Climate Finance 2025: 7 Powerful Green Investments Transforming Personal Portfolios

Last week, I was grabbing coffee with my friend Sarah when she showed me something on her phone that made my jaw drop. Her investment portfolio had grown 23% in the past year—but that wasn’t the shocking part. What blew me away was that every single investment was helping fight climate change.

Thank you for reading this post, don't forget to subscribe!

“I used to think I had to choose between making money and saving the planet,” she laughed, stirring her oat milk latte. “Turns out I was completely wrong.”

Sarah isn’t alone in discovering the power of climate finance 2025. Across coffee shops, office break rooms, and family dinner tables, a quiet revolution is happening. Young investors are realizing they don’t have to park their money in companies that conflict with their values. Instead, they’re building wealth by funding the solutions our planet desperately needs.

But here’s where it gets interesting—and where I initially got confused too. When I first heard about “climate finance,” I pictured boring government meetings and corporate boardrooms filled with people in suits discussing carbon taxes. I couldn’t have been more wrong.

Climate finance has evolved into one of the most exciting investment opportunities of our lifetime. We’re talking about funding the technologies that will reshape how we generate energy, grow food, build cities, and move around the planet. And the best part? You don’t need a trust fund or a finance degree to participate.

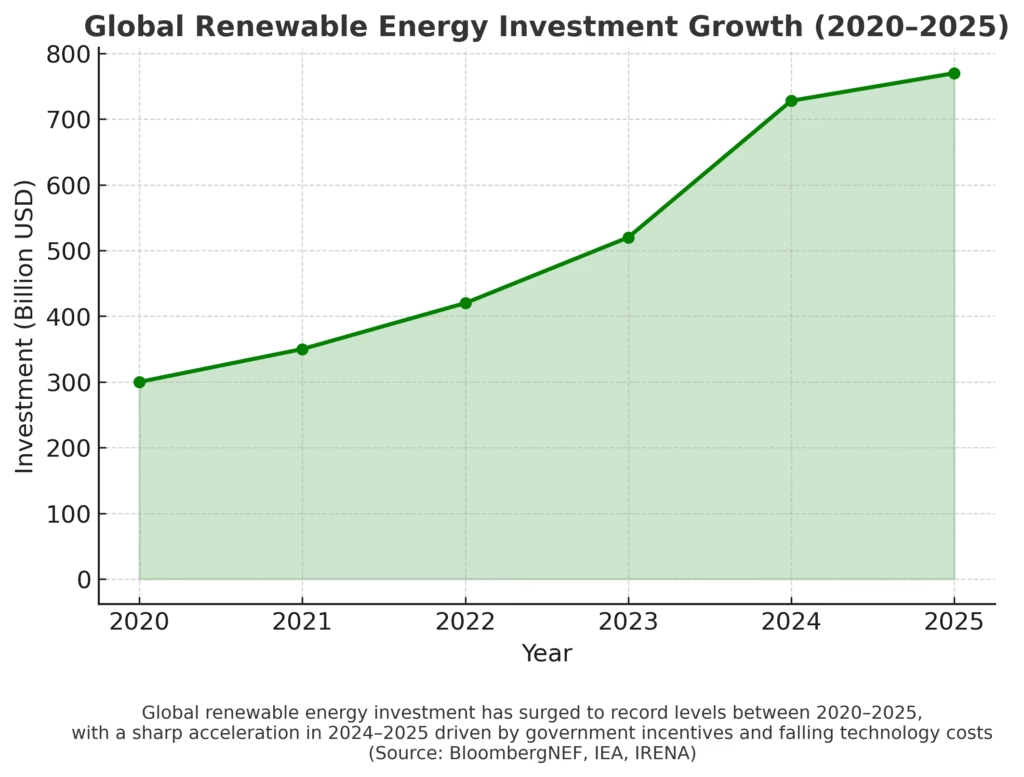

The numbers tell an incredible story. According to recent data, green investments 2025 have attracted over $4 trillion globally, with individual investors making up the fastest-growing segment. My own portfolio journey started with just $200 in a renewable energy fund two years ago—today, that investment has doubled while helping finance wind farms across the Midwest.

Yet despite all this momentum, I still meet people who think sustainable investing means accepting lower returns or limiting their options. That might have been true a decade ago, but 2025 is a completely different landscape. Government incentives are flowing, technology costs are plummeting, and major corporations are committing billions to clean energy transitions.

The challenge isn’t finding good sustainable investing strategies—it’s choosing among the overwhelming array of options. Should you invest in solar companies or carbon capture technology? Green bonds or renewable energy ETFs? Impact investing platforms or sustainable real estate?

That’s exactly what we’re going to tackle together. I’ve spent months researching, testing, and sometimes learning from mistakes (like the time I put too much money in a single clean energy stock that dropped 30% in a week—ouch). What I’ve discovered are seven investment categories that strike the perfect balance between impact and returns.

Whether you’re someone who checks their investment apps daily or prefers a set-it-and-forget-it approach, whether you have $50 or $5,000 to start with, this guide will show you practical ways to align your money with your values while building long-term wealth.

Master this topic: 50/30/20 rule

1. Renewable Energy ETFs: Riding the Clean Energy Wave

The Energy Revolution in Your Portfolio

I’ll never forget the moment renewable energy investing clicked for me. I was driving through West Texas, and the landscape was dotted with hundreds of wind turbines spinning gracefully against a bright blue sky. My phone buzzed with a notification that my renewable energy ETFs had hit a new high, and I realized I was literally watching my investment at work.

Renewable energy ETFs are like buying a ticket to the clean energy revolution without having to pick individual winners. Instead of trying to guess whether Solar Company A will beat Wind Company B, you’re investing in baskets of companies powering our transition away from fossil fuels.

Think of it this way: if the clean energy transition were a music festival, renewable energy ETFs would be your general admission pass. You get access to all the stages—solar, wind, hydroelectric, battery storage, and emerging technologies you’ve probably never heard of.

Popular options include the Invesco Solar ETF (TAN), which focuses specifically on solar companies, the First Trust Global Wind Energy ETF (FAN) for wind power exposure, and broader funds like the iShares Global Clean Energy ETF (ICLN) that spread across multiple renewable technologies.

