This isn’t affecting everyone equally. The students feeling the biggest impact:

Professional school students: Med school, law school, dental school—these programs were already expensive, and now federal options are more limited. A first-year med student from Texas told me she’s looking at $40,000 in private loans because federal aid won’t cover her costs.

Students from middle-income families: Too wealthy for need-based aid, too cash-strapped to pay out of pocket, and now facing tighter PLUS loan limits. This is the group getting squeezed hardest.

Adult learners going back to school: Many are hitting aggregate borrowing limits from previous degrees, forcing them into private markets where their age and career changes work against them in underwriting.

Federal vs. Private: The Numbers Game Everyone Gets Wrong

Every financial aid office will tell you to “exhaust federal options first.” Most of the time, that’s still good advice. But not always, and here’s why the standard advice is getting more complicated.

What Federal Loans Actually Cost

Everyone talks about federal loan interest rates like they’re the whole story. They’re not. Federal loans come with origination fees that nobody mentions upfront.

Direct Subsidized and Unsubsidized loans have a 1.057% origination fee. PLUS loans? 4.228%. These fees get deducted from your loan disbursement, but you pay interest on the full loan amount.

So that 6.39% undergraduate federal loan? Your effective first-year cost is closer to 7.4% when you factor in the origination fee. After year one, it’s 6.39%. Still competitive, but not as amazing as the headline rate suggests.

Here’s the math on a $10,000 federal loan:

- You receive: $9,894 (after $106 origination fee)

- You owe: $10,000

- You pay interest on: $10,000

- Effective first-year rate: ~7.4%

What Private Loans Actually Cost

Private loan advertising is designed to confuse you. “Rates as low as 2.99%!” screams every website. What they don’t mention is that rate requires:

- 780+ credit score

- Debt-to-income ratio under 20%

- Stable employment history

- Often, a qualified cosigner

Most college students don’t check those boxes. A more realistic rate for a student with limited credit history, even with a cosigner, is 7% to 11%. Still potentially competitive with federal rates, but not the dream scenario the ads suggest.

The advantage of private loans? No origination fees from reputable lenders. That 8.5% private loan rate is actually 8.5%, not 8.5% plus hidden fees.

The Protection Factor

Here’s where federal loans earn their keep: the protections. These aren’t just nice-to-have features—they’re financial insurance policies.

Income-driven repayment plans: Cap your payments at 10% to 20% of your discretionary income. If you graduate into a low-paying job or face unemployment, your payments can drop to zero.

Forbearance and deferment: Temporary payment suspensions for economic hardship, unemployment, or returning to school. No questions asked, no credit impact.

Loan forgiveness programs: Public Service Loan Forgiveness, Teacher Loan Forgiveness, and other programs that can eliminate remaining debt after a certain number of qualifying payments.

Death and disability discharge: If something happens to you, federal loans are forgiven. Your family isn’t stuck with the debt.

Private loans offer some forbearance options, but they’re limited and often temporary. Most private lenders will work with you if you’re struggling, but they’re not required to, and the terms vary wildly.

The Consumer Financial Protection Bureau (CFPB) is a U.S. government agency that protects consumers in the financial marketplace. It provides clear information, enforces fair lending laws, and helps people make informed decisions about loans, credit cards, mortgages, and other financial products. The CFPB also offers tools and resources to avoid scams, resolve disputes, and manage debt responsibly.

When Private Makes Sense

Despite the protection advantages of federal loans, there are situations where private loans are the smarter choice:

You have excellent credit: If you can qualify for private rates significantly below federal rates (say, 4.5% vs. 6.39%), and you’re confident in your career prospects, the savings can be substantial.

You’re borrowing large amounts: The protection value of federal loans is worth roughly 1% to 2% in additional interest. If private rates are more than 2% below federal rates, the math works.

You don’t need income-driven repayment: If you’re entering a high-paying field and comfortable with fixed payments, private loans can save money.

Your federal options are maxed out: If you’ve hit borrowing limits or don’t qualify for federal aid, private loans beat alternative funding sources like credit cards or home equity loans.

Building Your Financial Firewall (Before You Need It)

Most students think about debt management after they graduate. That’s too late. The smart money moves happen while you’re still in school, before debt becomes unmanageable.

I learned this lesson the hard way watching friends graduate with $40,000 in student loans plus another $15,000 in credit card debt they racked up “just for emergencies.” Don’t be that person.

Separate Your Money, Separate Your Problems

The biggest mistake I see students make is mixing their education expenses with regular living expenses. It seems harmless, but it’s how you end up with credit card debt on top of student loans.

