How to Escape the Paycheck-to-Paycheck Trap (Even If You’re Broke)

That sinking feeling when you check your bank account three days before payday. The mental math you do at the grocery store. The pit in your stomach when an unexpected expense pops up.

If this sounds familiar, you’re not alone. Nearly 60% of Americans live paycheck to paycheck, and it’s not because they’re irresponsible with money. The system is rigged, wages haven’t kept up with living costs, and sometimes life just hits hard.

But here’s what I’ve learned after helping hundreds of people break this cycle: you don’t need a massive income to escape the paycheck-to-paycheck trap. You need the right systems, a few mindset shifts, and most importantly, a plan that actually works for real people with real problems.

Why “Just Budget Better” Advice Doesn’t Work

Let me be blunt: most financial advice is garbage if you’re actually struggling.

“Track every penny!” they say. Meanwhile, you’re choosing between gas money and groceries. “Cut out your daily coffee!” But that $4 latte isn’t why you can’t afford rent.

The truth? Living paycheck to paycheck isn’t always a spending problem. Sometimes it’s an income problem. Sometimes it’s a “life keeps happening” problem. And sometimes it’s a “the deck is stacked against us” problem.

Traditional budgeting advice assumes you have wiggle room. But when every dollar is already spoken for, you need a different approach entirely.

The Real Reasons You’re Stuck (And It’s Not Your Fault)

Before we talk solutions, let’s acknowledge what’s actually happening:

The income gap is real. Minimum wage hasn’t kept pace with the cost of living. Housing costs have skyrocketed. Healthcare is expensive. Student loans are crushing. These aren’t personal failings—they’re systemic issues.

Unexpected expenses are expected. Your car will break down. Someone will get sick. The hot water heater will die. If you don’t have an emergency fund (and most people don’t), these “surprises” derail everything.

