How to build wealth in your 20s: Smart money moves most people ignore

Look, I’m gonna be straight with you. When I was 20, I thought “building wealth” meant having enough money left over after rent to buy name-brand cereal instead of the store brand. Fast forward five years, and I’ve learned that most of us are getting terrible financial advice.

Everyone’s telling you to “just save more” or “cut out the coffee.” But honestly? That’s not going to make you wealthy. It might help you scrape together an extra ₹2,000 a month, but it won’t change your life.

What will change your life is understanding how money actually works when you’re young. And I mean really understanding it—not just nodding along to some finance bro on YouTube who’s probably trying to sell you a course.

So here’s what I wish someone had told me when I was drowning in student loans and living paycheck to paycheck , even though I was making decent money.

Why Everyone Gets This Wrong (Including Your Parents)

Your parents’ financial advice worked great… in 1985 or at there time when the time and the situation of the world is different. Back then, you could work at the same company for 30 years, get a pension, and buy a house for three times your annual salary.

Today? We’re job-hopping every two to three years, dealing with inflation that makes groceries cost more than rent used to, and housing prices that would make our grandparents cry. The old playbook doesn’t work anymore. We have to change according to the time we live or era.

But here’s the thing nobody talks about: being in your 20s right now is actually a massive advantage. Yeah, I know—hard to believe when you’re splitting rent with three roommates and your biggest financial decision is whether to pay the minimum on your credit card or eat something other than street food this week.

Time is literally your secret weapon. Every dollar or rupees you invest now has 40+ years to grow. Your 35-year-old self will have maybe 30 years. That head start is worth more than you think—we’re talking hundreds of thousands of dollars more, just from starting earlier.

Plus, you’re already living like you’re broke (because you probably are). This is the perfect time to figure out how to live below your means without it feeling like punishment.

The Budget That Won’t Make You Want to Throw Your Phone

I’ve tried every budgeting app, spreadsheet, and system out there. Most of them are designed by people who’ve never had to decide between gas money and groceries.

Here’s what actually works when your income changes every month and you have approximately zero predictability in your life:

The “Pay Yourself First” Approach

Forget tracking every coffee purchase. Instead, do this:

- The minute you get paid, automatically move money to three places:

- Emergency fund: ₹1,500-3,000 ($25-50)

- Investment account: ₹1,000-2,500 ($20-40)

- “Fun money” account: ₹2,000-4,000 ($30-75)

- Whatever’s left is for rent, groceries, and keeping yourself alive.

This sounds backwards, right? But here’s why it works: you’re prioritizing your future while still giving yourself permission to enjoy your money. No guilt, no tracking every rupee, no feeling like you’re failing every time you order takeout.

The Irregular Income Hack

If your money comes in waves (hello, freelancers and gig workers), base everything on your worst month, not your best. Made ₹80,000 last month but only ₹25,000 the month before? Budget like you make ₹25,000. take a balanced amount from three to six months then mark the amount as constant amount like ₹25,000 a month its easy to manage the monthly earnings and expenditures.

Everything above that? That’s your wealth-building accelerator.

How I Started Investing With ₹500 (And Why You Can Too)

Two years ago, I thought you needed ₹50,000 sitting around to start investing. Turns out, that’s complete nonsense.

I started with ₹500. Not because I read some inspiring story about compound interest (though those are nice), but because I was tired of watching my savings account “grow” by ₹12 a month while everything around me got more expensive.

tip: start investing as soon as possible even a small amount for future.

Index Funds: The “Set It and Forget It” Approach

Here’s what I wish someone had explained to me in simple terms:

Index funds are like buying a tiny piece of hundreds of companies at once. When the stock market goes up, you make money. When it goes down, you lose money temporarily—but historically, it always goes back up.

In India, start with:

- Nifty 50 index funds (tracks the top 50 companies)

- UTI Nifty Index Fund or SBI Nifty Index Fund

- You can literally start with ₹500 through apps like Groww or Zerodha

In the US:

- S&P 500 index funds (tracks 500 big companies)

- Start with Vanguard’s VOO or Fidelity’s FZROX

- Most brokers let you start with $1

The Numbers That Changed My Mind

Let me show you something that made me finally start taking this seriously.