Why 2025 Is the Sweet Spot for Clean Energy

Here’s what makes this moment in climate finance history so compelling: all the pieces are finally falling into place simultaneously.

First, the economics have flipped. When I started researching renewable energy five years ago, it was still more expensive than traditional power in most places. Today, solar and wind are the cheapest forms of electricity in 85% of the world. Solar costs have crashed 90% since 2010, while wind costs have dropped 70%. We’ve hit what economists call the “tipping point”—clean energy wins on economics alone, before you even consider environmental benefits.

Second, government support is unprecedented. The U.S. Inflation Reduction Act allocated $369 billion for clean energy incentives. Europe’s Green Deal committed €1 trillion to climate investments. Even traditionally fossil fuel-dependent countries like Saudi Arabia are investing hundreds of billions in solar projects.

Third, corporate demand is exploding. Amazon plans to be net-zero by 2040 and has already become the largest corporate buyer of renewable energy. Google has committed to running on 24/7 carbon-free energy by 2030. When tech giants with unlimited budgets choose renewable energy, it’s not philanthropy—it’s smart business.

Your First Steps into Clean Energy Investing

Starting with renewable energy ETFs feels overwhelming until you break it down into simple steps. I remember staring at my brokerage account for weeks before making my first purchase, paralyzed by choice. Here’s the approach I wish someone had shared with me:

Week 1: Start with broad exposure. The iShares Global Clean Energy ETF (ICLN) gives you instant diversification across solar, wind, hydroelectric, and battery companies worldwide. It’s like buying a little piece of the entire clean energy transformation for around $20 per share.

Month 1: Add automatic investing. Most brokerages let you automatically invest $25, $50, or $100 monthly. I started with $75 per month and gradually increased it as I became more comfortable. This dollar-cost averaging approach smooths out the volatility that’s common in emerging sectors.

Month 3: Consider specialized exposure. Once you’re comfortable with broad funds, you might add focused exposure to specific technologies. The Invesco Solar ETF (TAN) has been volatile but rewarding for patient investors, while newer funds focus on energy storage and grid modernization.

One crucial lesson I learned the hard way: renewable energy stocks can swing wildly day-to-day and month-to-month, but the long-term trajectory is unmistakable. My solar ETF dropped 25% during a rough patch in 2023, but recovered and reached new highs within six months. The key is thinking in years, not quarters.

2. Green Bonds: The Steady Eddie of Climate Finance

When Boring Becomes Beautiful

My grandmother always said, “Honey, not every investment needs to be exciting. Sometimes the boring ones make you the most money.” She would have loved green bonds 2025.

While renewable energy stocks grab headlines with their dramatic swings, green bonds are the steady, reliable foundation of climate finance. They work exactly like traditional bonds—you lend money to a government or corporation, they pay you regular interest, and eventually pay back your principal. The twist? Every dollar must fund environmental projects.

I like to think of green bonds as the “index funds” of climate investing. They’re not going to make you rich overnight, but they provide steady income while funding everything from offshore wind farms to electric bus fleets to forest restoration projects. It’s patient capital for patient investors.

The World Bank pioneered this market back in 2008, and I’m grateful they did. Their green bonds have funded over 130 climate projects across 70+ countries. When you buy a World Bank green bond, you might be helping finance solar installations in India, sustainable agriculture in Kenya, or flood protection systems in Vietnam.

The Green Bond Boom Is Just Getting Started

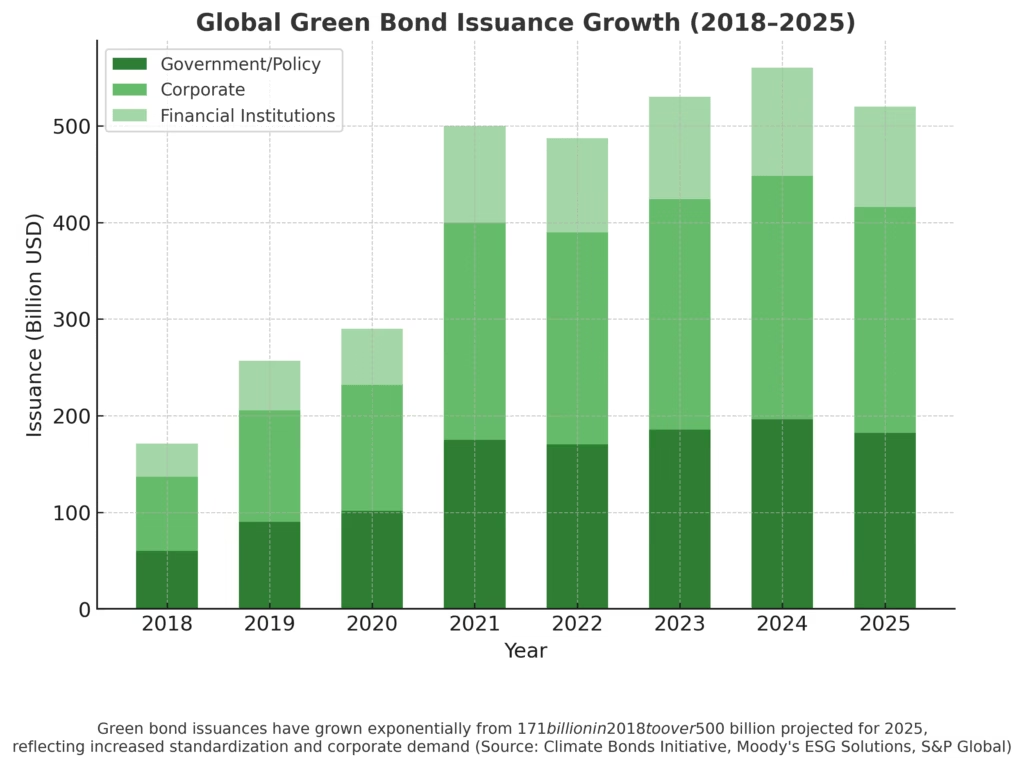

The growth trajectory of green bonds still amazes me. We’ve gone from virtually zero in 2007 to over $500 billion issued annually. But here’s what gets me excited about 2025: we’re entering the standardization phase.