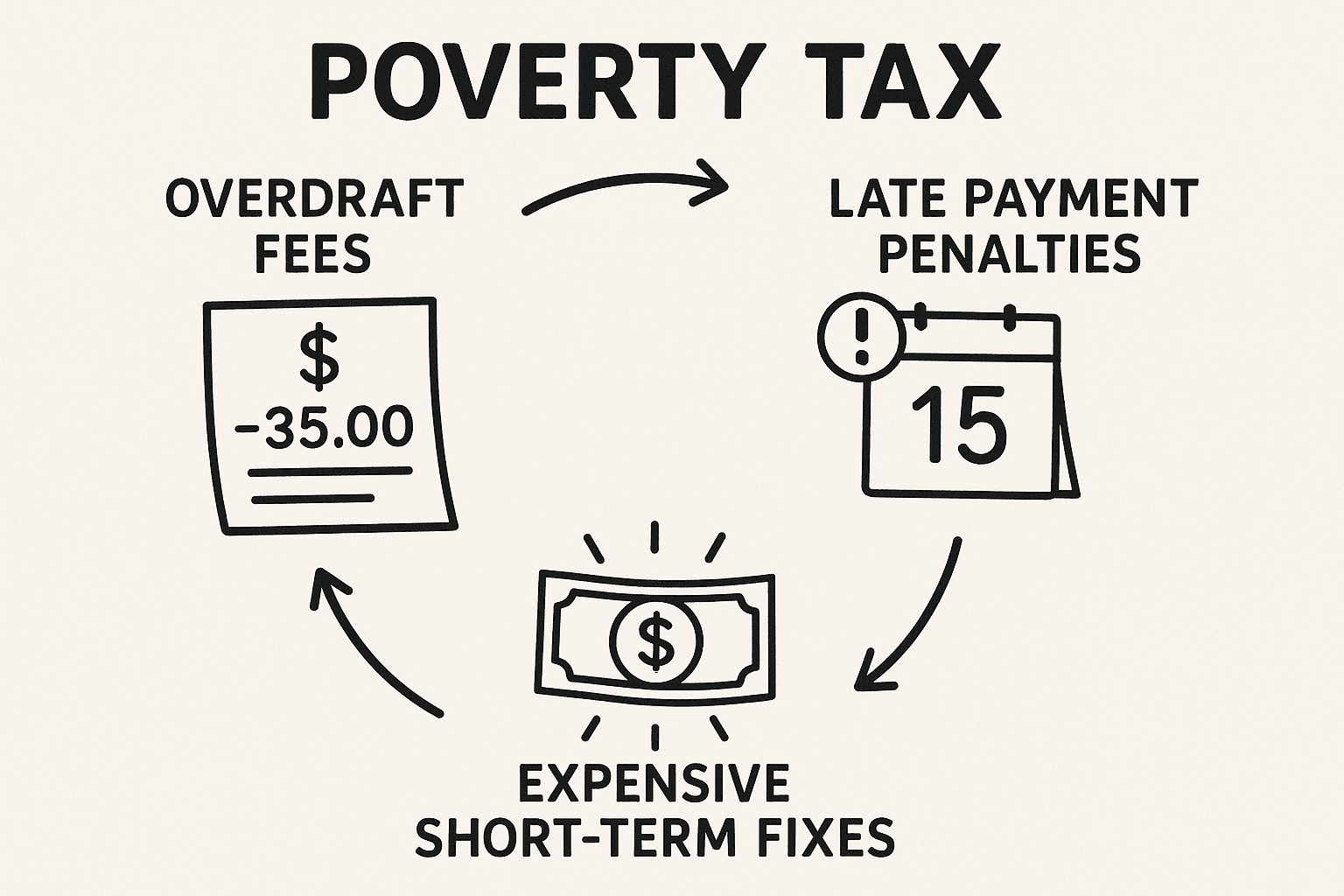

The poverty tax is brutal. Being broke is expensive. Overdraft fees. Late payment penalties. Having to buy cheap items that break quickly instead of quality items that last. The system literally punishes you for not having money.

Mental load is exhausting. Constantly worrying about money is mentally draining. It affects your sleep, your relationships, your work performance. It’s hard to make good long-term decisions when you’re in survival mode.

I’m not saying this to make you feel helpless. I’m saying it because you need to know: this isn’t your fault, and you’re not broken.

The Mindset Shift That Changes Everything

Here’s the mental reframe that started turning things around for me and my clients:

Stop trying to be perfect. Start trying to be better.

Forget the Instagram-worthy budget spreadsheets. Forget the “pay yourself first” advice when there’s nothing left to pay yourself with. Instead, focus on creating tiny margins of safety and building momentum.

Think of it like this: you’re not trying to become wealthy overnight. You’re trying to create breathing room. Space between you and financial disaster. Room to think, plan, and make better choices.

Every small win matters. Every dollar you manage to keep matters. Every system you put in place matters. Progress isn’t linear, and that’s okay.

The Escape Plan: 5 Phases That Actually Work

Phase 1: Stop the Bleeding (Weeks 1-2)

First, we need to understand where you are right now. But not with some complicated budgeting app—with brutal honesty.

Write down these numbers:

- How much money do you have right now?

- When is your next payday?

- What bills are due before then?

- What’s the gap?

If there’s a gap, you’re in crisis mode. That’s okay. Crisis mode has its own rules:

- Contact your creditors immediately. Most utility companies, credit card companies, and lenders have hardship programs. They’d rather work with you than send you to collections.

- Prioritize ruthlessly. Housing, transportation to work, minimum food, and any medicine you need. Everything else can wait.

- Look for quick income. Sell something. Pick up a gig. Ask family for help. Swallow your pride—it’s temporary.

Phase 2: Create Micro-Margins (Weeks 3-8)

Once you’re not in immediate crisis, it’s time to create tiny buffers. We’re not talking about a six-month emergency fund here. We’re talking about $50 that sits in your account and doesn’t get touched.