If you invest ₹2,000 every month starting at 25:

- At 35: You’ll have about ₹4 lakh (assuming 10% returns)

- At 45: About ₹14 lakh

- At 65: About ₹1.4 crore

If you wait until 35 to start:

- At 65: You’ll have about ₹41 lakh

Waiting 10 years costs you nearly ₹1 crore. That’s the price of procrastination.

But here’s what really got me: even if you can only do ₹1,000 a month, you’ll still end up with about ₹70 lakh by 65. That’s way better than the ₹0 you’ll have if you never start.

Where to Put Your Emergency Fund (Hint: Not Your Regular Savings Account)

Your emergency fund is probably earning you about 3% interest in your regular savings account. Meanwhile, inflation is running at 6-7%. You’re literally losing money.

Better options:

- High-yield savings accounts: 6-8% in India, 4-5% in the US

- Short-term fixed deposits

- Liquid mutual funds (slightly riskier but higher returns)

How much to save: Start with ₹25,000 ($500). I know that sounds like a lot, but break it down: ₹2,000 a month for a year. That’s less than what most people spend on food delivery.

Once you hit that, aim for 3-6 months of expenses. If you’re freelancing or your income is unpredictable, go for 6 months.

The Debt Trap (And How to Escape It)

Let’s talk about the elephant in the room: debt. Credit cards, student loans, that money you borrowed from your parents—it’s all keeping you from building wealth.

But not all debt is evil. Here’s how to think about it:

Bad debt (pay this off ASAP):

- Credit cards (18-24% interest)

- Personal loans (12-16% interest)

- Anything above 10% interest rate

Okay debt (pay minimums, invest the rest):

- Student loans under 8%

- Home loans under 9%

- Any debt under 6-7%

My strategy: I paid minimums on my 6% student loan while investing extra money in index funds. Over 10 years, this probably saved me ₹2-3 lakh compared to paying off the loan early.

Side Hustles: Your Wealth-Building Rocket Fuel

Your 9-to-5 pays the bills. Your side hustle builds wealth.

I started freelance writing while working full-time. First month, I made ₹3,000. Second month, ₹8,000. By month six, I was making an extra ₹25,000 monthly.

Here’s the key: Don’t just spend that extra money. Have a plan for it.

My rule: 50% goes to investments, 30% goes to enjoying life, 20% goes back into growing the side hustle.

Popular side hustles that actually work:

- Freelance writing, design, or coding

- Online tutoring

- Delivery driving (when you have free time)

- Selling stuff online

- Digital marketing for small businesses

Pro tip: Keep detailed records. You can deduct business expenses from taxes, which saves you money.

Money Mistakes That Keep You Broke

I’ve made most of these mistakes. Learn from my stupidity:

Lifestyle Inflation

Got a raise? Great! Don’t immediately upgrade your apartment, car, and wardrobe. Upgrade your investments first. Take 50% of any raise and invest it immediately. Enjoy the other 50%.

Subscription Creep

I once discovered I was paying for three different music streaming services. Check your bank statements monthly and cancel anything you haven’t used recently.

Emotional Spending

Bad day at work? Don’t buy things to feel better. Go for a walk, call a friend, or work out. Shopping therapy is expensive therapy.

FOMO Investing

Your friend made ₹50,000 on some random cryptocurrency? Good for them. That’s gambling, not investing. Stick to boring index funds for 90% of your money.