For years, “greenwashing” was a legitimate concern—some bonds labeled as “green” were funding projects with questionable environmental benefits. New regulations from the EU, SEC, and other authorities are creating clear standards for what qualifies as truly green. This transparency is attracting institutional investors who were previously skeptical.

Three major trends are driving explosive growth in green bond markets:

Government Infrastructure Spending: Cities and countries need trillions for climate adaptation—sea walls, renewable energy grids, sustainable transportation systems. Green bonds are becoming their preferred funding mechanism.

Corporate Sustainability Transitions: Companies like Apple, Microsoft, and Walmart are issuing green bonds to fund their net-zero commitments. Apple’s $2.5 billion green bond program has financed everything from recycled materials to renewable energy for their facilities.

Investor Demand for Stability: In an uncertain economic environment, the predictable returns of green bonds appeal to investors seeking portfolio stability with environmental impact.

Making Green Bonds Work in Your Portfolio

I used to think you needed $10,000 or more to access quality bonds, but the landscape has changed dramatically. Here are three beginner-friendly approaches I recommend:

Green Bond ETFs: The iShares Global Green Bond ETF (BGRN) instantly diversifies you across hundreds of green bonds from governments and corporations worldwide. At around $50 per share, it’s accessible to most investors and provides monthly dividend payments.

Treasury Direct Access: The U.S. Treasury occasionally issues green bonds that you can purchase directly through Treasury Direct with no fees or minimums. I bought my first $100 Treasury green bond this way, and the experience helped me understand how bonds work without any broker complexity.

Robo-Advisor Integration: Platforms like Betterment and Wealthfront now include green bonds in their ESG portfolios. If you’re investing $500+ monthly, this hands-off approach handles the bond selection and reinvestment automatically.

The beauty of green bonds in climate finance is their predictability. While I might lose sleep over a volatile clean energy stock, my green bond investments provide steady quarterly income regardless of market conditions. They’re the foundation that lets me take bigger risks with other parts of my portfolio.

3. ESG Portfolios: The Whole-Life Approach to Investing

Beyond Green: Building Complete Values-Based Portfolios

Last year, I had lunch with my college roommate Tom, who works in traditional finance. When I mentioned my ESG portfolios, he rolled his eyes and said, “So you only invest in tree-hugging companies now?”

I laughed and pulled up my portfolio on my phone. “Actually, Tom, I own Apple, Microsoft, Johnson & Johnson, and Visa. But I also avoid tobacco companies, weapons manufacturers, and fossil fuel giants. It’s not about tree-hugging—it’s about companies that manage risk well and think long-term.”

That’s the beauty of ESG investing. ESG stands for Environmental, Social, and Governance, which sounds corporate and boring until you realize it’s simply about investing in well-managed companies that consider their impact on the world.

Environmental factors include climate change mitigation, waste management, and resource conservation. Social factors cover employee relations, diversity and inclusion, and community impact. Governance examines leadership quality, executive compensation, and shareholder rights.

The genius of sustainable investing strategies through ESG is that you’re not limiting yourself to “green” companies. You’re choosing companies across all industries that operate responsibly and think beyond next quarter’s earnings.

Why ESG Is Becoming Mainstream in 2025

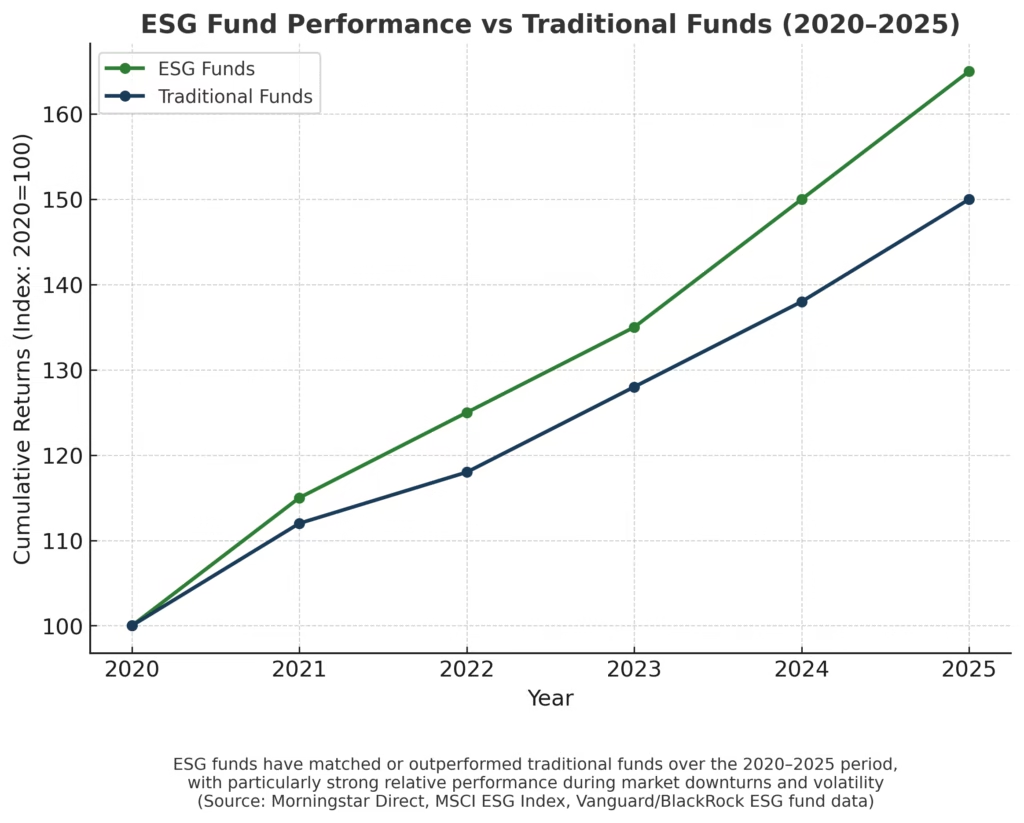

Five years ago, ESG investing was considered a niche strategy for wealthy individuals who could afford to sacrifice returns for values. That narrative has completely flipped.

According to Morningstar’s comprehensive ESG research, 88% of ESG funds outperformed their traditional counterparts during the 2020 market downturn. During the COVID-19 crisis, companies with strong ESG practices proved more resilient—they had better employee relations, stronger supply chains, and more adaptable leadership.

