Best Index Funds for Beginners (2025): Your Simple Path to Building Wealth

Why I Wish Someone Had Told Me About Index Funds Sooner

Look, I’ll be straight with you—my first attempt at investing was a disaster.

I spent hours reading stock tips online, trying to figure out which companies were going to be “the next big thing.” I’d wake up at odd hours checking stock prices, stressing over every 2% drop, and honestly? I had no clue what I was doing.

Then a friend mentioned index funds over coffee one afternoon, and I remember thinking, “That sounds way too simple.” But here’s the thing: sometimes the simplest approach actually works best.

These days, I sleep better knowing my money’s invested in funds that track the entire market instead of betting everything on my ability to pick winners. And you know what? My returns have been better too.

If you’re sitting there wondering whether you should start investing, or maybe you’ve got some money saved up and don’t know where to put it—stick with me. I’m going to walk you through everything I wish someone had explained to me five years ago about the best index funds for beginners.

No fancy jargon. No complicated formulas. Just real talk about how regular people like us can actually build wealth.

So What’s an Index Fund Anyway? (Explained Like You’re Having Coffee with a Friend)

Imagine you’re at a farmers market, and instead of picking individual fruits one by one, someone hands you a pre-made basket with a little bit of everything—apples, oranges, berries, the works.

That’s basically what an index fund does with stocks.

When you buy into something like an S&P 500 index fund, you’re not trying to guess which single company will do great. You’re buying tiny pieces of 500 different companies all at once. We’re talking Apple, Microsoft, Amazon, Coca-Cola, Johnson & Johnson—basically America’s biggest and most successful businesses, all bundled together.

The beauty here? You don’t need to be a Wall Street genius to make this work.

If tech stocks boom, you benefit. If healthcare companies surge, you benefit. Heck, even if one company completely tanks (remember Enron?), it barely touches your overall investment because you own so many others.

Now here’s where it gets even better—these funds are dirt cheap to own. While some fancy hedge funds might take 1% or 2% of your money every year just for “management fees,” most index funds charge less than 0.05%. That’s basically nothing.

To put real numbers on it: let’s say you invest $10,000. With a typical index fund charging 0.03% annually, you’d pay about $3 per year. Compare that to an actively managed fund charging 1%, where you’d fork over $100 annually for the privilege of… usually getting worse returns anyway.

Those fees might seem small, but over 20 or 30 years? They compound into massive differences in how much wealth you actually keep.