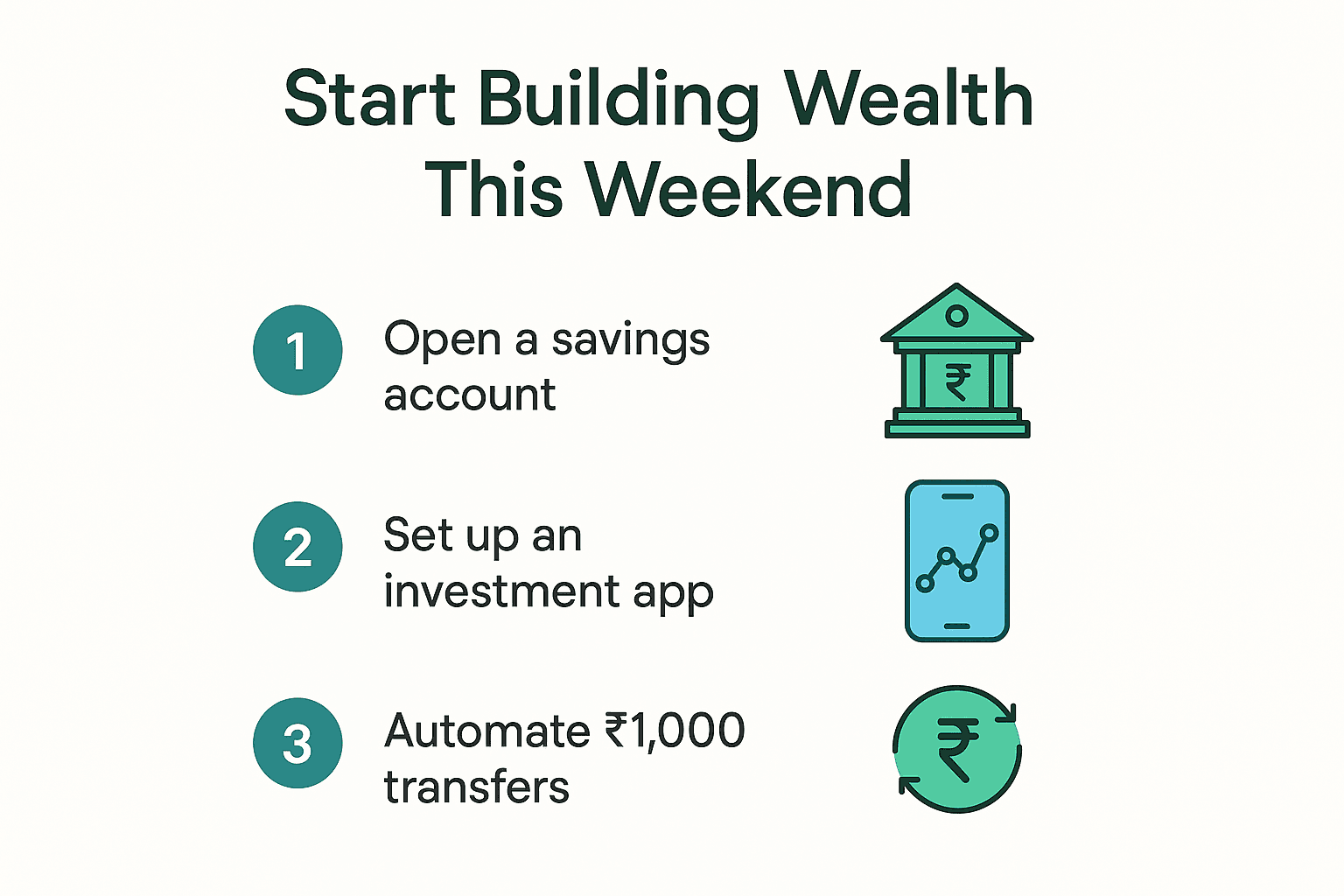

The Action Plan (Start This Weekend)

Ready to stop talking and start doing? Here’s your homework:

This Weekend:

- Open a high-yield savings account

- Download an investment app (Groww, Zerodha, Vanguard, etc.)

- Set up automatic transfers for ₹1,000 to savings, ₹500 to investments

Next Week:

- List all your debts with interest rates

- Cancel subscriptions you don’t use

- Research one side hustle idea

Next Month:

- Increase your investment by ₹500

- Track your net worth (assets minus debts)

- Set a specific financial goal for next year

The Reality Check

Look, I’m not going to promise you’ll be rich by 30. Building wealth takes time, and there will be setbacks. The market will crash, you’ll have unexpected expenses, and sometimes you’ll want to give up.

But here’s what I can promise: every rupee you invest in your 20s is worth more than any rupee you’ll invest later. Every month you wait is money you’re leaving on the table.

You don’t need to be perfect. You don’t need to have all the answers. You just need to start.

Your 40-year-old self is counting on the decisions you make today. Don’t let them down.

What’s your biggest money challenge right now? Seriously, I want to know. Drop a comment below—maybe we can figure it out together.

And if this helped you, share it with a friend who needs to see it. We’re all figuring this out as we go.

About the Author: I’m just someone who learned about money the hard way and wants to help others avoid the same mistakes. I’m not a financial advisor—just someone sharing what worked for me.

Disclaimer: This is educational content, not financial advice. Your situation is unique, so consider talking to a professional if you need personalized guidance.