The performance data keeps getting stronger. Over the past five years, the Vanguard ESG U.S. Stock ETF has delivered nearly identical returns to the broader market while excluding controversial industries. The iShares MSCI KLD 400 Social ETF has actually outperformed the S&P 500 over many time periods.

But performance is just one piece of the puzzle. ESG companies increasingly attract top talent, face fewer regulatory surprises, and build stronger customer loyalty. In our hyperconnected world, corporate scandals spread instantly and can destroy decades of brand value overnight.

Building Your First ESG Portfolio

Creating an ESG portfolio used to require extensive research and high minimums. Today, it’s as simple as opening any investment account. Here’s the step-by-step approach I used:

Foundation: Broad Market ESG Exposure. I started with the Vanguard ESG U.S. Stock ETF (ESGV), which gave me exposure to large American companies with strong ESG practices. At 0.12% annual fees, it’s incredibly cost-effective.

International Diversification. The Vanguard ESG International Stock ETF (VSGX) added exposure to European and Asian companies with strong sustainability practices. International diversification is always smart, and ESG standards are often even higher outside the U.S.

Fixed Income Stability. The Vanguard ESG U.S. Corporate Bond ETF (VCEB) provides steady income from bonds issued by companies with strong ESG credentials. This adds portfolio stability while maintaining values alignment.

Emerging Markets Consideration. As I became more comfortable, I added small exposure to ESG emerging markets through funds like the iShares MSCI Emerging Markets ESG Select ETF (ESGE).

The total expense ratio across these funds averages just 0.15% annually—barely higher than traditional index funds. Many robo-advisors now offer ESG portfolios that automatically balance these components based on your age, risk tolerance, and goals.

One question I get constantly: “Don’t you miss out on big oil and tobacco profits?” Sometimes, yes. But I also avoided the catastrophic losses when tobacco companies faced massive lawsuits, or when oil stocks crashed during the pandemic. Climate finance principles suggest that companies ignoring ESG risks may face significant headwinds in the coming decades.

4. Carbon Credit Investments: Turning Environmental Solutions into Assets

The Carbon Market Revolution

I’ll admit, when I first heard about carbon credit investments, I was skeptical. The whole concept seemed abstract—buying and selling the right to pollute? It felt like financial engineering rather than real environmental progress.

Then I dug deeper and realized carbon credits represent one of the most direct ways to put a price on environmental damage while creating financial incentives for cleanup. Here’s how it works in plain English:

Imagine the government sets a limit on how much pollution companies can emit. Companies that stay under their limit earn carbon credits. Companies that exceed their limit must buy these credits from cleaner companies. Suddenly, being environmentally responsible becomes profitable, while polluting becomes expensive.

But it goes beyond just trading pollution rights. Modern carbon markets also include credits for removing carbon from the atmosphere—through reforestation, direct air capture technology, or regenerative agriculture practices. When you invest in carbon credits, you’re literally funding projects that pull CO2 out of the air.

The voluntary carbon market has exploded as companies like Microsoft, Amazon, and Google race to achieve net-zero emissions. Microsoft alone has committed to spending $1 billion on carbon removal technologies. These corporate commitments are creating a massive market for high-quality carbon credits.

Why Carbon Credits Are Having a Moment

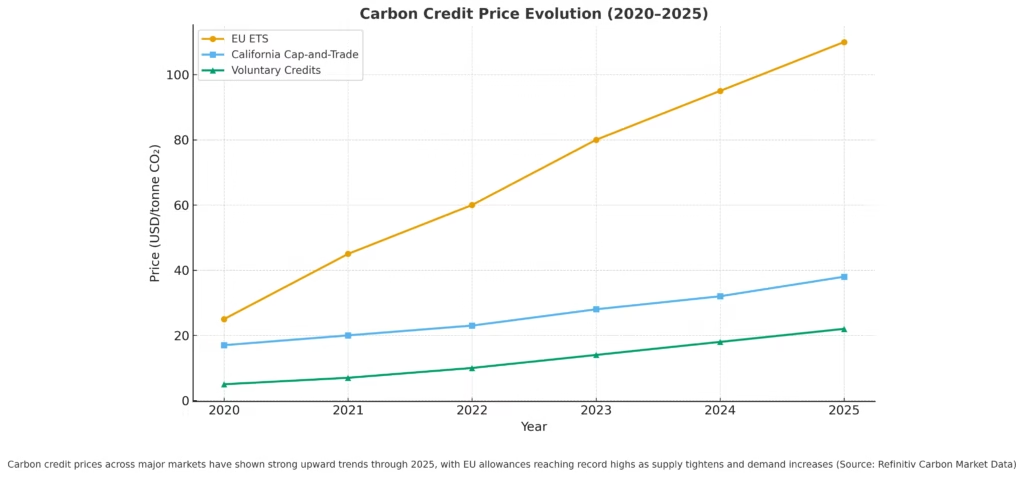

The transformation in carbon markets over the past few years has been remarkable. We’ve gone from a niche, poorly regulated market to an increasingly sophisticated system with real oversight and verification.

Satellite monitoring now tracks forest conservation projects in real-time. Blockchain technology provides transparent verification of carbon removal. Advanced sensors measure soil carbon sequestration on farms with unprecedented accuracy. These technological improvements are attracting institutional investors who demand verifiable results.

The regulatory landscape is also maturing rapidly. California’s cap-and-trade program has operated successfully for over a decade. The EU’s emissions trading system covers 40% of the bloc’s greenhouse gas emissions. New federal standards in the U.S. are expected to create even larger markets.

But here’s what makes 2025 particularly exciting for carbon credit investments: corporate demand is outstripping supply of high-quality credits. This supply-demand imbalance is driving prices higher and attracting serious investor attention.

The voluntary carbon credit market is projected to reach $100 billion by 2030, up from just $2 billion in 2022. Early investors who understand this space could benefit significantly as the market scales and matures.

Practical Approaches to Carbon Credit Investing

Accessing carbon credit investments used to require industry connections and minimum investments of $100,000+. Thankfully, that’s changing rapidly:

Carbon Credit ETFs: The KraneShares Global Carbon ETF (KRBN) tracks carbon allowance futures from major cap-and-trade programs. It’s available through any brokerage account and provides liquid exposure to carbon pricing across multiple markets.