Set up three different accounts:

Education account: Only for tuition, fees, books, and required supplies. Student loan money goes here and nowhere else.

Living expenses account: Rent, groceries, transportation, phone bill. This is your “real world” money.

Emergency buffer: $500 to $1,000 for genuinely unexpected costs. Medical bills, car repairs, emergency flights home.

The rule is simple: never mix these accounts. Education money doesn’t pay for pizza. Living expense money doesn’t pay for textbooks. Emergency money is truly for emergencies.

This separation prevents the “lifestyle creep” that destroys so many students. When you get that $5,000 loan disbursement, it feels like you’re rich. But if it’s sitting in your checking account next to your regular spending money, you’ll spend it on regular stuff. Guaranteed.

The Credit Card Trap (And How to Avoid It)

Credit cards are useful tools. They’re also incredibly dangerous for students living on borrowed money. Here’s the reality: if you can’t afford something with cash, you probably can’t afford the monthly payment either.

But since you probably already have credit cards, let’s make them work for you instead of against you:

The one-card rule: Keep one low-limit card for genuine emergencies and online purchases. Leave it at home. Seriously. If it’s in your wallet, you’ll use it.

Weekly payments: Pay off your balance every week, not every month. This keeps spending visible and prevents the “I’ll figure it out later” mindset.

Automatic alerts: Set up text alerts for every purchase over $25. It’s annoying, which is the point. The friction makes you think twice.

The replacement test: Before charging anything, ask yourself: “If I pay cash for this, what will I have to cut from my budget this week?” If you can’t answer that question, don’t buy it.

Students who follow these rules typically graduate with less than $1,000 in credit card debt. Students who don’t follow them average $8,000 to $12,000.

Prioritizing Your Debt (The Smart Way)

Not all debt is created equal, and the payoff strategy that works for your parents might not work for you. The traditional “debt avalanche” (pay highest interest first) needs some modifications when you’re dealing with student loans.

Here’s the priority order that actually makes sense:

Level 1: Consumer debt above 15%: Credit cards, personal loans, payday loans. These will destroy your financial future if you don’t kill them first.

Level 2: Variable-rate private loans: These can increase without warning. Fixed-rate debt is predictable; variable-rate debt is a ticking time bomb.

Level 3: Private loans with cosigners: Getting cosigners off your loans should be a priority. It protects their credit and your relationship with them.

Level 4: High-rate fixed private loans: Anything above 8% without federal protections.

Level 5: Federal loans: Generally last priority because of repayment flexibility and forgiveness options.

This isn’t always the mathematically optimal strategy, but it’s the psychologically sustainable one. You eliminate uncertainty and relationship stress first, then focus on pure cost optimization.

Spotting the Traps (Before They Catch You)

The shift toward private lending has attracted some sketchy operators alongside the legitimate lenders. I’ve seen students get burned by confusing terms, hidden fees, and outright predatory practices. Here’s how to protect yourself.

Variable Rate Russian Roulette

Variable interest rates can be great when rates are falling. They can be devastating when rates rise. The problem is, most students don’t understand how variable rates actually work.

I reviewed one loan agreement where the rate was tied to something called the “30-day average SOFR plus margin.” Sounds official, right? The borrower had no idea what SOFR was or how volatile it could be. When rates jumped 2% in six months, her payment increased by $180 per month.

Before taking any variable-rate loan, ask these questions:

- What specific index determines rate changes?

- How often can rates change?

- What’s the maximum rate increase per year?

- What’s the lifetime cap on rate increases?

- Can I convert to a fixed rate later?

If the lender can’t answer these questions clearly, walk away.

Cosigner Quicksand

Cosigner arrangements seem straightforward: someone with good credit helps you qualify for better rates. In reality, they’re relationship minefields and credit traps.

The worst cosigner clause I’ve seen: the loan went into automatic default if the cosigner’s credit score dropped below 700 for any reason. The cosigner got divorced, which temporarily dinged their credit. The loan defaulted, even though payments were current. Both the borrower and cosigner’s credit got destroyed.

Other cosigner red flags:

- Vague cosigner release requirements (“after 24 consecutive payments and credit review”)

- Automatic default if cosigner dies or becomes disabled

- Requirements for cosigner to maintain specific credit scores

- No written policy for cosigner release

Get everything in writing. If the lender won’t provide clear, specific cosigner release terms, find another lender.

The Marketing Maze

Student loan marketing has gotten sophisticated and deceptive. Here are the tricks that catch even smart borrowers:

The “as low as” trap: Advertised rates that require perfect credit and high income. In fine print: “Rate shown requires excellent credit, DTI below 20%, autopay enrollment, and qualification for additional discounts.”

