Why You Still Feel Broke (Even After a Raise)—And What to Do About It

That “Wait, Where Did It Go?” Feeling

Let me guess—you landed a better job, finally got that raise, maybe picked up a new client or two. Either way, your income’s gone up… and yet, somehow, it feels like your money vanishes just as fast.

If anything, you’re more stressed about money than before.

You’re not crazy. You’re not bad with money. You’re just stuck in something that’s way more common (and sneaky) than most people talk about.

Let’s unpack why earning more doesn’t always lead to feeling better off—and how to shift things without going into budget lockdown mode or escaping any emergency in life without going into debts

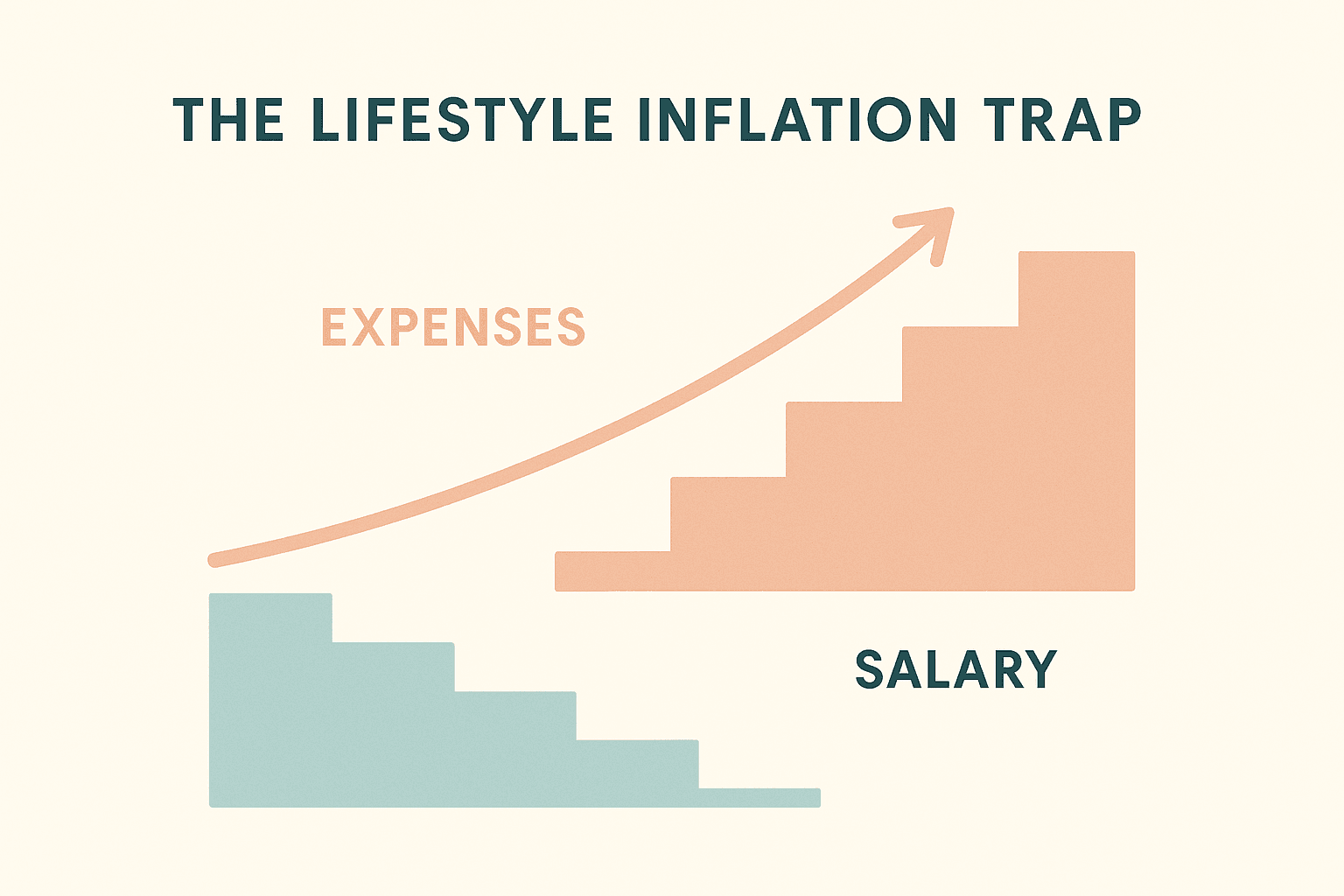

It’s Not You—It’s Lifestyle Inflation

There’s this thing that happens when we start making more money. Slowly—sometimes immediately—we start upgrading our lifestyle. New clothes, better takeout, maybe a fancier apartment or more nights out. It’s subtle at first. You barely notice it.

But then one day you realize… you’re earning more but not keeping more. Sound familiar?