More: Index Funds vs. ETFs

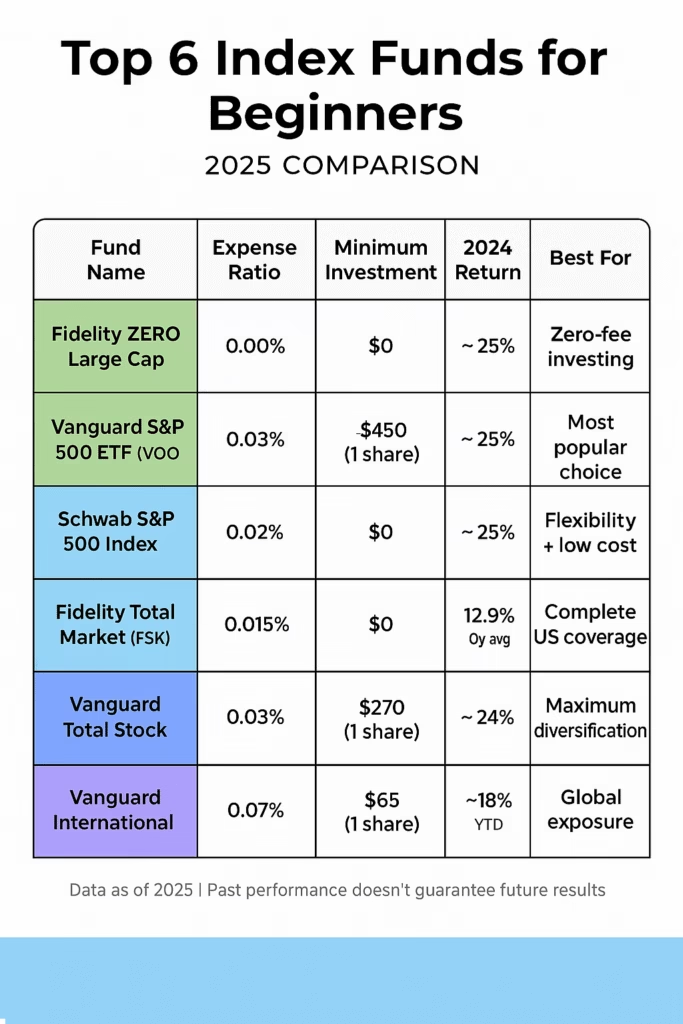

My Top Picks: The Best Index Funds for Beginners in 2025

I’ve spent way too much time researching funds (seriously, my partner thinks I have a problem), but I’ve narrowed it down to six solid options. These are funds I either own myself or would feel completely comfortable recommending to my own family.

1. Fidelity ZERO Large Cap Index Fund (FNILX)

What it costs: Literally nothing—0.00% in fees

Minimum to start: $0

How it did last year: Roughly 25% (tracking the S&P 500’s 2024 performance)

Why I like it: This is probably the easiest entry point for anyone just starting out. Fidelity basically said, “You know what? We’re not even going to charge fees on this one.” It tracks large American companies, gives you instant diversification across the biggest names in business, and you can start with whatever amount you have—even if it’s just $20.

Last year was actually a fantastic year for this fund, mirroring the broader market’s strong performance. But here’s the thing—some years it’ll do better, some years worse. That’s investing.

Best for: Anyone who’s never invested before and wants to just get started without overthinking it.

2. Vanguard S&P 500 ETF (VOO)

What it costs: 0.03% annually

Minimum to start: The price of one share (usually between $400-500)

How it did last year: Around 25%

Why I like it: Vanguard pretty much invented the index fund concept back in the 1970s, and VOO is one of their most popular products—with over $1.4 trillion in assets from investors worldwide.

It tracks the S&P 500 perfectly, which means you’re getting exposure to companies like Apple (currently the world’s largest company by market cap), Microsoft, NVIDIA, and 497 others. According to Vanguard’s official data, this fund has consistently delivered strong long-term returns with minimal costs.

Over the past decade, VOO has averaged annual returns somewhere in the 14-15% range. That’s nothing to sneeze at.

Best for: People who prefer ETFs (exchange-traded funds) over mutual funds, or anyone who wants the gold standard of S&P 500 investing.

3. Schwab S&P 500 Index Fund (SWPPX)

What it costs: 0.02% per year

Minimum to start: Zero dollars

How it did last year: Approximately 25%

Why I like it: Schwab has always been great about keeping costs low and making investing accessible. This fund has been around since 1997, so it’s proven itself through multiple market crashes and recoveries.

The 0.02% expense ratio is slightly lower than even Vanguard’s, and with no minimum investment, you could literally start with $10 if that’s all you’ve got right now. Every dollar counts when you’re building wealth from scratch.

Best for: Beginners who want rock-solid reliability, ultra-low costs, and the flexibility to invest whatever amount they can afford.

4. Fidelity Total Market Index Fund (FSKAX)

What it costs: 0.015% annually

Minimum to start: $0

Long-term track record: About 12.90% average annual returns over 10 years

Why I like it: While the other S&P 500 funds focus mainly on large companies, FSKAX gives you exposure to nearly 3,000 stocks—including mid-sized and smaller companies that might be tomorrow’s giants.

Think of it this way: the S&P 500 would’ve captured Apple when it was already huge. A total market fund would’ve caught Apple earlier in its growth journey, plus hundreds of other companies you’ve never heard of that might blow up in the next decade.

Some of the best-performing stocks over the past 20 years were small-cap companies that eventually grew into household names. With a total market approach, you don’t miss out on that potential.

Best for: Investors who want maximum diversification across every size of American company, from giants to up-and-comers.