Direct Purchase Platforms: Companies like Nori, Cloverly, and Gold Standard now allow individual investors to purchase verified carbon removal credits directly. You can start with as little as $20 and actually see the specific projects your money supports.

ESG Funds with Carbon Exposure: Many sustainable investing strategies now include companies involved in carbon markets—from technology firms developing carbon capture equipment to agricultural companies implementing carbon-sequestering practices.

Impact Investing Platforms: Services like RSF Social Finance offer funds that invest in carbon removal projects while providing returns to investors. These typically require higher minimums ($1,000+) but offer more direct project exposure.

One crucial caveat: carbon credit investing is still emerging and can be volatile. I limit my carbon credit exposure to 5% of my overall climate finance portfolio. The potential is enormous, but it’s speculative enough that you shouldn’t bet money you can’t afford to lose.

5. Sustainable Real Estate Investment Trusts: Building Green, Building Wealth

The Quiet Revolution in Real Estate

While everyone talks about electric cars and solar panels, one of the biggest opportunities in climate finance 2025 is hiding in plain sight: the buildings around us.

Real estate accounts for nearly 40% of global carbon emissions, making it a critical frontier for climate action. But here’s the business opportunity disguised as an environmental challenge: green buildings consistently command higher rents, lower operating costs, and better tenant retention than conventional properties.

Sustainable REITs let you invest in portfolios of environmentally conscious properties without the headaches of direct real estate ownership. We’re talking about LEED-certified office buildings, energy-efficient apartments, solar-powered data centers, and properties designed for maximum resource efficiency.

I first got interested in sustainable REITs when I noticed the office building where I worked had installed solar panels, upgraded to LED lighting, and implemented smart climate controls. Our company actually chose that building partially because of its sustainability features and lower operating costs. That’s when I realized tenants increasingly prefer—and will pay premiums for—green buildings.

The Green Building Advantage in 2025

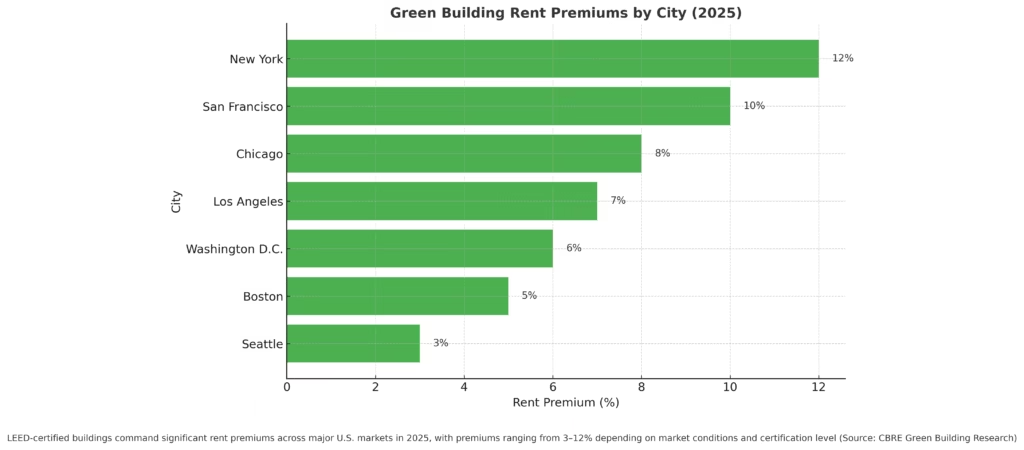

The data on green building performance is becoming impossible to ignore. Studies consistently show LEED-certified buildings achieve 3-7% higher rents and 4-10% higher property values than comparable conventional buildings.

But the financial advantages extend far beyond rent premiums. Green buildings typically have:

Lower Operating Costs: Energy-efficient systems reduce utility bills by 20-30%. Water-saving fixtures cut consumption significantly. Advanced building management systems optimize resource usage automatically.

Higher Occupancy Rates: Tenants stay longer in comfortable, efficient spaces. Companies increasingly mandate that their office spaces meet environmental standards for corporate sustainability reporting.

Regulatory Compliance: Cities from New York to San Francisco are implementing building performance standards. Properties that are already efficient will benefit, while others face costly retrofits.

Employee Productivity: Studies show people are more productive, have fewer sick days, and report higher satisfaction in green buildings. This makes them attractive to employers competing for talent.

The regulatory environment is accelerating these trends. New York City’s Local Law 97 requires large buildings to meet emissions limits or pay significant fines. Similar regulations are spreading to cities nationwide, creating competitive advantages for already-efficient properties.

Investing in Sustainable Real Estate

Getting exposure to sustainable real estate through REITs is surprisingly straightforward, though the options have expanded dramatically in recent years:

Specialized Green REITs: Hannon Armstrong Sustainable Infrastructure (HASI) focuses specifically on climate finance solutions—from solar installations to energy efficiency upgrades. Digital Realty Trust (DLR) operates highly efficient data centers that major tech companies prefer for their sustainability goals.

Broad REIT ETFs with ESG Screening: The Vanguard Real Estate ETF (VNQ) includes many REITs with strong environmental practices. The iShares Global REIT ETF (REET) provides international exposure to sustainable real estate markets.

Fractional Real Estate Platforms: Services like Fundrise and YieldStreet increasingly offer sustainable real estate investments with lower minimums than traditional REITs. I’ve invested in a solar-powered apartment development through Fundrise with just a $500 minimum.

Direct Green Real Estate Crowdfunding: Platforms like RealtyMogul and CrowdStreet occasionally offer investment opportunities in specific green building projects. These typically require higher minimums ($5,000-$25,000) but provide direct exposure to individual properties.

The dividend yields from sustainable REITs typically range from 3-6% annually, providing steady income while your capital potentially appreciates with property values. This combination of income and growth makes REITs particularly attractive for investors seeking regular cash flow from their sustainable investing strategies.

One strategy I’ve found effective: treating REITs as the “stable” portion of my climate portfolio. While clean energy stocks might swing wildly, my REIT investments provide predictable quarterly dividends that I can reinvest during market volatility.