The autopay bait: “3.99% with autopay!” But the base rate is 4.49%, and you only get the discount if you give them automatic access to your bank account.

The teaser rate: Low introductory rates that increase after 12 or 24 months. Always ask about rate changes over the life of the loan.

The comparison game: “Our 6% rate beats federal loans at 6.39%!” But they don’t mention origination fees, protections, or repayment flexibility.

Safe Lender Checklist

Before signing anything, verify:

Regulatory status: Licensed in your state, no recent regulatory actions, member of responsible lending organizations.

Transparent pricing: All costs disclosed upfront, no hidden fees, clear explanation of how rates are determined.

Customer service: Real humans available by phone, responsive to questions, positive Better Business Bureau rating.

Financial stability: At least three years in business, clear ownership structure, adequate capital reserves.

Reasonable terms: No prepayment penalties, clear forbearance policies, realistic cosigner release requirements.

If a lender fails any of these tests, keep looking. There are plenty of legitimate options available.

Refinancing in 2025: Timing the Market

If you already have student loans, 2025 might be a good year to refinance—or it might be terrible, depending on your situation and timing.

Interest rate environments change constantly. Federal rates are set once per year and don’t change, but private rates fluctuate with market conditions. Understanding these patterns can save or cost you thousands of dollars.

The Current Rate Environment

Right now, we’re in an interesting position. Federal rates dropped slightly for 2025-26, but they’re still higher than many private options. The Federal Reserve has been making noises about potential rate cuts, but inflation concerns are keeping rates elevated.

Private lenders are competing aggressively for high-quality borrowers. If you have good credit and stable income, you can probably find rates below current federal levels. If your credit is mediocre, private rates might not beat federal loans.

The key insight most people miss: private loan rates change daily. Federal loan rates change once per year. This creates timing opportunities if you’re paying attention.

When Refinancing Makes Sense

Don’t refinance just because you can. Refinance because it improves your overall financial position. Here are the scenarios where refinancing typically makes sense:

Your credit has improved significantly: If your credit score has increased by 50+ points since you borrowed, you might qualify for much better rates.

You have stable, growing income: Refinancing federal loans means giving up income-driven repayment options. Only do this if you’re confident about your earning trajectory.

You’re paying high rates on private loans: If you have existing private loans above 8%, shopping for better rates makes sense regardless of federal loan considerations.

You want to simplify payments: Consolidating multiple loans into one payment can reduce complexity and potentially lower your average rate.

When to Wait

Sometimes the best move is no move. Don’t refinance if:

Rate improvements are minimal: If you can only improve your rate by 0.5% or less, the hassle probably isn’t worth it.

Your job situation is uncertain: If you might face income disruption in the next year, keep the flexibility of federal loan protections.

You work in public service: Federal loan forgiveness programs are worth more than private rate savings for most public sector workers.

You’re close to paying off loans: If you have less than two years remaining, refinancing costs and complications probably outweigh benefits.

The Application Strategy

If you decide to refinance, do it right:

Shop around quickly: Credit inquiries for the same type of loan within a 14-45 day window count as a single inquiry for credit scoring purposes.

Get multiple offers: Apply to 3-5 lenders to compare actual offers, not just advertised rates.

Read the fine print: Pay attention to variable rate terms, cosigner requirements, and forbearance policies.

Keep federal loans separate: Consider refinancing private loans only, keeping federal loans for their protections.

Time your application: Apply when your credit utilization is low and your income is stable or growing.

Don’t let lenders pressure you into quick decisions. Good offers don’t disappear overnight, and you have time to compare options.

Quick Wins for Current Borrowers

You don’t need to refinance or make major changes to improve your student loan situation. Small optimizations can save hundreds or thousands of dollars with minimal effort.

The Phone Call That Saves Money

Most borrowers never call their loan servicer unless there’s a problem. That’s a mistake. A simple phone call can often result in immediate benefits.

Call each of your loan servicers and ask:

- “Are there any rate reduction programs I qualify for?”

- “Can you review my account for autopay discounts I might have missed?”

- “What forbearance or payment reduction options are available if I need them?”

- “Are there any promotional rates or loyalty programs for current borrowers?”

About one in three borrowers gets some kind of benefit from these calls. Common results include autopay discounts (typically 0.25%), loyalty rate reductions (0.1% to 0.5%), or information about programs they didn’t know existed.

Document everything. If they promise a rate reduction or discount, get it in writing via email.

Autopay Optimization

Autopay discounts are free money, but most people set them up wrong. The key is creating a dedicated account for loan payments that prevents overdrafts while capturing the discount.