You’re Rewarding Yourself—And That’s Normal

Most of us were raised to believe that more money = more freedom. So when we get a raise, our brains go, “Heck yes, we made it!” And honestly? We deserve to celebrate.

But here’s the tricky part: those “treats” turn into habits real fast. What used to be a once-a-month splurge turns into a weekly expense. The bar just keeps moving.

It’s not because you’re reckless—it’s just how humans operate when left on autopilot. And most of us are living on that financial autopilot without realizing it.

The Comparison Pressure Is Brutal

We’re constantly bombarded with images of what “success” is supposed to look like. Friends jet-setting. People our age buying homes. That coworker who always has the latest tech.

Even if we know it’s curated, it still hits a nerve. And without thinking, we start upgrading—not because we need to, but because we’re trying to keep up.

Truth? You don’t need to. But the pressure is real. And it can get expensive.

Your Brain Isn’t Helping (Thanks, Dopamine)

Here’s something wild: your brain literally rewards you for spending.

When you buy something—especially right after a win or during a high-stress moment—your brain releases dopamine. That little “yay!” chemical gives you a boost. But it fades quick… and then you’re left wanting to feel that rush again.

Cue another purchase. And another. This is called dopamine spending, and it’s sneaky. You’re not shopping for stuff—you’re shopping for a feeling.

Ever bought something online, got a thrill clicking “Place Order”… and then forgot about it until it arrived? Yep, that’s it.

Now imagine this cycle after a big income jump. It’s the perfect storm for overspending without realizing it.

Oh, And Then There’s Financial Trauma

Not everyone talks about this, but it matters: your past experiences with money shape how you deal with it now.

If you grew up with instability, or money was always tight, you might feel unsafe holding onto money. So you spend it fast, even if part of you knows better.

Or maybe you feel like you don’t “deserve” to keep it. Or you associate savings with something boring or unreachable. These patterns are real. And they’re not fixed by spreadsheets or another finance podcast.

They’re only addressed when you pause and ask: “Why do I do what I do with money?”

So What Can You Actually Do?

Let’s be real. You’re not about to cancel joy or live like a monk. You want a life that feels good and sets you up for stability.

Here’s how to start shifting without burning out:

1. Create a Conscious Spending Plan (Not a Budget

Forget the old-school “track every penny” budget. Most of us won’t stick to that long-term.

Instead, try a conscious spending plan—something flexible but intentional.

Start with these rough percentages:

- 60% → needs (rent, bills, groceries)

- 30% → wants (fun, shopping, dining out)

- 10% → savings/investing

Even if your numbers don’t fit perfectly, the framework helps. You get to enjoy your money—but on purpose.

Ask yourself before a purchase: “Is this helping the future I want, or just reacting to how I feel right now?” No judgment—just curiosity.

2. Automate Your Savings Like a Subscription

Think about how easily we pay for Netflix or Spotify—every month, without thinking.

What if your savings worked the same way?

Set up an automatic transfer the day after payday. Even ₹500 or $50 a month counts. You can increase it later, but the habit is what matters.

Treat saving like a bill. You’ll never miss it—and future-you will thank you.

3. Zoom Out and Create a “Wealth Vision”

This sounds big, but hear me out: What do you actually want money to do for you?

Not in a generic “be rich” way. But like:

- Do you want flexibility to take a month off every year?

- Freedom to leave a job that drains you?

- To help your parents retire early?

- Buy land? Travel solo? Start something?

When your money has a job, it becomes way easier to say no to impulse buys that don’t fit the plan. Suddenly, saving feels exciting—not restrictive.

4. Catch the Patterns Before They Spiral

Go back and look at the last 30–60 days of your spending. No shame—just observation.

- What expenses made you feel good long-term?

- What purchases do you not even remember?

- Where did you spend just because you were tired, bored, or stressed?

You’ll start to see patterns. That awareness alone can save you so much stress and money.

Real Talk: I’ve Been There

When I first started earning more, I felt unstoppable… for about three weeks. Then reality hit. I was spending without thinking, skipping savings “just for now,” and wondering why I still felt broke.

It wasn’t until I automated my savings and actually looked at where my money was going that things shifted. Not overnight—but slowly, steadily, my anxiety faded.

Now? I still enjoy my money. But I do it with intention. That’s the real flex.

TL;DR (But Read the Full Post, Seriously)

- More income doesn’t equal less stress without a plan

- Lifestyle inflation and dopamine spending are real

- Conscious spending > extreme budgeting

- Automate savings. Even a small amount helps.

- Your past with money matters—be kind to yourself

- Create a vision. That’s where the motivation lives.

Final Thought

You don’t need to be perfect with money. You just need to pay attention. The goal isn’t to restrict your life—it’s to build a better one, slowly and intentionally.

That raise? It’s a gift. But how you use it is where the real magic happens.