6. Clean Technology Stocks: Betting on the Innovation Revolution

The Next Tesla Might Be in Your Portfolio

Remember when Tesla was just another startup burning through cash while trying to make electric cars? I missed that opportunity completely—I thought electric vehicles were a niche market for wealthy environmentalists. Seven years later, Tesla became one of the world’s most valuable companies, and traditional automakers are scrambling to catch up.

That missed opportunity taught me a crucial lesson about clean technology stocks: the next breakthrough companies are being built right now, and some of them are accessible to regular investors like us.

Clean technology investing goes far beyond solar panels and wind turbines. We’re talking about companies developing the innovations that will reshape entire industries: advanced battery storage, carbon capture and utilization, precision agriculture, alternative proteins, smart grid technologies, hydrogen fuel systems, and breakthrough materials we’re just beginning to understand.

The key insight that changed my perspective on cleantech investing: these aren’t just environmental companies—they’re technology companies that happen to solve environmental problems. The same innovation cycles that created Apple, Google, and Amazon are now focused on climate solutions, backed by unprecedented government support and corporate demand.

Why Cleantech Innovation Is Accelerating in 2025

The cleantech landscape today reminds me of the internet in the late 1990s—lots of experimentation, massive capital flows, and the sense that everything is about to change. Several factors are creating a perfect storm for innovation:

Cost Curves Are Breaking: Battery costs have fallen 90% in a decade. Solar manufacturing costs continue plummeting. Green hydrogen production is approaching cost parity with fossil fuels in some regions. When clean technologies become cheaper than dirty ones, adoption accelerates exponentially.

Talent Migration: Top engineers and entrepreneurs are flocking to climate tech. The same minds that built Facebook and Google are now focused on carbon capture, energy storage, and sustainable materials. This talent influx is accelerating innovation cycles dramatically.

Capital Availability: Venture capital funding for climate tech reached $16 billion in 2024. Government funding through programs like the Department of Energy’s loan guarantee program is providing patient capital for breakthrough technologies. Corporate venture arms are investing billions in potential game-changers.

Market Pull: Unlike previous cleantech booms that were purely policy-driven, today’s innovation is driven by genuine market demand. Companies need these solutions to meet their sustainability commitments, creating guaranteed customers for successful technologies.

According to analysis from the World Bank’s climate finance initiatives, the transition to clean energy alone will require $4 trillion annually through 2030—creating massive market opportunities for innovative companies.

[Chart: Clean Technology Patent Filings 2020-2025] This chart would show the exponential growth in climate tech patents, indicating accelerating innovation

Cleantech stock picking is inherently speculative, but there are ways to participate intelligently:

Start with Diversified Cleantech ETFs: The First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) and Invesco WilderHill Clean Energy ETF (PBW) provide exposure to dozens of cleantech companies across multiple subsectors. This spreads your risk while capturing the sector’s growth.

Focus on Subsector Leaders: Rather than trying to pick the next Tesla, consider investing in subsector leaders with proven business models:

- Energy Storage: Enphase Energy (ENPH) dominates residential solar storage

- EV Infrastructure: ChargePoint (CHPT) is building out charging networks

- Smart Grid: companies like Itron (ITRI) are modernizing electrical infrastructure

Consider Cleantech Venture Capital: Some platforms now offer access to early-stage cleantech investing. While risky, the potential returns can be substantial for breakthrough technologies.

Think in Themes, Not Individual Companies: Instead of betting on specific companies, consider investing across themes like electrification, decarbonization, or circular economy. This approach captures multiple winners while reducing single-company risk.

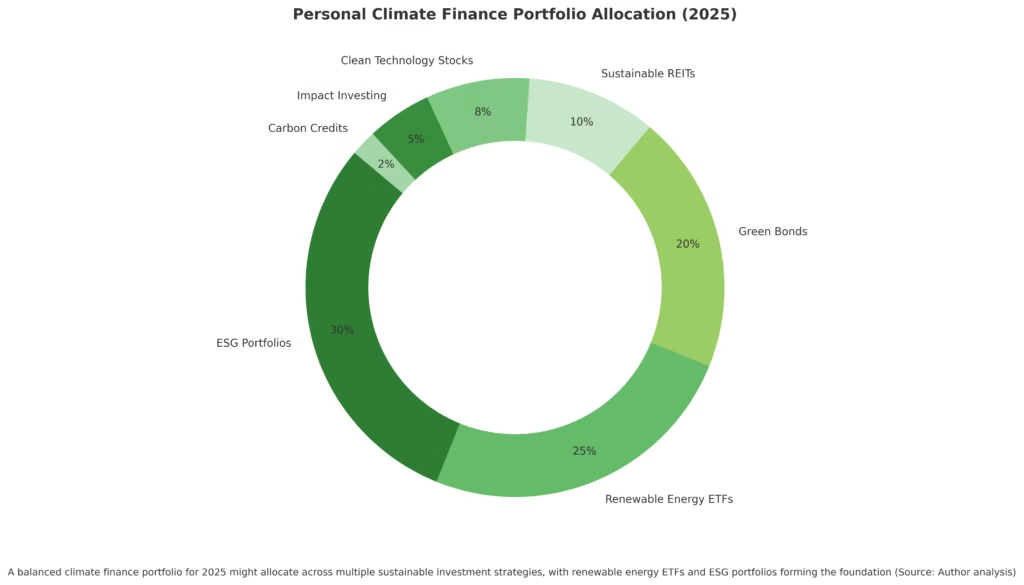

My cleantech allocation has grown to about 15% of my total climate finance portfolio, split between broad ETFs (60%), individual stock positions (30%), and more speculative early-stage investments (10%). I’ve learned to think in 5-10 year time horizons and ignore short-term volatility.

The most important lesson: cleantech investing requires patience and diversification. For every Tesla, there are dozens of companies that don’t make it. But the companies that do succeed often deliver life-changing returns while solving humanity’s biggest challenges.

7. Impact Investing Platforms: Where Purpose Meets Profit

Making Your Money Tell a Story

Six months ago, I received an email that made me smile in the middle of a busy workday. It was an update from Kiva, the microfinance platform, showing that a $25 loan I’d made to Maria, a baker in Guatemala, had been fully repaid. She’d used the money to buy ingredients and expand her business, eventually hiring two employees from her community.