The $50 Challenge: Find $50 somewhere. Anywhere. Maybe you:

- Return something you bought but don’t need

- Sell something on Facebook Marketplace

- Pick up one extra shift

- Use a cashback app for groceries you’re buying anyway

- Collect loose change for a month

Put that $50 in a separate account (or envelope) and pretend it doesn’t exist. This is your “oh shit” fund.

Why $50 matters: It’s not about the money—it’s about proving to yourself that you can do this. It’s about breaking the mental pattern of spending every dollar that comes in.

Phase 3: The Income vs. Expenses Reality Check (Weeks 6-12)

Now we need to get real about your money without judgment. There are only three ways to fix a money problem:

- Make more money

- Spend less money

- Do both

Track everything for two weeks. Not to shame yourself, but to see patterns. Use your phone’s notes app, a notebook, whatever. Just write down what comes in and what goes out.

Look for the surprises. Where is your money actually going? Most people are shocked by:

- Subscription fees they forgot about

- How much they spend on convenience (fast food, gas station snacks)

- Small purchases that add up ($3 here, $7 there)

Find your low-hanging fruit. What can you cut without affecting your quality of life? Maybe it’s:

- Downgrading your phone plan

- Canceling subscriptions you don’t use

- Buying generic brands

- Meal planning to reduce food waste

Phase 4: Build Your Buffer Zone (Months 3-6)

Time to grow that $50 into $500. This isn’t about depriving yourself—it’s about creating options.

The Pay Yourself First Hack: Traditional advice says to save first. But when you’re broke, there’s nothing to save. Instead, try this:

Every time you get paid, immediately move $5-20 to your buffer fund. Before you pay bills, before you buy groceries, before you do anything. Start small—even $5 counts.

Why this works: You’re creating a new habit while the amount is too small to miss. As you get used to living on slightly less, gradually increase the amount.

Use windfalls wisely. Tax refund? Birthday money? Overtime pay? Put half toward your buffer, use half for something you need or want. This way you’re making progress without feeling deprived.

Automate what you can. Set up automatic transfers on payday, even if it’s just $10. Automation removes the decision fatigue and temptation to spend it elsewhere.

Phase 5: Create Sustainable Systems (Months 6+)

Once you have $500 in your buffer (or whatever feels like breathing room for you), it’s time to think bigger picture.