5. Vanguard Total Stock Market ETF (VTI)

What it costs: 0.03% per year

Minimum to start: One share (typically $250-300)

Coverage: Approximately 3,700 stocks across all market sizes

Why I like it: This is essentially the ETF version of a total market fund. If you like the idea behind FSKAX but prefer how ETFs trade and their slightly better tax efficiency, VTI is your answer.

Last year it delivered returns similar to the broader market’s impressive gains. What I really appreciate about VTI is that it’s so comprehensive—you’re basically saying, “I want to own a piece of every publicly traded company in America worth owning.”

Best for: Beginners who want complete U.S. stock market exposure in a single, tax-efficient investment that’s easy to buy and sell.

6. Vanguard Total International Stock Index Fund (VXUS)

What it costs: 0.07% annually

Minimum to start: One share (around $60-70)

What it covers: Thousands of companies in developed and emerging markets globally

Recent performance: Up over 18% year-to-date in 2025

Why I like it: Here’s a mistake I see all the time—people invest exclusively in U.S. stocks and completely ignore the rest of the world.

VXUS gives you exposure to European luxury brands, Japanese automakers, Chinese tech companies, Indian financial firms—basically, growing businesses everywhere except the United States. While U.S. stocks dominated the 2010s, international markets have shown renewed strength lately and offer important diversification benefits.

Markets move in cycles. Sometimes U.S. stocks lead, sometimes international stocks outperform. By owning both, you’re not putting all your eggs in one geographical basket.

Best for: Investors who understand that roughly half the world’s stock market value exists outside America and want exposure to global growth opportunities.

Real Numbers: How Much Money Do You Actually Need?

This is probably the question I get asked most often: “I don’t have much saved up—is it even worth starting?”

Short answer: Yes. Absolutely yes.

Thanks to zero-minimum funds and something called fractional shares, you can literally start investing with a single dollar. But let me show you some real numbers that might surprise you.

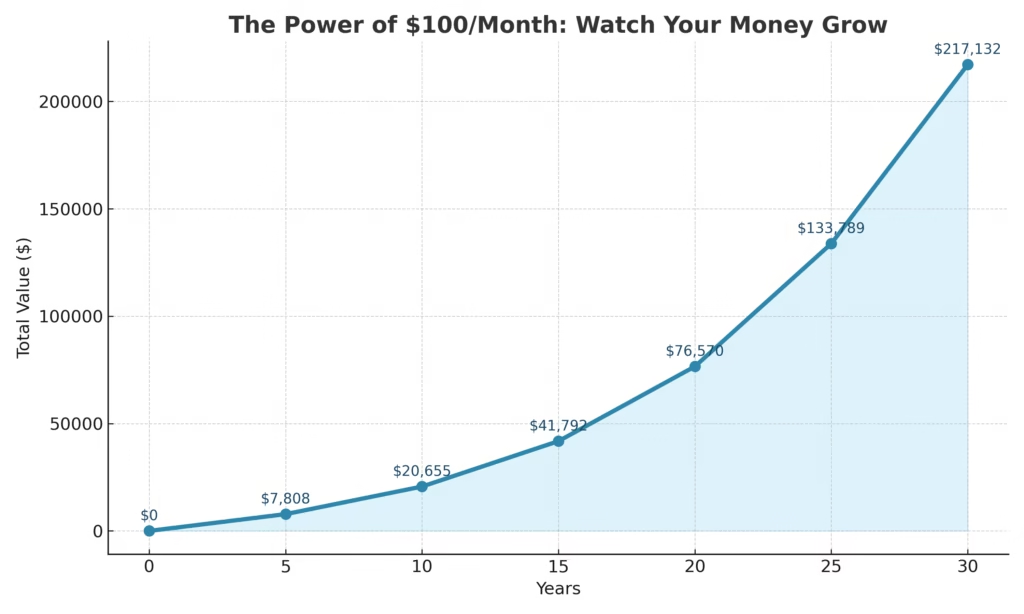

Meet Sarah: A Real Example That Changed How I Think About “Small” Investments

Sarah teaches middle school, and when she started investing at 25, she didn’t have much left over after rent, student loans, and normal life expenses. But she committed to putting away $100 every single month into a basic S&P 500 index fund.

That’s it. No fancy strategy. No market timing. Just $100 a month, consistently, through good times and bad.