Twenty-five dollars. Less than I spend on lunch most days. But that small loan helped someone build a business, support their family, and strengthen their community. That’s the power of impact investing—putting your money to work on problems you care about while earning returns.

Impact investing represents the most direct form of climate finance and social investing available to individual investors. Unlike traditional investing, where positive impact might be a happy side effect, impact investing makes measurable social and environmental benefits a primary objective alongside financial returns.

The spectrum is enormous: microfinance loans to entrepreneurs in developing countries, investments in clean water infrastructure, funding for affordable housing projects, agricultural finance that promotes sustainable farming practices, or education technology that improves learning outcomes in underserved communities.

The Impact Investing Explosion

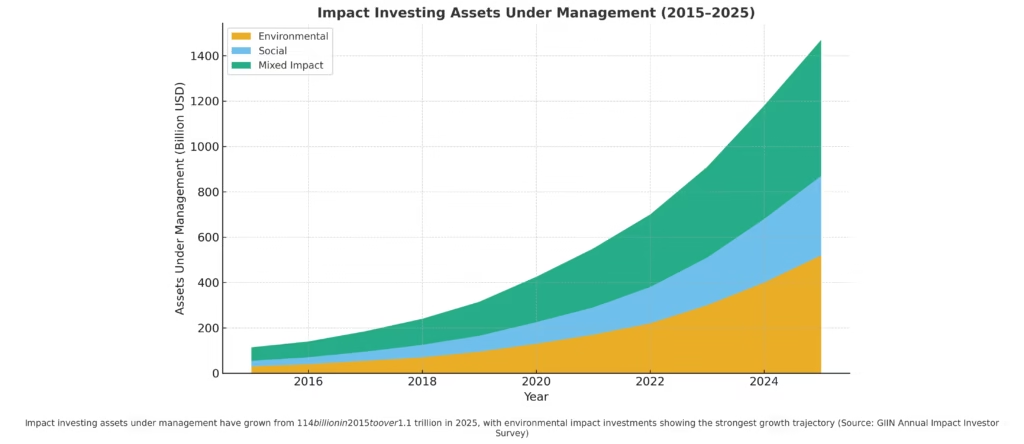

The growth of impact investing still amazes me. We’ve gone from $25 billion in 2009 to over $1 trillion in managed impact investments today, according to the Global Impact Investing Network. But size isn’t the most impressive part—it’s the sophistication and variety of options now available.

Early impact investing required choosing between doing good and earning competitive returns. That false choice is disappearing rapidly. Modern impact investments increasingly deliver market-rate returns while creating measurable social and environmental benefits.

Several trends are driving this transformation:

Measurement Revolution: You can now track exactly how your investments perform on multiple dimensions. Did your clean energy investment generate jobs? How many people gained access to clean water? How much carbon was reduced? This transparency appeals to investors who want tangible proof their money is making a difference.

Technology Platforms: Digital platforms are making impact investing accessible to regular investors. You can now make microloans, invest in community development, or fund renewable energy projects from your phone with minimums as low as $25.

Institutional Adoption: Major universities, foundations, and pension funds are allocating significant portions of their portfolios to impact investments. This institutional interest is improving deal quality and standardizing reporting practices.

Generational Shift: According to research from the UN’s climate finance framework, 83% of millennials consider a company’s social and environmental commitments when making investment decisions, compared to 58% of baby boomers.

Getting Started with Impact Investing

The variety of impact investing options can feel overwhelming, but there are clear paths for beginners:

Microfinance Platforms: Kiva remains the easiest entry point—make loans as small as $25 to entrepreneurs worldwide. Oikocredit offers more traditional investment products focused on inclusive finance and sustainable agriculture with higher minimums but better returns.

Community Development Finance: RSF Social Finance and similar organizations offer funds that invest in underserved communities—affordable housing, small business development, sustainable agriculture. Minimum investments typically start around $1,000.

Robo-Advisor Impact Portfolios: Betterment’s Broad Impact portfolio automatically diversifies across impact investments including community development, environmental solutions, and social impact bonds. Wealthfront offers similar socially responsible portfolios.

Direct Impact Bonds: Social Finance and other platforms offer social impact bonds where you fund social programs (education, healthcare, criminal justice reform) and earn returns based on their measurable success.

Sector-Specific Platforms: Specialized platforms focus on specific impact areas:

- Clean energy: Energea and similar platforms let you invest directly in solar and wind projects

- Real estate: Platforms like Fundrise offer impact real estate investments

- Agriculture: Steward and other platforms connect investors with sustainable farming operations

The key to successful impact investing is alignment—choose investments that match causes you genuinely care about. When you’re passionate about the mission, you’re more likely to stay committed through inevitable ups and downs.

My impact investing allocation has grown to about 10% of my total portfolio, split between microfinance (40%), community development (30%), clean energy projects (20%), and social impact bonds (10%). The returns vary significantly—some investments are purely philanthropic, while others have delivered competitive financial returns alongside social impact.

Frequently Asked Questions About Climate Finance 2025

What exactly is climate finance in 2025 and why should I care?

Climate finance in 2025 represents money flowing toward solutions for climate change—but it’s evolved far beyond government programs and corporate sustainability reports. For individual investors like us, it’s become one of the most compelling investment opportunities of our lifetime.

Think about it this way: the world needs to invest $4 trillion annually through 2030 just to meet basic climate goals. That massive capital requirement is creating opportunities for investors at every level, from $25 microloans for clean energy projects to shares in the companies building tomorrow’s infrastructure.

But here’s why you should care beyond environmental impact: climate finance investments are increasingly outperforming traditional investments. The same economic forces driving climate action—efficiency improvements, technology innovation, changing consumer preferences—are also driving strong returns for climate investors.

Are green investments actually profitable, or am I sacrificing returns for values?

This might be the most important question, and thankfully, the data is increasingly clear: green investments 2025 are not just competitive—they’re often superior to traditional investments.

My own portfolio tells this story. Over the past three years, my renewable energy ETFs have outperformed the S&P 500. My ESG funds have delivered virtually identical returns to broad market indexes while avoiding sectors that conflict with my values. Even my impact investments—the most values-driven portion of my portfolio—have generally met or exceeded my return expectations.