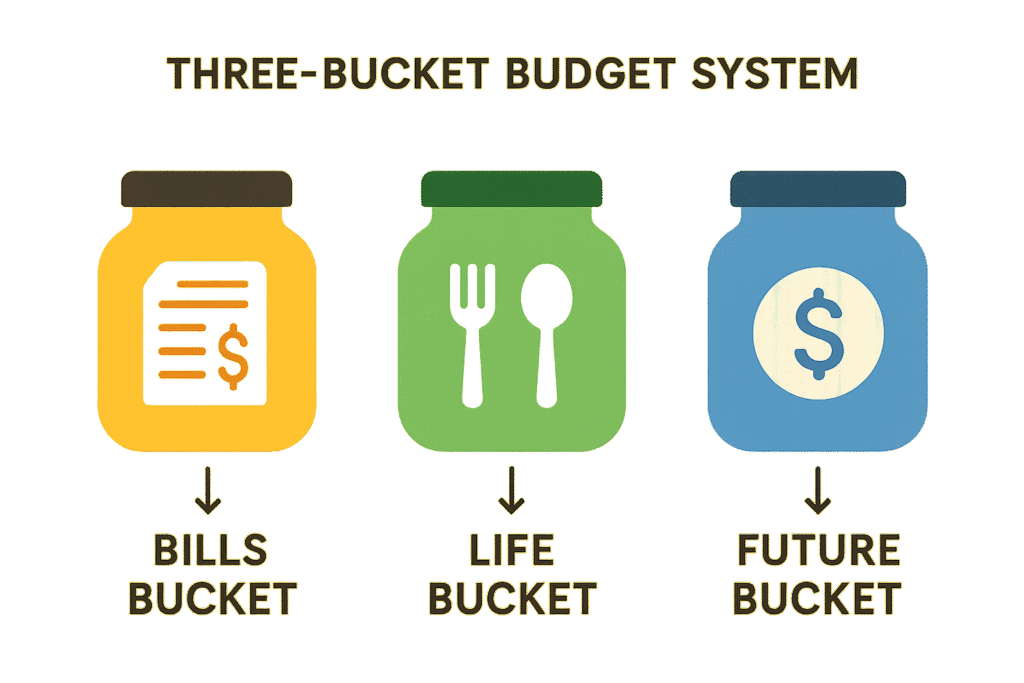

The Three-Bucket System:

- Bills Bucket: Money for fixed expenses (rent, utilities, car payment)

- Life Bucket: Money for variable expenses (food, gas, clothes)

- Future Bucket: Money for unexpected expenses and goals

Increase your income strategically. Now that you have some stability, you can think about:

- Asking for a raise (you have more negotiating power when you’re not desperate)

- Learning new skills that pay better

- Starting a side hustle that actually makes sense for your schedule

- Looking for a better job (easier to find when you already have one)

The Psychology of Breaking Free

Here’s what nobody tells you about escaping the paycheck-to-paycheck cycle: it’s as much mental as it is mathematical.

Scarcity mindset is real. When you’ve been broke, you develop certain thinking patterns. You might overspend when you get money because you don’t know when you’ll have it again. You might avoid looking at your bank account. You might feel guilty spending money on anything “extra.”

These reactions are normal. They’re survival mechanisms. But they can also keep you stuck.

Practice abundance thinking. This doesn’t mean pretending you have more money than you do. It means:

- Believing you’re capable of improving your situation

- Looking for opportunities instead of just problems

- Trusting that you can handle whatever comes next

- Recognizing that money is a tool, not a measure of your worth

Common Mistakes That Keep People Stuck

Mistake 1: Trying to change everything at once. You can’t go from financial chaos to perfect budgeting overnight. Pick one thing and do it consistently.

Mistake 2: Being too restrictive. If your plan doesn’t include any fun or flexibility, you’ll rebel against it. Build in small treats and unexpected expenses.

Mistake 3: Focusing only on cutting expenses. There’s a limit to how much you can cut. At some point, you need to increase your income.

Mistake 4: Comparing your behind-the-scenes to someone else’s highlight reel. Social media makes everyone look like they have their financial life together. They don’t.

Mistake 5: Giving up after one setback. You will have bad months. You will make mistakes. That doesn’t mean you’re back to square one.

What Success Actually Looks Like

Breaking free from paycheck-to-paycheck living doesn’t mean you suddenly become wealthy. It means:

- You sleep better because you’re not constantly worried about money

- Unexpected expenses are inconvenient, not catastrophic

- You have choices—maybe not unlimited choices, but real options

- You can think beyond this week’s survival to next month’s goals

- Money stops controlling your every decision

The timeline is different for everyone. Some people see improvements in weeks. For others, it takes months or years. The key is consistent progress, not perfect progress.

Your Next Steps (Start Today)

Don’t try to implement everything at once. Pick one action and do it today:

- If you’re in crisis: Make a list of your bills and contact creditors about payment plans

- If you want to start building: Find $20 and put it somewhere safe

- If you’re ready to track: Write down everything you spend for the next three days

- If you want to increase income: Apply for one job or research one side hustle

- If you’re building systems: Set up an automatic $10 transfer to savings

The Bottom Line

You are not destined to live paycheck to paycheck forever. This situation is temporary, even when it doesn’t feel like it.

The path out isn’t always linear. There will be setbacks, unexpected expenses, and months where you feel like you’re going backward. That’s normal. What matters is that you keep going.

Start where you are. Use what you have. Do what you can.

Every person who has successfully broken this cycle started exactly where you are right now. The only difference between them and you is time and consistent action.

You’ve got this. One dollar, one decision, one day at a time.