Assuming the historical average return of about 10% annually (which is what the S&P 500 has delivered over the long haul), here’s where that puts her:

- After 5 years: $7,808 (not bad!)

- After 10 years: $20,655 (getting interesting…)

- After 20 years: $76,570 (okay, now we’re talking)

- After 30 years: $217,132 (wait, what?!)

Think about that for a second. A hundred bucks a month—the cost of a few dinners out—turns into over $200,000 given enough time.

That’s not magic. That’s just compound interest doing what Einstein supposedly called “the eighth wonder of the world.”

The point isn’t that you need to invest exactly $100. Maybe you can only do $50. Maybe you can do $200. The exact amount matters less than starting now and being consistent.

The Mistakes I Made (So You Don’t Have To)

Over the years, I’ve watched friends, family, and honestly myself make some pretty avoidable mistakes. Let me save you the headache and money by sharing what NOT to do.

Mistake #1: Waiting for the “Right Time” to Invest

I can’t tell you how many people I know who’ve been “about to start investing” for literal years.

They’re waiting for the market to drop. Or for inflation to stabilize. Or until they understand more about economics. Or until [insert excuse here].

Meanwhile, they’re missing out on years of compound growth.

Here’s what the research shows (and yes, actual research has been done on this): if you miss just the 10 best trading days over a 20-year period, your returns drop dramatically. The problem? Nobody—and I mean nobody—can predict which days those will be.

I learned this the hard way. Back in 2020 when COVID hit and markets tanked, I thought, “I’ll wait for them to drop more before buying.” Guess what happened? The market recovered faster than anyone expected, and I missed the entire run-up.

What to do instead: Just start. Use something called dollar-cost averaging—fancy term for “invest a fixed amount regularly, regardless of market conditions.” Some months you’ll buy when prices are higher, some months when they’re lower, but over time it all averages out.

Mistake #2: Ignoring Fees (They’re Wealth Killers)

When I first started, I honestly didn’t pay much attention to expense ratios. A 1% fee versus a 0.03% fee—what’s the big deal?

Turns out, it’s a massive deal.

According to research from financial education sites like Investopedia, fees are one of the most predictable factors affecting your returns. You can’t control whether the market goes up or down, but you absolutely can control what you pay.

Let me show you the math: $10,000 invested at 10% annual returns over 30 years…

- With a 0.03% fee: You end up with about $174,000

- With a 1% fee: You end up with about $132,000

That’s $42,000 left on the table. For what? Usually worse performance than the index funds anyway.

What to do instead: Stick with funds charging less than 0.10%. Every basis point matters over decades. The funds I’ve listed above all qualify as ultra-low-cost options.

Mistake #3: Checking Your Account Every Day (Recipe for Panic)

When I first started investing, I checked my account constantly. Multiple times a day. I’d wake up, check the market. Lunch break, check the market. Before bed, check the market.

You know what happened? Every red day sent me into a mini panic. My brain would scream, “You’re losing money! Do something!”

That “do something” urge is how people destroy their long-term wealth. They sell when things look scary, which locks in losses permanently.

Index fund investing isn’t a daily activity. Heck, it’s barely a monthly activity. The real magic happens over years and decades.

What to do instead: Check your portfolio quarterly at most. Set up automatic investments and then go live your actual life. Your index funds don’t need babysitting—they’re doing fine without your constant attention.

Mistake #4: Going All-In on U.S. Stocks Only

America has had an incredible run over the past decade, no question. But putting 100% of your money exclusively in U.S. stocks means you’re making a huge bet on one country’s economy.

What if Europe’s economy starts outperforming? What if Asian markets boom? What if emerging markets in places like India or Brazil take off?

If you only own U.S. stocks, you miss all of that.