Here’s the setup:

- Open a separate checking account for loan payments only

- Calculate your total monthly loan payments

- Set up automatic transfers to this account two days before your payment dates

- Keep a $50 buffer to prevent overdrafts

- Enable autopay from this dedicated account

This system captures autopay discounts (usually 0.25% per loan) while protecting your main checking account from overdraft fees that could cost more than the discount saves.

Tax Optimization

Student loan interest is tax-deductible up to $2,500 per year, but many borrowers miss opportunities to maximize this benefit.

Basic optimization: Make sure you’re claiming the full deduction if you paid more than $600 in student loan interest during the tax year.

Advanced timing: If you’re close to the $2,500 limit, consider timing additional payments. Making a large payment in December vs. January can shift the deduction to the current tax year.

Income planning: The student loan interest deduction phases out at higher income levels ($70,000 for single filers, $140,000 for married filing jointly). If you’re close to these thresholds, timing income and payments becomes more complex.

Credit Score Acceleration

Better credit scores unlock better refinancing opportunities. Here are quick moves that typically boost scores within 30-60 days:

Pay down credit card balances: Get all cards below 30% of their limits, ideally below 10%.

Request credit limit increases: Don’t use the extra credit, just let it improve your utilization ratio.

Become an authorized user: Ask family members with long credit histories and good payment records to add you as an authorized user.

Check for errors: Get free credit reports from annualcreditreport.com and dispute any errors immediately.

These moves typically boost scores by 20-50 points, which can qualify you for better refinancing rates or private loan terms.

Emergency Fund Building

The biggest mistake borrowers make is aggressively paying down low-rate student loans while having no emergency fund. A $1,000 car repair shouldn’t force you to use credit cards or skip loan payments.

Build a small emergency fund before making extra loan payments. Even $500-$1,000 prevents most financial emergencies from becoming debt disasters.

The easiest way to build this fund: set aside your tax refund. Most students get refunds of $300-$1,500. Instead of spending it, park it in a high-yield savings account and forget about it until you need it.

Looking Forward: Your Student Loan Strategy

The student loan landscape will keep changing. New policies, rate fluctuations, and economic conditions will create new opportunities and challenges. The key is building a strategy that adapts to these changes while protecting your long-term financial health.

For New Borrowers

If you’re just starting your education financing journey, you’re actually in a good position. You can learn from the mistakes of previous borrowers and take advantage of current market conditions.

Start with federal aid: Despite the new restrictions, federal loans still offer the best protections for most students. Apply early and understand exactly how much federal aid you qualify for.

Shop private options carefully: If you need private loans, compare at least three lenders. Don’t just look at interest rates—consider fees, repayment options, and cosigner policies.

Borrow strategically: Only borrow what you need, and consider working part-time or summers to reduce borrowing. Every dollar you don’t borrow saves you $1.50-$2.00 over the life of the loan.

Plan for repayment before graduation: Understand what your monthly payments will be and whether they’re realistic given your expected starting salary.

For Current Borrowers

If you already have student loans, focus on optimization rather than perfection. Small improvements compound over time and can save substantial money.

Review your loans annually: Interest rates, repayment options, and your financial situation change. Set a calendar reminder to review everything each year.

Take advantage of rate improvements: If your credit has improved or market rates have dropped, explore refinancing opportunities.

Don’t ignore federal loan benefits: Income-driven repayment and forgiveness programs can be worth more than private loan rate savings.

Build financial flexibility: Emergency funds and stable income matter more than aggressive debt payoff when you’re starting your career.

For Everyone

Regardless of where you are in your student loan journey, focus on these fundamentals:

Understand what you owe: Know your exact balances, rates, and payment terms for every loan.

Maintain good credit: Your credit score affects everything from loan rates to job opportunities.

Keep learning: Student loan rules change frequently. Stay informed about policy changes that might affect you.

Don’t panic: Student loans feel overwhelming, but they’re manageable with good information and consistent effort.

The 2025 student loan changes have made financing education more complex, but they haven’t made it impossible. By understanding the new rules, avoiding common traps, and implementing smart strategies, you can achieve your education goals without destroying your financial future.

Remember: the perfect loan doesn’t exist, but the right loan for your situation does. Take the time to understand your options, and don’t let anyone pressure you into quick decisions. Your future self will thank you for the extra effort you put in today.

Ready to take control of your student loans? Get personalized rate comparisons, payment calculators, and ongoing strategy updates delivered straight to your inbox. Because the rules keep changing, but your need for clear, actionable information doesn’t.