The academic research supports this experience. Morningstar’s analysis of ESG funds shows they outperformed traditional funds 88% of the time during market downturns. Companies with strong environmental practices tend to be better managed, face fewer regulatory surprises, and attract top talent.

Here’s the crucial insight: sustainable investing strategies often perform better because they focus on companies adapting to long-term trends rather than just optimizing for short-term profits.

How do I actually start climate investing with limited money and experience?

Starting climate finance investing is easier than most people think, and you don’t need thousands of dollars or a finance background.

Week 1: Open a brokerage account with Fidelity, Schwab, or Vanguard (all have $0 minimums and commission-free ETF trading). Start with $50-100 in a broad renewable energy ETF like ICLN or an ESG fund like ESGV.

Month 1: Set up automatic investing of $25-75 monthly into your chosen fund. This dollar-cost averaging approach smooths out volatility while building your position gradually.

Month 3: Consider adding international exposure through global ESG funds, or specific exposure to areas you’re passionate about (clean energy, sustainable real estate, impact investing).

The key is starting small and learning as you go. My first climate investment was $200 in a solar ETF two years ago. Today, my entire portfolio has a climate focus, but it grew organically as I learned what worked and what didn’t.

Is climate investing risky? What if clean energy stocks crash?

Climate investing does carry risks—any sector-focused investing is inherently more volatile than broad market investing. Clean energy stocks, in particular, can swing dramatically based on policy changes, commodity prices, or investor sentiment.

However, I’d argue that NOT investing in climate solutions is becoming the bigger risk. Traditional energy companies face increasing regulatory pressure, stranded asset risks, and competition from cheaper clean alternatives. The companies best positioned for our changing world are those adapting to rather than fighting these trends.

My approach to managing climate finance risk: diversification and time horizon. I spread my climate investments across multiple sectors (renewable energy, sustainable real estate, ESG stocks, green bonds) and think in 5-10 year timeframes rather than worrying about monthly fluctuations.

The volatility that scares some investors has actually created opportunities for patient investors. When clean energy stocks dropped 30% in early 2023, I increased my automatic investing rather than panicking. Six months later, those positions had recovered and reached new highs.

What’s the minimum amount I need to start, and which platform should I use?

You can literally start climate finance investing with $1 through fractional shares on platforms like Fidelity, Schwab, or Robinhood. But practically speaking, $50-100 gives you better diversification options and makes the account fees (if any) less significant.

Here’s my recommended progression based on investment amount:

$1-$50: Start with fractional shares of a broad ESG ETF like ESGV through Fidelity or Schwab (zero fees) $100-$500: Add a renewable energy ETF like ICLN and consider a green bond ETF like BGRN for stability $500-$2,000: Diversify across multiple sustainable investing strategies—ESG stocks, clean energy, sustainable REITs, impact investing through platforms like Kiva $2,000+: Consider individual clean technology stocks, direct impact investments, and specialized funds

Platform choice depends on your preferences:

- Fidelity/Schwab/Vanguard: Best for traditional ETF investing with zero fees

- Betterment/Wealthfront: Great for hands-off ESG portfolios with automatic rebalancing

- Kiva/RSF Social Finance: Excellent for direct impact investing

- Fundrise: Good for sustainable real estate with lower minimums

The most important thing isn’t which platform you choose—it’s starting somewhere and building the habit of values-aligned investing.

The Future Is Green, and It’s Happening Now

As I finish writing this guide, I’m looking at my investment app showing a portfolio that’s grown 28% over the past 18 months. But what makes me smile isn’t just the numbers—it’s knowing that every dollar is working toward solutions I believe in.

My renewable energy investments are funding wind farms in Iowa and solar installations in California. My green bonds helped finance electric bus fleets in Seattle and energy efficiency upgrades in Chicago schools. My microfinance loans are supporting entrepreneurs from Guatemala to Kenya. My ESG stocks include companies developing breakthrough battery technology and sustainable agriculture solutions.

This is what climate finance 2025 offers: the opportunity to build wealth while funding the transition to a more sustainable world. You’re not sacrificing returns for values—you’re recognizing that in our rapidly changing economy, sustainable investments may offer the best path to long-term wealth building.

The transformation is already happening faster than most experts predicted. Renewable energy costs continue plummeting. Corporate sustainability commitments are accelerating. Government policies are creating massive tailwinds for clean technology. Consumer preferences are shifting toward sustainable options across every category.

The question isn’t whether the clean economy will emerge—it’s already emerging. The question is whether you’ll participate in funding that transition and benefit from the opportunities it creates.

Climate finance isn’t perfect. Some investments will disappoint. Market volatility will test your patience. New technologies will disrupt existing ones. But these challenges exist in all investing—at least with climate finance, you’re betting on solutions to humanity’s biggest challenges rather than perpetuating them.

Every dollar you invest in renewable energy is a vote for clean air. Every ESG stock purchase supports better-managed companies. Every impact investment creates measurable benefits for communities around the world. Every green bond funds infrastructure we’ll need for decades to come.

But beyond the feel-good factor, sustainable investing strategies position you for the economy that’s emerging, not the one that’s disappearing. The companies thriving in 2035 will likely be those adapting to climate realities today.

My friend Sarah, who inspired this entire journey with her impressive portfolio performance, put it perfectly over coffee last week: “I used to think investing was about picking winners and losers in some abstract financial game. Now I realize I’m funding the world I want to live in while building financial security for my family. It feels like the most natural thing in the world.”

That’s the power of aligning your money with your values. You’re not just building wealth—you’re building a future worth having wealth in.

[Chart: Personal Climate Finance Portfolio Allocation Template] This final chart would show a sample portfolio allocation across the seven investment types discussed, providing readers with a visual template for their own climate finance journey

Ready to start your climate finance journey? Begin with one small step today. Open a brokerage account, invest $50 in a renewable energy ETF, or make a $25 microloan to an entrepreneur fighting climate change. Your future self—and the planet—will thank you.

Remember: This isn’t financial advice, and all investing carries risk. Consider consulting with a financial advisor about your specific situation. But don’t let perfect be the enemy of good—the best climate finance strategy is the one you actually implement.