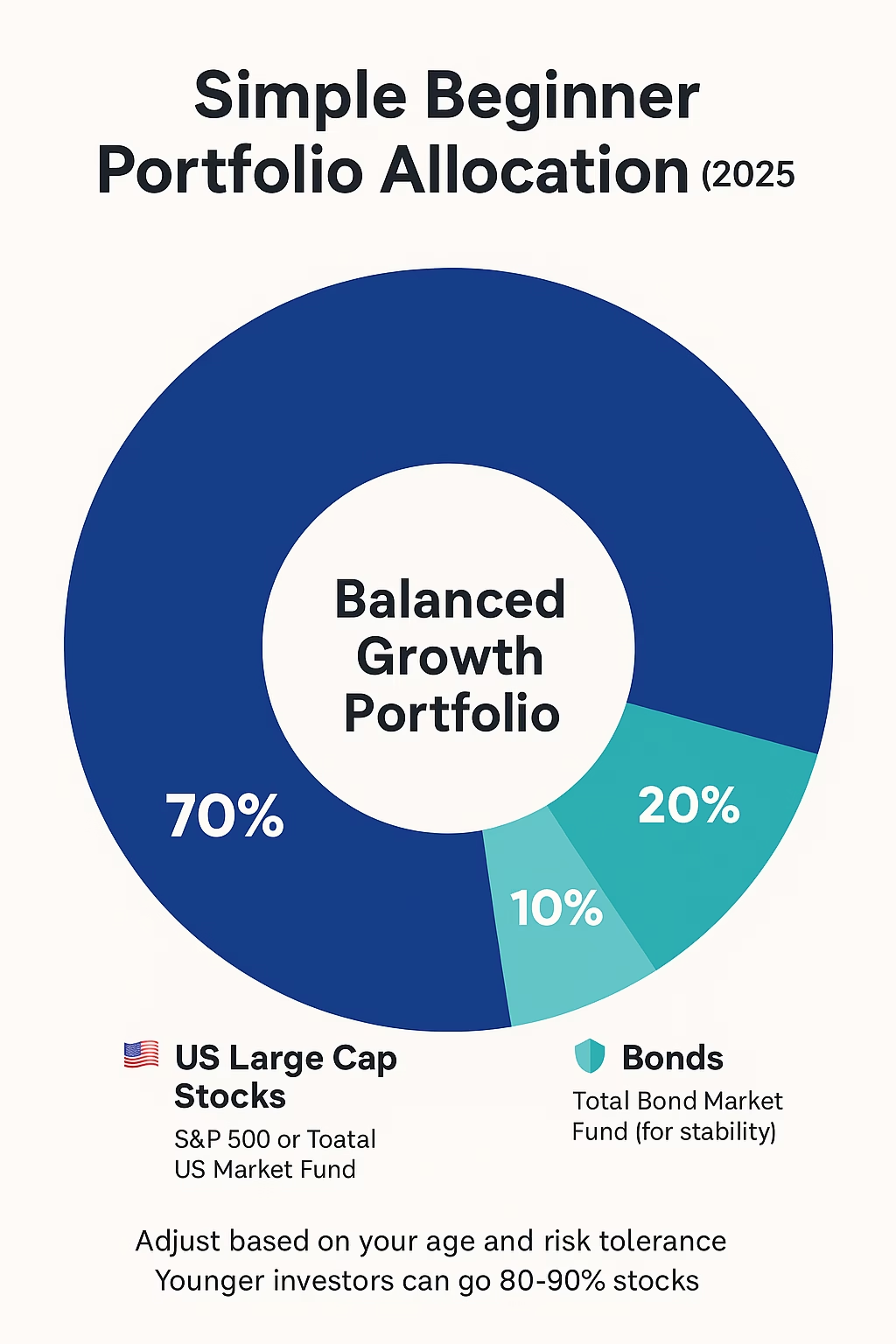

What to do instead: Consider a simple split like 70% U.S. stocks, 20% international stocks, and 10% bonds. This gives you global exposure while keeping things straightforward. You can adjust based on your age and risk tolerance, but having some international exposure just makes sense.

Mistake #5: Panic-Selling During Downturns (The Biggest Wealth Destroyer)

This is the mistake that costs people the most money—by far.

The market drops 15%. Fear kicks in. Headlines scream about recession. Your neighbor says he sold everything. So you panic and sell too, “cutting your losses.”

Except you didn’t cut your losses—you locked them in permanently. And then you miss the recovery, which often happens faster than the drop.

Every market crash in history has eventually recovered. Every. Single. One.

The 2008 financial crisis? Recovered. The 2020 COVID crash? Recovered in months. The dot-com bubble? Recovered.

According to Morningstar’s research on investor behavior, the biggest predictor of investment success isn’t intelligence or education—it’s simply staying invested through volatility.

What to do instead: When markets drop, remind yourself that you’re now buying shares “on sale.” Some of the best wealth-building opportunities come during the scariest times. I know it’s hard, but this is where fortunes are built.

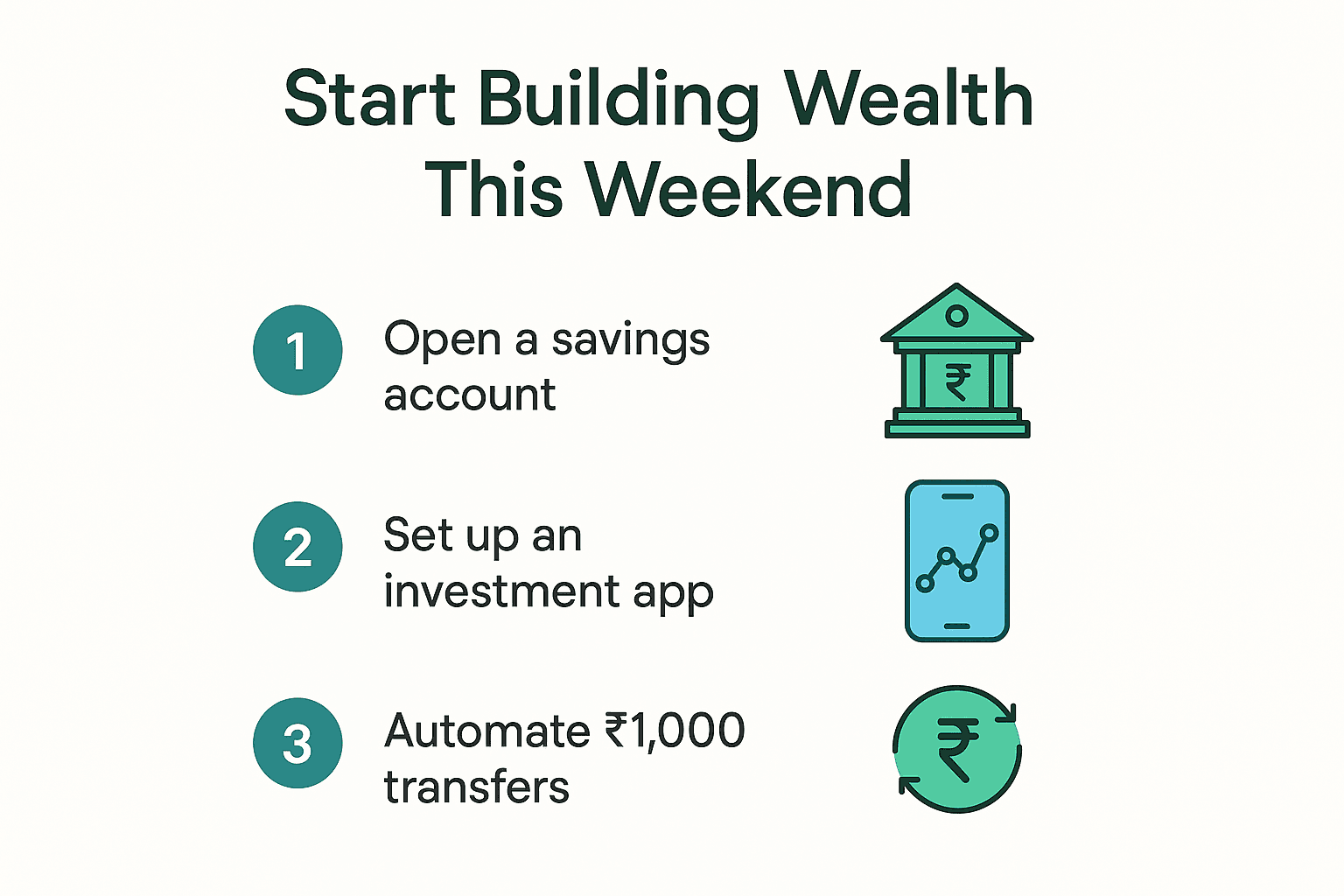

Your Dead-Simple Action Plan: 3 Steps to Start Today

Alright, enough theory. Let’s get practical. Here’s exactly what to do if you’re ready to start investing in index funds.

Step 1: Open a Brokerage Account (Takes About 15 Minutes)

You need somewhere to actually buy these funds, which means opening a brokerage account. I’d recommend one of these three:

- Fidelity – Great interface, excellent customer service, zero account minimums

- Vanguard – The OG of index investing, rock-solid reputation

- Schwab – User-friendly, great mobile app, no account minimums

All three offer commission-free trading, which means you won’t pay extra fees when buying or selling. The sign-up process is straightforward—you’ll need your Social Security number, bank account details, and basic personal info.

It’s less complicated than opening a new email account, honestly.

Step 2: Pick Your First Fund (Don’t Overthink This)

For your very first investment, I’d suggest starting with one of these depending on which broker you chose:

- At Fidelity? → Start with FNILX (the ZERO fund)

- At Vanguard? → Go with VOO (the S&P 500 ETF)

- At Schwab? → Choose SWPPX (their S&P 500 index fund)

Seriously, you cannot go wrong with any of these. They all accomplish the same basic goal: giving you broad exposure to America’s biggest companies at minimal cost.

Don’t stress about picking the “perfect” fund. The difference between these options is minimal, and getting started matters way more than optimizing every tiny detail.

Step 3: Set Up Automatic Investments (The Real Secret Weapon)

This is where most people miss out. They invest once, then forget about it, or they try to time when to invest next.

Instead, do this: Set up recurring automatic investments. Whether it’s $25, $100, or $500 per paycheck, make it automatic.

Why does this matter so much? Because it removes emotions and decision-making from the process. You’ll invest consistently through market highs and lows, through good news and bad news, through your anxious days and confident days.

It just happens, like paying your rent or your phone bill.

This is honestly the closest thing to a “set it and forget it” wealth-building strategy that actually works.

Bonus move: Once you’re comfortable (maybe after 6-12 months), consider adding international exposure with VXUS and maybe some bonds with something like BND (Vanguard Total Bond Market) to round things out. But don’t stress about that yet—getting started with one solid fund is the important part.

Why Index Funds Still Work When Everything Feels Uncertain

I know what you might be thinking: “But what about all the scary stuff in the news? Trade wars, inflation, political chaos, tech bubbles—should I really be investing right now?”

Fair question. Opening Twitter or reading the news in 2025 can feel overwhelming. There’s always something to worry about.

But here’s what I’ve learned: there’s ALWAYS something to worry about. Always.

In 2008, it was the financial crisis. In 2020, it was COVID. In 2022, it was inflation and recession fears. In 2025, it’s tariffs and geopolitical tensions. The specific worries change, but there are always worries.

Index funds work through all of this because you’re not betting on any single outcome. You’re investing in a fundamental principle: that over time, human beings innovate, businesses grow, and the economy expands.

Yes, your account balance will bounce around. Earlier this year, markets got nervous about new tariff policies and some funds dipped. By mid-year, the S&P 500 was up over 13% anyway, once again proving that short-term noise doesn’t dictate long-term outcomes.

Think about it this way: if you’d invested $10,000 in an S&P 500 index fund 30 years ago—right before the dot-com crash, the 2008 financial crisis, the 2020 pandemic, and every other scary event—you’d have over $180,000 today.

That’s not luck or timing. That’s just staying invested while the world kept spinning.

Your Most Common Questions, Answered Honestly

Are index funds good for beginners?

Honestly? They’re probably the best investment for beginners. You don’t need to analyze individual companies, follow earnings reports, or time the market. You just own a piece of everything and let it grow. Even Warren Buffett—literally one of the best investors ever—recommends index funds for most people. That should tell you something.

How much should I invest in index funds?

Start with whatever you can genuinely afford without stressing your budget. Even $25 or $50 a month adds up over time. A common rule of thumb is investing 10-20% of your income, but the most important thing is consistency, not the initial amount. Better to invest $50 monthly for years than to invest $500 once and never again.

Should I choose ETFs or mutual funds?

For beginners, this honestly doesn’t matter as much as people make it sound. ETFs trade like stocks and are slightly more tax-efficient. Mutual funds let you invest exact dollar amounts automatically. Pick whichever is easier through your broker and don’t overthink it. The actual fund performance is virtually identical.

Can I lose money with index funds?

In the short term? Yes, absolutely—your balance will go up and down with the market. But here’s the thing: historically, holding index funds for 10+ years has never resulted in losses. Never. The key is having a long-term perspective and not panicking when you see red numbers. Time is your friend here.

What’s the difference between the S&P 500 and a total market fund?

The S&P 500 includes the 500 largest U.S. companies—basically the heavy hitters everyone’s heard of. A total market fund includes those same 500 plus thousands of mid-sized and smaller companies. Both are excellent choices for beginners. Total market funds give you slightly more diversification, but the performance is usually pretty similar.

What happens to my index fund if the market crashes?

Your fund’s value will drop right along with the market—there’s no way around that. But every single market crash in history has eventually recovered and gone on to reach new highs. The 2008 crash saw drops of 50%, but investors who stayed put recovered fully by 2013 and made huge gains afterward. The absolute worst thing you can do is sell during a crash and lock in those losses forever. Crashes are actually buying opportunities if you can keep your cool.

Can I invest in index funds through my 401(k)?

Yep! Most 401(k) plans offer index fund options, though they might be labeled differently depending on your plan provider. Look for funds with “S&P 500,” “Total Stock Market,” or “Index” in the name, and check that the expense ratios are low (under 0.20% is good). If your employer offers matching contributions, definitely max that out first—it’s literally free money—then consider opening a separate IRA for even more fund choices and flexibility.

Index funds vs. target-date funds: which is better for beginners?

Both are solid choices, just with different approaches. Target-date funds automatically adjust your asset allocation as you get older, becoming more conservative over time. They’re perfect if you want completely hands-off investing. Index funds give you more control and typically have lower fees, but you’ll need to occasionally rebalance your portfolio yourself. If you want autopilot and are investing for retirement 30+ years away, target-date funds are great. If you want to learn more about investing and save on fees, stick with simple index funds like the ones I’ve covered.

Your Next Move: Time to Actually Start

Look, I can share strategies and data all day, but none of it matters unless you actually take action.

Building wealth through index funds genuinely isn’t complicated—but it does require two things: patience and consistency.

You don’t need to be a finance whiz. You don’t need thousands of dollars sitting in your bank account. You don’t even need to understand complex economic theories or follow the news obsessively.

What you do need:

- A brokerage account (15 minutes to set up)

- One solid, low-cost index fund (pick any from my list)

- Automatic monthly investments (even $50 counts)

- The discipline to stay invested when markets get bumpy

That’s it. That’s the formula.

The best index funds for beginners in 2025 are the same ones that worked in 2015, 2010, and will probably work in 2035: low-cost, broadly diversified funds from companies like Vanguard, Fidelity, and Schwab that have proven track records.

The hardest part—honestly, the only hard part—is starting. But once you make that first investment, even if it’s just $20, you’ve officially begun building wealth for your future.

Five years from now, you’ll look back and be so glad you started today instead of waiting for the “perfect moment” that never comes.

So here’s my challenge to you: finish reading this, then immediately open a brokerage account. Don’t wait until tomorrow. Don’t wait until you “learn more.” Don’t wait until you have more money saved up.

Start small, start now, and let time do the heavy lifting.

Your future self—the one who’s financially secure and doesn’t stress about money—will thank you for making this decision today.

Disclaimer: This article is for educational purposes only and shouldn’t be considered personalized financial advice. I’m sharing what’s worked for me and others, but everyone’s situation is different. Consider talking with a financial advisor before making major investment decisions. And remember, past performance doesn’t guarantee future results—but historically, staying invested in low-cost index funds has been one of the most reliable paths to building wealth.